Xcel Energy 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

The accounting related to the TIPA was recorded beginning in the fourth quarter of 2014 because a change in tax law is accounted for

in the period of enactment.

American Taxpayer Relief Act of 2012 — In 2013, the American Taxpayer Relief Act (ATRA) was signed into law. The ATRA

provided for the following:

• The top tax rate for dividends increased from 15 percent to 20 percent. The 20 percent dividend rate is now consistent with

the tax rates for capital gains;

• The R&E credit was extended for 2012 and 2013;

• PTCs were extended for projects that began construction before the end of 2013 with certain projects qualifying into future

years; and

• 50 percent bonus depreciation was extended one year through 2013. Additionally, some longer production period property

placed in service in 2014 is also eligible for 50 percent bonus depreciation.

The accounting related to the ATRA, including the provisions related to 2012, was recorded beginning in the first quarter of 2013

because a change in tax law is accounted for in the period of enactment.

Prescription drug tax benefit — In the third quarter of 2012, Xcel Energy implemented a tax strategy related to the allocation of

funding of Xcel Energy’s retiree prescription drug plan. This strategy restored a portion of the tax benefit associated with federal

subsidies for prescription drug plans that had been accrued since 2004 and was expensed in 2010. As a result, Xcel Energy recognized

approximately $17 million of income tax benefit.

Medicare Part D — In March 2010, the Patient Protection and Affordable Care Act was signed into law. The law includes provisions

to generate tax revenue to help offset the cost of the new legislation. One of these provisions reduces the deductibility of retiree health

care costs to the extent of federal subsidies received by plan sponsors that provide retiree prescription drug benefits equivalent to

Medicare Part D coverage, beginning in 2013. Xcel Energy expensed approximately $17 million of previously recognized tax benefits

relating to the federal subsidies during the first quarter of 2010.

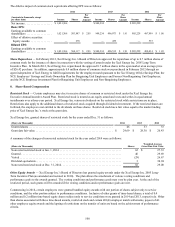

Federal Tax Loss Carryback Claims — In 2012, 2013 and 2014, Xcel Energy identified certain expenses related to 2009, 2010, 2011,

2013 and 2014 that qualify for an extended carryback beyond the typical two-year carryback period. As a result of a higher tax rate in

prior years, Xcel Energy recognized a tax benefit of approximately $17 million in 2014, $12 million in 2013 and $15 million in 2012.

Federal Audit — Xcel Energy files a consolidated federal income tax return. The statute of limitations applicable to Xcel Energy’s

2008 federal income tax return expired in September 2012. The statute of limitations applicable to Xcel Energy’s 2009 federal income

tax return expires in March 2016. In the third quarter of 2012, the IRS commenced an examination of tax years 2010 and 2011,

including the 2009 carryback claim. As of Dec. 31, 2014, the IRS had proposed an adjustment to the federal tax loss carryback claims

that would result in $12 million of income tax expense for the 2009 through 2011 claims, the recently filed 2013 claim, and the

anticipated claim for 2014. At Dec. 31, 2014, the IRS has begun the Appeals process; however, the outcome and timing of a resolution

is uncertain.

State Audits — Xcel Energy files consolidated state tax returns based on income in its major operating jurisdictions of Colorado,

Minnesota, Texas, and Wisconsin, and various other state income-based tax returns. As of Dec. 31, 2014, Xcel Energy’s earliest open

tax years that are subject to examination by state taxing authorities in its major operating jurisdictions were as follows:

State Year

Colorado. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2009

Minnesota. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2009

Texas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2009

Wisconsin. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2010

In the first quarter of 2014, the state of Wisconsin commenced an examination of tax years 2009 through 2011. No material

adjustments were proposed for those tax years. As of Dec. 31, 2014, there were no state income tax audits in progress.