Xcel Energy 2014 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132

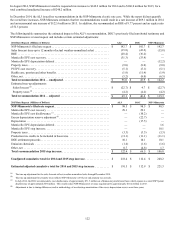

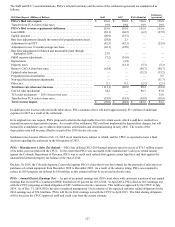

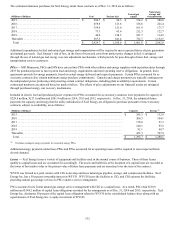

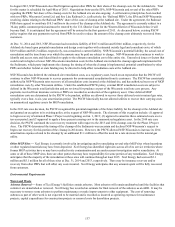

The estimated minimum purchases for Xcel Energy under these contracts as of Dec. 31, 2014 are as follows:

(Millions of Dollars) Coal Nuclear fuel Natural gas

supply

Natural gas

storage and

transportation

2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 900.7 $ 90.3 $ 374.2 $ 280.0

2016. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 659.8 121.8 158.8 221.4

2017. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 359.6 121.0 161.9 171.7

2018. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73.3 65.6 212.3 122.7

2019. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44.0 128.5 221.7 114.5

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 387.3 641.4 732.7 1,152.5

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,424.7 $ 1,168.6 $ 1,861.6 $ 2,062.8

Additional expenditures for fuel and natural gas storage and transportation will be required to meet expected future electric generation

and natural gas needs. Xcel Energy’s risk of loss, in the form of increased costs from market price changes in fuel, is mitigated

through the use of natural gas and energy cost-rate adjustment mechanisms, which provide for pass-through of most fuel, storage and

transportation costs to customers.

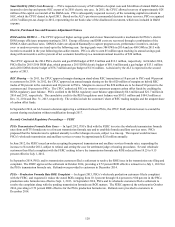

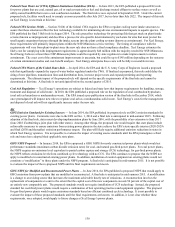

PPAs — NSP Minnesota, PSCo and SPS have entered into PPAs with other utilities and energy suppliers with expiration dates through

2033 for purchased power to meet system load and energy requirements and meet operating reserve obligations. In general, these

agreements provide for energy payments, based on actual energy delivered and capacity payments. Certain PPAs accounted for as

executory contracts also contain minimum energy purchase commitments. Capacity and energy payments are typically contingent on

the independent power producing entity meeting certain contract obligations, including plant availability requirements. Certain

contractual payments are adjusted based on market indices. The effects of price adjustments on our financial results are mitigated

through purchased energy cost recovery mechanisms.

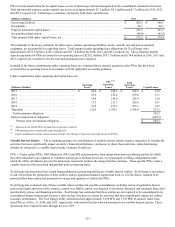

Included in electric fuel and purchased power expenses for PPAs accounted for as executory contracts were payments for capacity of

$229.8 million, $217.0 million and $261.9 million in 2014, 2013 and 2012, respectively. At Dec. 31, 2014, the estimated future

payments for capacity and energy that the utility subsidiaries of Xcel Energy are obligated to purchase pursuant to these executory

contracts, subject to availability, are as follows:

(Millions of Dollars) Capacity Energy (a)

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 245.3 $ 132.9

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 206.5 104.1

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 178.0 91.3

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 140.1 93.2

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92.1 98.7

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 433.7 767.9

Total. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,295.7 $ 1,288.1

(a) Excludes contingent energy payments for renewable energy PPAs.

Additional energy payments under these PPAs and PPAs accounted for as operating leases will be required to meet expected future

electric demand.

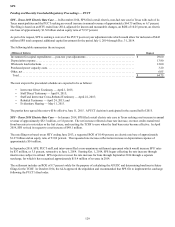

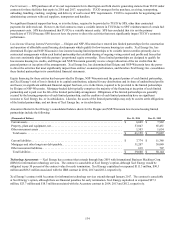

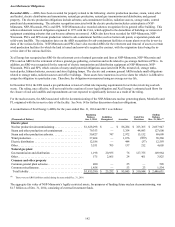

Leases — Xcel Energy leases a variety of equipment and facilities used in the normal course of business. Three of these leases

qualify as capital leases and are accounted for accordingly. The assets and liabilities at the inception of a capital lease are recorded at

the lower of fair market value or the present value of future lease payments and are amortized over the term of the contract.

WYCO was formed as a joint venture with CIG to develop and lease natural gas pipeline, storage, and compression facilities. Xcel

Energy Inc. has a 50 percent ownership interest in WYCO. WYCO leases the facilities to CIG, and CIG operates the facilities,

providing natural gas storage services to PSCo under a service arrangement.

PSCo accounts for its Totem natural gas storage service arrangement with CIG as a capital lease. As a result, PSCo had $138.9

million and $144.2 million of capital lease obligations recorded for the arrangement as of Dec. 31, 2014 and 2013, respectively. Xcel

Energy Inc. eliminates 50 percent of the capital lease obligation related to WYCO in the consolidated balance sheet along with an

equal amount of Xcel Energy Inc.’s equity investment in WYCO.