Xcel Energy 2014 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.144

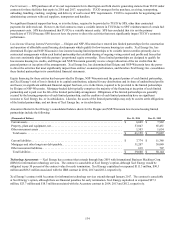

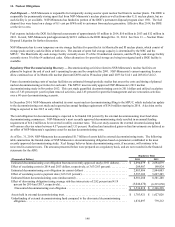

NSP-Minnesota purchases insurance for property damage and site decontamination cleanup costs from Nuclear Electric Insurance Ltd.

(NEIL). The coverage limits are $2.3 billion for each of NSP-Minnesota’s two nuclear plant sites. NEIL also provides business

interruption insurance coverage, including the cost of replacement power obtained during certain prolonged accidental outages of

nuclear generating units. Premiums are expensed over the policy term. All companies insured with NEIL are subject to retroactive

premium adjustments if losses exceed accumulated reserve funds. Capital has been accumulated in the reserve funds of NEIL to the

extent that NSP-Minnesota would have no exposure for retroactive premium assessments in case of a single incident under the

business interruption and the property damage insurance coverage. However, in each calendar year, NSP-Minnesota could be subject

to maximum assessments of approximately $17.9 million for business interruption insurance and $43.6 million for property damage

insurance if losses exceed accumulated reserve funds.

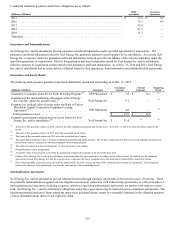

Legal Contingencies

Xcel Energy is involved in various litigation matters that are being defended and handled in the ordinary course of business. The

assessment of whether a loss is probable or is a reasonable possibility, and whether the loss or a range of loss is estimable, often

involves a series of complex judgments about future events. Management maintains accruals for such losses that are probable of

being incurred and subject to reasonable estimation. Management is sometimes unable to estimate an amount or range of a reasonably

possible loss in certain situations, including but not limited to when (1) the damages sought are indeterminate, (2) the proceedings are

in the early stages, or (3) the matters involve novel or unsettled legal theories. In such cases, there is considerable uncertainty

regarding the timing or ultimate resolution of such matters, including a possible eventual loss. For current proceedings not

specifically reported herein, management does not anticipate that the ultimate liabilities, if any, arising from such current proceedings

would have a material effect on Xcel Energy’s financial statements. Unless otherwise required by GAAP, legal fees are expensed as

incurred.

Employment, Tort and Commercial Litigation

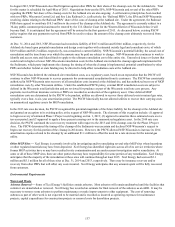

Exelon Wind (formerly John Deere Wind) Complaint — Several lawsuits in Texas state and federal courts and regulatory

proceedings have arisen out of a dispute concerning SPS’ payments for energy and capacity produced from the Exelon Wind

subsidiaries’ projects. There are two main areas of dispute. First, Exelon Wind claims that it established legally enforceable

obligations (LEOs) for each of its 12 wind facilities in 2005 through 2008 that require SPS to buy power based on SPS’ forecasted

avoided cost as determined in 2005 through 2008. Although SPS has refused to accept Exelon Wind’s LEOs, SPS accepts that it must

take energy from Exelon Wind under SPS’ PUCT-approved Qualifying Facilities (QF) Tariff. Second, Exelon Wind has raised various

challenges to SPS’ PUCT-approved QF Tariff, which became effective in August 2010. On Jan.16, 2015, Exelon Wind filed motions

to dismiss or notices of non-suits for its state and federal lawsuits regarding the QF tariff, and for its state and federal lawsuits and

regulatory proceedings regarding the LEOs. Later in January, the PUCT and state and federal courts issued orders dismissing the

cases. The only remaining proceedings are pending before the FERC (one regarding the QF Tariff and the other regarding the LEOs).

SPS believes the likelihood of loss in these proceedings is remote based primarily on existing case law and while it is not possible to

estimate the amount or range of reasonably possible loss in the event of an adverse outcome, SPS believes such loss would not be

material based upon its belief that it would be permitted to recover such costs, if needed, through its various fuel clause mechanisms.

No accrual has been recorded for this matter.

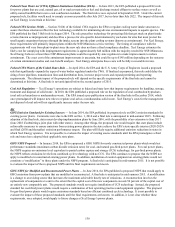

Pacific Northwest FERC Refund Proceeding — In July 2001, the FERC ordered a preliminary hearing to determine whether there

were unjust and unreasonable charges for spot market bilateral sales in the Pacific Northwest for December 2000 through June 2001.

PSCo supplied energy to the Pacific Northwest markets during this period and has been a participant in the hearings. In September

2001, the presiding ALJ concluded that prices in the Pacific Northwest during the referenced period were the result of a number of

factors, including the shortage of supply, excess demand, drought and increased natural gas prices. Under these circumstances, the

ALJ concluded that the prices in the Pacific Northwest markets were not unreasonable or unjust and no refunds should be ordered.

Subsequent to the ruling, the FERC has allowed the parties to request additional evidence. Parties have claimed that the total amount

of transactions with PSCo subject to refund is $34 million. In June 2003, the FERC issued an order terminating the proceeding

without ordering further proceedings. Certain purchasers filed appeals of the FERC’s orders in this proceeding with the Ninth Circuit.

In an order issued in August 2007, the Ninth Circuit remanded the proceeding back to the FERC and indicated that the FERC should

consider other rulings addressing overcharges in the California organized markets. The Ninth Circuit denied a petition for rehearing in

April 2009, and the mandate was issued.

The FERC issued an order on remand establishing principles for the review proceeding in October 2011. In September 2012, the City

of Seattle filed its direct case against PSCo and other Pacific Northwest sellers claiming refunds for the period January 2000 through

June 2001. The City of Seattle indicated that for the period June 2000 through June 2001 PSCo had sales to the City of Seattle of

approximately $50 million. The City of Seattle did not identify specific instances of unlawful market activity by PSCo, but rather

based its claim for refunds on market dysfunction in the Western markets. PSCo submitted its answering case in December 2012.