Xcel Energy 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.48

Driving operational excellence

Managing our operational performance and satisfying our customers has, and will continue to be, a fundamental priority. However,

operational excellence also includes managing costs. By building on past success, leveraging technology, managing risks and

continuously striving to improve our processes, we can bend the cost curve downward. Over the next five years, Xcel Energy is

planning to implement cost saving measures which are intended to align increases in O&M expense more closely to sales growth. Our

financial objective is to slow our annual O&M expense growth to approximately zero percent to two percent. However, we will not

sacrifice reliability or safety to meet this initiative.

In addition, 50 percent of our workforce will be eligible to retire in the next ten years. Managing this workforce transition is key to

our operational excellence objective.

Providing options and solutions to customers

Adapting to a changing environment is critical to our success. Our customers expect to be offered choices and we are committed to

providing options and solutions that are fair and satisfy their needs. Environmental leadership is a core priority and is designed to

meet customer and policy maker expectations for clean energy at a competitive price while creating shareholder value. We will

continue to offer and expand our production of renewable energy, including wind and solar alternatives, and further develop DSM,

conservation and renewable programs.

Investing for the future

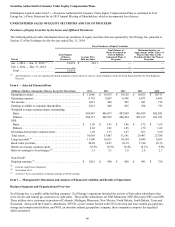

Sound investments today are necessary for tomorrow’s success. Our base capital expenditures are projected to be approximately $14.5

billion from 2015 through 2019. This capital forecast will grow rate base at a compounded average annual rate of approximately 4.7

percent. Our capital investment plan includes needed investments in transmission, adding new generation, reducing emissions in our

power plants, refreshing our infrastructure, improving reliability, replacing natural gas pipelines and increasing the levels of renewable

energy on our system. In addition to our base capital investment plan, we are looking at potential incremental investments in natural

gas assets and transmission projects through our recently established independent TransCos.

Xcel Energy has a proven track record of making sound investments. We proactively made the decision to balance our generation

portfolio and expand our alternative energy production. Our customers, stakeholders and the environment are currently benefiting

from these decisions and will continue to do so in the future.

Providing an attractive total return

Successful execution of our strategic plan should allow Xcel Energy to deliver an attractive total return for our shareholders. Through

a combination of earnings growth and dividend yield, we plan to:

• Deliver long-term annual EPS growth of four percent to six percent, based on a weather-normalized 2014 EPS of $2.00;

• Deliver annual dividend increases of five percent to seven percent;

• Target a dividend payout ratio of 60 to 70 percent of annual ongoing EPS; and

• Maintain senior unsecured debt credit ratings in the BBB+ to A range.

We have successfully achieved our prior financial objectives, meeting or exceeding our earnings guidance range for ten consecutive

years and believe we are positioned to continue to achieve our value proposition. Our ongoing earnings have grown approximately

6.5 percent and our dividend has grown approximately 3.8 percent annually from 2005 through 2014. Prior to 2014, our objective was

to grow the dividend two to four percent annually. In addition, our current senior unsecured debt credit ratings for Xcel Energy and its

utility subsidiaries are in the BBB+ to A range.

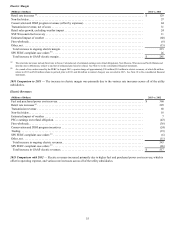

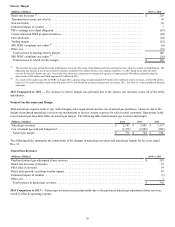

Financial Review

The following discussion and analysis by management focuses on those factors that had a material effect on Xcel Energy’s financial

condition, results of operations and cash flows during the periods presented, or are expected to have a material impact in the future. It

should be read in conjunction with the accompanying consolidated financial statements and the related notes to consolidated financial

statements.