Xcel Energy 2014 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146

14. Nuclear Obligations

Fuel Disposal — NSP-Minnesota is responsible for temporarily storing used or spent nuclear fuel from its nuclear plants. The DOE is

responsible for permanently storing spent fuel from NSP-Minnesota’s nuclear plants as well as from other U.S. nuclear plants, but no

such facility is yet available. NSP-Minnesota has funded its portion of the DOE’s permanent disposal program since 1981. The fuel

disposal fees were based on a charge of 0.1 cent per KWh sold to customers from nuclear generation. Effective May 2014, the DOE

set the fee to zero.

Fuel expense includes the DOE fuel disposal assessments of approximately $5 million in 2014, $10 million in 2013 and $12 million in

2012. In total, NSP-Minnesota paid approximately $452.1 million to the DOE through Dec. 31, 2014. See Note 13 — Nuclear Waste

Disposal Litigation for further discussion.

NSP-Minnesota has its own temporary on-site storage facilities for spent fuel at its Monticello and PI nuclear plants, which consist of

storage pools and dry cask facilities at both sites. The amount of spent fuel storage capacity is determined by the NRC and the

MPUC. The Monticello dry-cask storage facility currently stores 15 of the 30 authorized canisters, and the PI dry-cask storage facility

currently stores 38 of the 64 authorized casks. Other alternatives for spent fuel storage are being investigated until a DOE facility is

available.

Regulatory Plant Decommissioning Recovery — Decommissioning activities related to NSP-Minnesota’s nuclear facilities are

planned to begin at the end of each unit’s operating license and be completed by 2091. NSP-Minnesota’s current operating licenses

allow continued use of its Monticello nuclear plant until 2030 and its PI nuclear plant until 2033 for Unit 1 and 2034 for Unit 2.

Future decommissioning costs of nuclear facilities are estimated through periodic studies that assess the costs and timing of planned

nuclear decommissioning activities for each unit. The MPUC most recently approved NSP-Minnesota’s 2011 nuclear

decommissioning study in November 2012. This cost study quantified decommissioning costs in 2011 dollars and utilized escalation

rates of 3.63 percent per year for plant removal activities, and 2.63 percent for spent fuel management and site restoration activities

over a 60-year decommissioning scenario.

In December 2014, NSP-Minnesota submitted its most recent nuclear decommissioning filing to the MPUC, which included an update

to the decommissioning cost study and requested an annual funding requirement of $14.0 million starting in 2016. A decision on the

filing is expected in late 2015 or early 2016.

The total obligation for decommissioning is expected to be funded 100 percent by the external decommissioning trust fund when

decommissioning commences. NSP-Minnesota’s most recently approved decommissioning study resulted in an annual funding

requirement of $14.2 million to be recovered in utility customer rates. This cost study assumes the external decommissioning fund

will earn an after-tax return between 4.57 percent and 5.53 percent. Realized and unrealized gains on fund investments are deferred as

an offset of NSP-Minnesota’s regulatory asset for nuclear decommissioning costs.

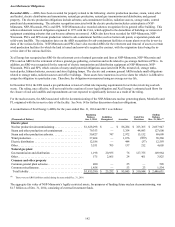

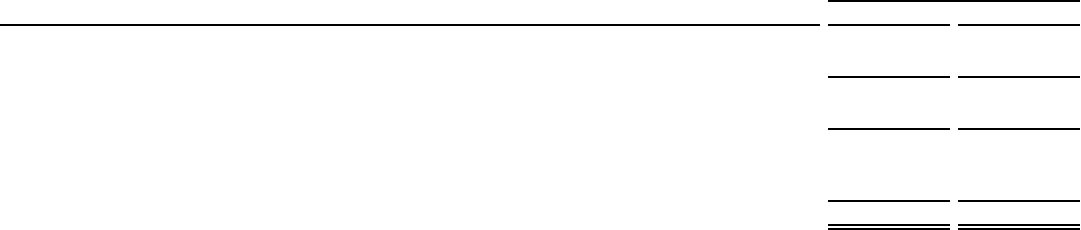

As of Dec. 31, 2014, NSP-Minnesota has accumulated $1.7 billion of assets held in external decommissioning trusts. The following

table summarizes the funded status of NSP-Minnesota’s decommissioning obligation based on parameters established in the most

recently approved decommissioning study. Xcel Energy believes future decommissioning costs, if necessary, will continue to be

recovered in customer rates. The amounts presented below were prepared on a regulatory basis, and are not recorded in the financial

statements for the ARO.

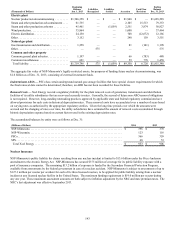

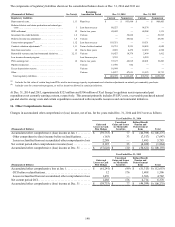

Regulatory Basis

(Thousands of Dollars) 2014 2013

Estimated decommissioning cost obligation from most recently approved study (2011 dollars). . . . . . $ 2,694,079 $ 2,694,079

Effect of escalating costs (to 2014 and 2013 dollars, respectively, at 3.63/2.63 percent). . . . . . . . . . . . 289,907 189,924

Estimated decommissioning cost obligation (in current dollars) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,983,986 2,884,003

Effect of escalating costs to payment date (3.63/2.63 percent). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,597,302 5,697,285

Estimated future decommissioning costs (undiscounted) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,581,288 8,581,288

Effect of discounting obligation (using average risk-free interest rate of 2.82 percent and 4.19

percent for 2014 and 2013, respectively). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,044,470) (6,215,050)

Discounted decommissioning cost obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,536,818 $ 2,366,238

Assets held in external decommissioning trust . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,703,921 $ 1,627,026

Underfunding of external decommissioning fund compared to the discounted decommissioning

obligation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,832,897 739,212