Xcel Energy 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.60

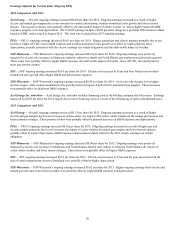

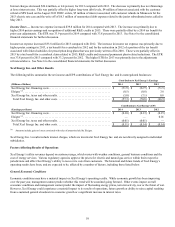

Fuel Supply and Costs

Xcel Energy Inc.’s operating utilities have varying dependence on coal, natural gas and uranium. Changes in commodity prices are

generally recovered through fuel recovery mechanisms and have very little impact on earnings. However, availability of supply, the

potential implementation of a carbon tax or emissions-related generation restrictions and unanticipated changes in regulatory recovery

mechanisms could impact our operations. See Item 1 for further discussion of fuel supply and costs.

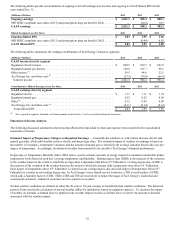

Pension Plan Costs and Assumptions

Xcel Energy has significant net pension and postretirement benefit costs that are measured using actuarial valuations. Inherent in

these valuations are key assumptions including discount rates and expected return on plan assets. Xcel Energy evaluates these key

assumptions at least annually by analyzing current market conditions, which include changes in interest rates and market returns.

Changes in the related net pension and postretirement benefits costs and funding requirements may occur in the future due to changes

in assumptions. The payout of a significant percentage of pension plan liabilities in a single year due to high retirements or employees

leaving the company would trigger settlement accounting and could require the company to recognize material incremental pension

expense related to unrecognized plan losses in the year these liabilities are paid. For further discussion and a sensitivity analysis on

these assumptions, see “Employee Benefits” under Critical Accounting Policies and Estimates.

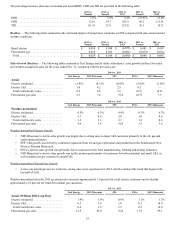

Regulation

FERC and State Regulation — The FERC and various state and local regulatory commissions regulate Xcel Energy Inc.’s utility

subsidiaries and TransCo subsidiaries. Decisions by these regulators can significantly impact Xcel Energy’s results of operations.

Xcel Energy expects to periodically file for rate changes based on changing energy market and general economic conditions.

The electric and natural gas rates charged to customers of Xcel Energy Inc.’s utility subsidiaries are approved by the FERC or the

regulatory commissions in the states in which they operate. The rates are designed to recover plant investment, operating costs and an

allowed return on investment. Xcel Energy requests changes in rates for utility services through filings with the governing

commissions. Changes in operating costs can affect Xcel Energy’s financial results, depending on the timing of filing general rate

cases and the implementation of final rates. In addition to changes in operating costs, other factors affecting rate filings are new

investments, sales, conservation and DSM efforts, and the cost of capital. In addition, the regulatory commissions authorize the ROE,

capital structure and depreciation rates in rate proceedings.

Wholesale Energy Market Regulation — Wholesale energy markets in the Midwest and South Central U.S. are operated by MISO

and SPP, respectively, to centrally dispatch all regional electric generation and apply a regional transmission congestion management

system. NSP-Minnesota and NSP-Wisconsin are members of MISO and SPS is a member of SPP. NSP-Minnesota, NSP-Wisconsin

and SPS expect to recover energy charges through either base rates or various recovery mechanisms. See Note 12 to the consolidated

financial statements for further discussion.

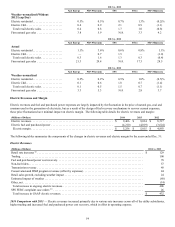

Capital Expenditure Regulation — Xcel Energy Inc.’s utility subsidiaries make substantial investments in plant additions to build and

upgrade power plants, and expand and maintain the reliability of the energy transmission and distribution systems. In addition to

filings for increases in base rates charged to customers to recover the costs associated with such investments, the CPUC, MPUC,

SDPUC, NDPSC and PUCT in certain instances have approved proposals to recover, through a rate rider, costs to upgrade generation

plants and lower emissions, increase transmission investment cost, and/or increase distribution investment cost, and increase

purchased power capacity cost. These non-fuel rate riders are expected to provide cash flows to enable recovery of costs incurred on a

more timely basis. For wholesale electric transmission and production services, Xcel Energy has, consistent with FERC policy,

implemented formula rates for each of the utility subsidiaries that will provide annual rate changes as transmission or production

investments increase in a manner similar to the retail rate riders. In November 2014, the FERC approved transmission formula rates

for XETD and XEST, which would apply to electric transmission assets the TransCos may own. NSP-Minnesota and NSP-Wisconsin

have no cost-based wholesale production customers and therefore have not implemented a production formula rate.

Environmental Matters

Environmental costs include accruals for nuclear plant decommissioning and payments for storage of spent nuclear fuel, disposal of

hazardous materials and waste, remediation of contaminated sites, monitoring of discharges to the environment and compliance with

laws and permits with respect to emissions. A trend of greater environmental awareness and increasingly stringent regulation may

continue to cause higher operating expenses and capital expenditures for environmental compliance.