Xcel Energy 2014 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

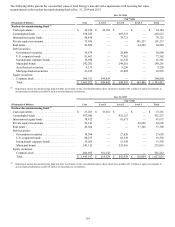

In August 2014, NSP-Minnesota revised its requested rate increase to $142.2 million for 2014 and to $106.0 million for 2015, for a

total combined unadjusted increase of $248.2 million.

In December 2014, the ALJ issued her recommendations in the NSP-Minnesota electric rate case. While the report did not quantify

the overall rate increases, NSP-Minnesota estimates that her recommendations would result in a rate increase of $69.1 million in 2014

and an incremental rate increase of $122.4 million in 2015. In addition, she recommended an ROE of 9.77 percent and an equity ratio

of 52.5 percent.

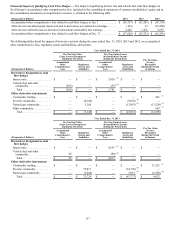

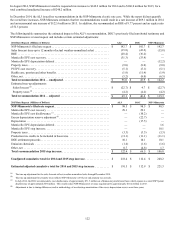

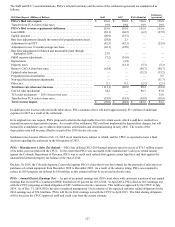

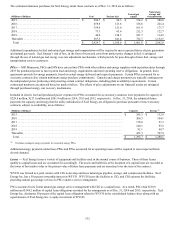

The following table summarizes the estimated impact of the ALJ’s recommendation, DOC’s previously filed surrebuttal testimony and

NSP-Minnesota’s revised request and includes certain estimated adjustments:

2014 Rate Request (Millions of Dollars) ALJ DOC NSP-Minnesota

NSP-Minnesota’s filed rate request . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 192.7 $ 192.7 $ 192.7

Sales forecast (true-up to 12 months of actual weather-normalized sales) . . . . . . . . . . (15.8)(43.2) (15.8)

ROE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (28.4)(36.2) —

Monticello EPU cost recovery . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (31.3)(33.9) —

Monticello EPU depreciation deferral . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (12.2)

Property taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9.0)(9.0) (9.0)

PI EPU cost recovery . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5.1)(5.1) (5.1)

Health care, pension and other benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.9)(11.4) (1.9)

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5.2)(8.0) (6.5)

Total recommendation 2014 — unadjusted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 96.0 $ 45.9 $ 142.2

Estimated true-up adjustments:

Sales forecast (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(22.7) $ 4.7 $ (22.7)

Property taxes (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4.2)(4.2) (4.2)

Total recommendation 2014 — adjusted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 69.1 $ 46.4 $ 115.3

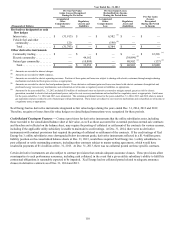

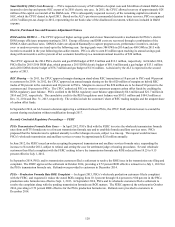

2015 Rate Request (Millions of Dollars) ALJ DOC NSP-Minnesota

NSP-Minnesota’s filed rate request. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 98.5 $ 98.5 $ 98.5

Monticello EPU cost recovery . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29.1 29.1 —

Monticello EPU cost disallowance (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (10.2) —

Excess depreciation reserve adjustment (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (22.7) —

Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (17.5) —

Monticello EPU depreciation deferral . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 1.6

Monticello EPU step increase. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 10.1

Property taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3.3)(3.3) (3.3)

Production tax credits to be included in base rates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . (11.1)(11.1) (11.1)

DOE settlement proceeds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.1 10.1 10.1

Emission chemicals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1.6)(1.6) (1.6)

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.7 (4.8) 1.7

Total recommendation 2015 step increase . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 122.4 $ 66.5 $ 106.0

Unadjusted cumulative total for 2014 and 2015 step increase . . . . . . . . . . . . . . . . . $ 218.4 $ 112.4 $ 248.2

Estimated adjusted cumulative total for 2014 and 2015 step increase . . . . . . . . . . $ 191.5 $ 112.9 $ 221.3

(a) The true-up adjustment for the sales forecast reflects weather-normalized sales through December 2014.

(b) The true-up adjustment for property taxes reflects NSP-Minnesota’s 2014 year end property tax accruals.

(c) In July 2014, the DOC recommended a cost disallowance of approximately $71.5 million on a Minnesota jurisdictional basis which equates to a total NSP System

disallowance of approximately $94 million. This would reduce NSP-Minnesota’s revenue requirement by approximately $10.2 million in 2015.

(d) Adjustment is due to timing differences and/or methodology of accelerating amortization of the excess depreciation reserve over three years.