Xcel Energy 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.85

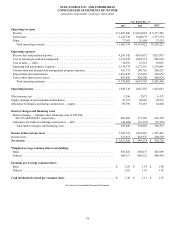

XCEL ENERGY INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

1. Summary of Significant Accounting Policies

Business and System of Accounts — Xcel Energy Inc.’s utility subsidiaries are engaged in the regulated generation, purchase,

transmission, distribution and sale of electricity and in the regulated purchase, transportation, distribution and sale of natural gas. Xcel

Energy’s consolidated financial statements and disclosures are presented in accordance with GAAP. All of the utility subsidiaries’

underlying accounting records also conform to the FERC uniform system of accounts or to systems required by various state

regulatory commissions, which are the same in all material respects.

Principles of Consolidation — In 2014, Xcel Energy’s operations included the activity of NSP-Minnesota, NSP-Wisconsin, PSCo and

SPS. These utility subsidiaries serve electric and natural gas customers in portions of Colorado, Michigan, Minnesota, New Mexico,

North Dakota, South Dakota, Texas and Wisconsin. Also included in Xcel Energy’s operations are WGI, an interstate natural gas

pipeline company, and WYCO, a joint venture with CIG to develop and lease natural gas pipelines, storage and compression facilities.

Xcel Energy Inc.’s nonregulated subsidiary is Eloigne, which invests in rental housing projects that qualify for low-income housing

tax credits. Xcel Energy Inc. owns the following additional direct subsidiaries, some of which are intermediate holding companies

with additional subsidiaries: Xcel Energy Wholesale Group Inc., Xcel Energy Markets Holdings Inc., Xcel Energy Ventures Inc., Xcel

Energy Retail Holdings Inc., Xcel Energy Communications Group, Inc., Xcel Energy International Inc., Xcel Energy Transmission

Holding Company, LLC, and Xcel Energy Services Inc. Xcel Energy Inc. and its subsidiaries collectively are referred to as Xcel

Energy.

Xcel Energy’s consolidated financial statements include its wholly-owned subsidiaries and variable interest entities for which it is the

primary beneficiary. In the consolidation process, all intercompany transactions and balances are eliminated. Xcel Energy uses the

equity method of accounting for its investment in WYCO. Xcel Energy’s equity earnings in WYCO are included on the consolidated

statements of income as equity earnings of unconsolidated subsidiaries. Xcel Energy has investments in several plants and

transmission facilities jointly owned with nonaffiliated utilities. Xcel Energy’s proportionate share of jointly owned facilities is

recorded as property, plant and equipment on the consolidated balance sheets, and Xcel Energy’s proportionate share of the operating

costs associated with these facilities is included in its consolidated statements of income. See Note 5 for further discussion of jointly

owned generation, transmission, and gas facilities and related ownership percentages.

Xcel Energy evaluates its arrangements and contracts with other entities, including but not limited to, investments, PPAs and fuel

contracts to determine if the other party is a variable interest entity, if Xcel Energy has a variable interest and if Xcel Energy is the

primary beneficiary. Xcel Energy follows accounting guidance for variable interest entities which requires consideration of the

activities that most significantly impact an entity’s financial performance and power to direct those activities, when determining

whether Xcel Energy is a variable interest entity’s primary beneficiary. See Note 13 for further discussion of variable interest entities.

Use of Estimates — In recording transactions and balances resulting from business operations, Xcel Energy uses estimates based on

the best information available. Estimates are used for such items as plant depreciable lives or potential disallowances, AROs, certain

regulatory assets and liabilities, tax provisions, uncollectible amounts, environmental costs, unbilled revenues, jurisdictional fuel and

energy cost allocations and actuarially determined benefit costs. The recorded estimates are revised when better information becomes

available or when actual amounts can be determined. Those revisions can affect operating results.

Regulatory Accounting — Our regulated utility subsidiaries account for certain income and expense items in accordance with

accounting guidance for regulated operations. Under this guidance:

• Certain costs, which would otherwise be charged to expense or OCI, are deferred as regulatory assets based on the expected

ability to recover the costs in future rates; and

• Certain credits, which would otherwise be reflected as income, are deferred as regulatory liabilities based on the expectation

the amounts will be returned to customers in future rates, or because the amounts were collected in rates prior to the costs

being incurred.

Estimates of recovering deferred costs and returning deferred credits are based on specific ratemaking decisions or precedent for each

item. Regulatory assets and liabilities are amortized consistent with the treatment in the rate setting process.