Xcel Energy 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

The federal carryforward periods expire between 2021 and 2034. The state carryforward periods expire between 2016 and 2034.

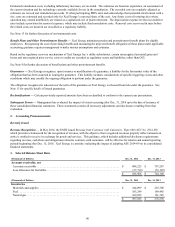

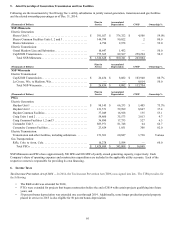

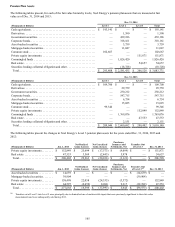

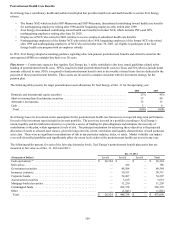

Total income tax expense from operations differs from the amount computed by applying the statutory federal income tax rate to

income before income tax expense. The following reconciles such differences for the years ending Dec. 31:

2014 2013 2012

Federal statutory rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.0% 35.0% 35.0%

Increases (decreases) in tax from:

Tax credits recognized, net of federal income tax expense . . . . . . . . . . . . . . . . . . . . . . . . (2.6)(2.6) (2.2)

Regulatory differences — utility plant items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.3)(1.6) (1.0)

NOL carryback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.9)(0.8) (1.1)

State income taxes, net of federal income tax benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.0 4.1 4.0

Change in unrecognized tax benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.2 0.6 —

Prescription drug tax benefit and Medicare Part D . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (1.2)

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.5)(0.9) (0.3)

Effective income tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33.9% 33.8% 33.2%

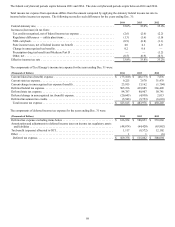

The components of Xcel Energy’s income tax expense for the years ending Dec. 31 were:

(Thousands of Dollars) 2014 2013 2012

Current federal tax (benefit) expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (73,160) $ (46,173) $ 7,876

Current state tax expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,225 7,678 31,478

Current change in unrecognized tax expense (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23,915 13,162 (1,704)

Deferred federal tax expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 505,236 439,085 366,409

Deferred state tax expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84,787 80,907 50,741

Deferred change in unrecognized tax (benefit) expense . . . . . . . . . . . . . . . . . . . . . . . . . . . (20,645)(4,930) 2,013

Deferred investment tax credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,543)(5,753) (6,610)

Total income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 523,815 $ 483,976 $ 450,203

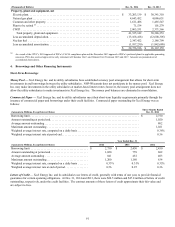

The components of deferred income tax expense for the years ending Dec. 31 were:

(Thousands of Dollars) 2014 2013 2012

Deferred tax expense excluding items below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 616,934 $ 588,053 $ 559,860

Amortization and adjustments to deferred income taxes on income tax regulatory assets

and liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (48,674)(64,420) (63,862)

Tax benefit (expense) allocated to OCI. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,117 (8,572) 12,102

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1 (6)

Deferred tax expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 569,378 $ 515,062 $ 508,094