Xcel Energy 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

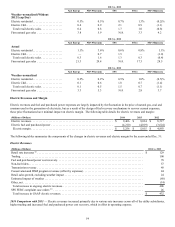

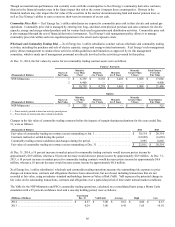

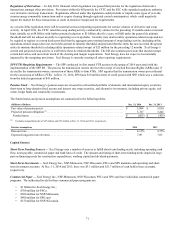

If Xcel Energy were to use alternative assumptions at Dec. 31, 2014, a one-percent change would result in the following impact on

2015 pension costs:

Pension Costs

(Millions of Dollars) +1% -1%

Rate of return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (20.6) $ 20.6

Discount rate (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10.6) 13.4

(a) These costs include the effects of regulation.

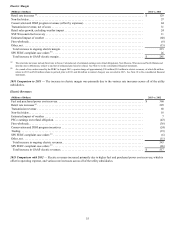

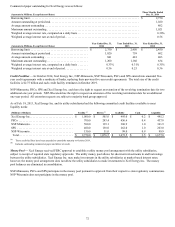

Effective Jan. 1, 2015, the initial medical trend assumption was decreased from 7.00 percent to 6.50 percent. The ultimate trend

assumption remained at 4.5 percent. The period until the ultimate rate is reached is four years. Xcel Energy bases its medical trend

assumption on the long-term cost inflation expected in the health care market, considering the levels projected and recommended by

industry experts, as well as recent actual medical cost experienced by Xcel Energy’s retiree medical plan.

• Xcel Energy contributed $17.1 million, $17.6 million and $47.1 million during 2014, 2013 and 2012, respectively, to the

postretirement health care plans.

• Xcel Energy expects to contribute approximately $12.8 million during 2015.

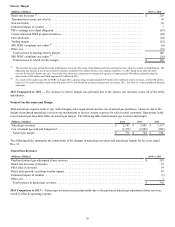

Xcel Energy recovers employee benefits costs in its regulated utility operations consistent with accounting guidance with the

exception of the areas noted below.

• NSP-Minnesota recognizes pension expense in all regulatory jurisdictions based on expense as calculated using the aggregate

normal cost actuarial method. Differences between aggregate normal cost and expense as calculated by pension accounting

standards are deferred as a regulatory liability.

• Colorado, Texas, New Mexico and FERC jurisdictions allow the recovery of other postretirement benefit costs only to the

extent that recognized expense is matched by cash contributions to an irrevocable trust. Xcel Energy has consistently funded

at a level to allow full recovery of costs in these jurisdictions.

• PSCo and SPS recognize pension expense in all regulatory jurisdictions based on expense consistent with accounting

guidance. The Colorado electric retail and Texas jurisdictions record the difference between annual recognized pension

expense and the annual amount of pension expense approved in their last respective general rate case as a deferral to a

regulatory asset.

• Beginning in 2015, the Colorado electric retail jurisdiction expects to recognize additional expense associated with a pending

order to accelerate amortization of the qualified prepaid pension asset. A regulatory liability would be recorded to account

for any resulting regulatory obligation.

See Note 9 to the consolidated financial statements for further discussion.

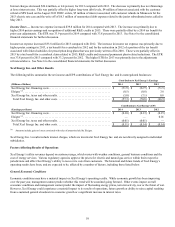

Nuclear Decommissioning

Xcel Energy recognizes liabilities for the expected cost of retiring tangible long-lived assets for which a legal obligation exists. These

AROs are recognized at fair value as incurred and are capitalized as part of the cost of the related long-lived assets. In the absence of

quoted market prices, Xcel Energy estimates the fair value of its AROs using present value techniques, in which it makes various

assumptions including estimates of the amounts and timing of future cash flows associated with retirement activities, credit-adjusted

risk free rates and cost escalation rates. When Xcel Energy revises any assumptions used to estimate AROs, it adjusts the carrying

amount of both the ARO liability and the related long-lived asset. Xcel Energy accretes ARO liabilities to reflect the passage of time

using the interest method.

A significant portion of Xcel Energy’s AROs relates to the future decommissioning of NSP-Minnesota’s nuclear facilities. The total

obligation for nuclear decommissioning is expected to be funded 100 percent by the external decommissioning trust fund. The

difference between regulatory funding (including depreciation expense less returns from the external trust fund) and expense

recognized under current accounting guidance is deferred as a regulatory asset. The amounts recorded for AROs related to future

nuclear decommissioning were $2,038 million and $1,628 million as of Dec. 31, 2014 and 2013, respectively. Based on their

significance, the following discussion relates specifically to the AROs associated with nuclear decommissioning.