Xcel Energy 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

NSP-Minnesota obtains periodic cost studies in order to estimate the cost and timing of planned nuclear decommissioning activities.

These independent cost studies are based on relevant information available at the time performed. Estimates of future cash flows for

extended periods of time are by nature highly uncertain and may vary significantly from actual results. NSP-Minnesota is required to

file a nuclear decommissioning study every three years. In December 2014, NSP-Minnesota submitted this filing to the MPUC, which

covered all expenses over the decommissioning period of the nuclear plants, including decontamination and removal of radioactive

material. A decision on the filing is expected in late 2015 or early 2016.

The following key assumptions have a significant effect on the estimated nuclear obligation:

• Timing — Decommissioning cost estimates are impacted by each facility’s retirement date and the expected timing of the

actual decommissioning activities. Currently, the estimated retirement dates coincide with each unit’s operating license with

the NRC (i.e., 2030 for Monticello and 2033 and 2034 for PI’s Unit 1 and 2, respectively). The estimated timing of the

decommissioning activities is based upon the DECON method, which is required by the MPUC. By utilizing this method,

which assumes prompt removal and dismantlement, these activities are expected to begin at the end of the license date and be

completed for both facilities by 2091.

• Technology and Regulation — There is limited experience with actual decommissioning of large nuclear facilities. Changes in

technology and experience as well as changes in regulations regarding nuclear decommissioning could cause cost estimates to

change significantly. NSP-Minnesota’s 2014 nuclear decommissioning filing assumed current technology and regulations.

• Escalation Rates — Escalation rates represent projected cost increases over time due to both general inflation and increases in

the cost of specific decommissioning activities. NSP-Minnesota used an escalation rate of 4.36 percent in calculating the

AROs related to nuclear decommissioning for the remaining operational period through the radiological decommissioning

period. An escalation rate of 3.36 percent was utilized for the period of operating costs related to interim dry cask storage of

spent nuclear fuel and site restoration.

• Discount Rates — Changes in timing or estimated expected cash flows that result in upward revisions to the ARO are

calculated using the then-current credit-adjusted risk-free interest rate. The credit-adjusted risk-free rate in effect when the

change occurs is used to discount the revised estimate of the incremental expected cash flows of the retirement activity. If the

change in timing or estimated expected cash flows results in a downward revision of the ARO, the undiscounted revised

estimate of expected cash flows is discounted using the credit-adjusted risk-free rate in effect at the date of initial measurement

and recognition of the original ARO. Discount rates ranging from approximately four and seven percent have been used to

calculate the net present value of the expected future cash flows over time.

Significant uncertainties exist in estimating the future cost of nuclear decommissioning including the method to be utilized, the

ultimate costs to decommission, and the planned method of disposing spent fuel. If different cost estimates, life assumptions or cost

escalation rates were utilized, the AROs could change materially. However, changes in estimates have minimal impact on results of

operations as NSP-Minnesota expects to continue to recover all costs in future rates.

Xcel Energy continually makes judgments and estimates related to these critical accounting policy areas, based on an evaluation of the

varying assumptions and uncertainties for each area. The information and assumptions underlying many of these judgments and

estimates will be affected by events beyond the control of Xcel Energy, or otherwise change over time. This may require adjustments

to recorded results to better reflect the events and updated information that becomes available. The accompanying financial

statements reflect management’s best estimates and judgments of the impact of these factors as of Dec. 31, 2014.

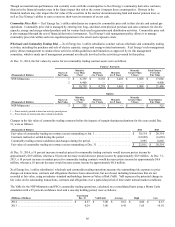

Derivatives, Risk Management and Market Risk

Xcel Energy Inc. and its subsidiaries are exposed to a variety of market risks in the normal course of business. Market risk is the

potential loss that may occur as a result of adverse changes in the market or fair value of a particular instrument or commodity. All

financial and commodity-related instruments, including derivatives, are subject to market risk. See Note 11 to the consolidated

financial statements for further discussion of market risks associated with derivatives.

Xcel Energy is exposed to the impact of adverse changes in price for energy and energy-related products, which is partially mitigated

by the use of commodity derivatives. In addition to ongoing monitoring and maintaining credit policies intended to minimize overall

credit risk, when necessary, management takes steps to mitigate changes in credit and concentration risks associated with its

derivatives and other contracts, including parental guarantees and requests of collateral. While Xcel Energy expects that the

counterparties will perform under the contracts underlying its derivatives, the contracts expose Xcel Energy to some credit and non-

performance risk.