Xcel Energy 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.103

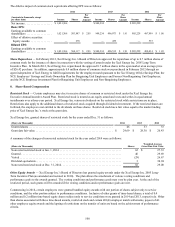

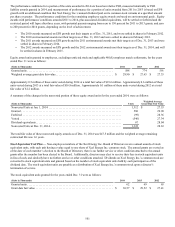

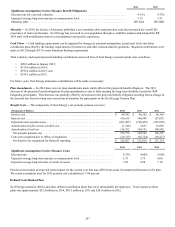

The maximum aggregate number of shares of common stock available for issuance under the Xcel Energy Inc. 2005 Long-Term

Incentive Plan (as amended and restated effective Feb. 17, 2010) is 8.3 million shares. Under the Xcel Energy Inc. Executive Annual

Incentive Award Plan (as amended and restated effective Feb. 17, 2010), the total number of shares approved for issuance is 1.2

million shares.

As of Dec. 31, 2014 and 2013, there was approximately $27.8 million and $22.1 million, respectively, of total unrecognized

compensation cost related to nonvested share-based compensation awards. Xcel Energy expects to recognize the amount

unrecognized at Dec. 31, 2014 over a weighted average period of 1.7 years.

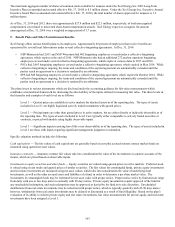

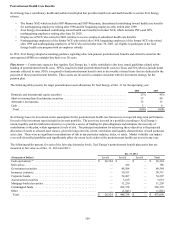

9. Benefit Plans and Other Postretirement Benefits

Xcel Energy offers various benefit plans to its employees. Approximately 48 percent of employees that receive benefits are

represented by several local labor unions under several collective-bargaining agreements. At Dec. 31, 2014:

• NSP-Minnesota had 2,011 and NSP-Wisconsin had 402 bargaining employees covered under a collective-bargaining

agreement, which expires at the end of 2016. NSP-Minnesota also had an additional 272 nuclear operation bargaining

employees covered under several collective-bargaining agreements, which expire at various dates in 2015 and 2016.

• PSCo had 2,063 bargaining employees covered under a collective-bargaining agreement, which expired in May 2014. While

collective bargaining is ongoing, the terms and conditions of the expired agreement are automatically extended until the

parties reach an agreement or a decision is rendered by an arbitrator.

• SPS had 840 bargaining employees covered under a collective-bargaining agreement, which expired in October 2014. While

collective bargaining is ongoing, the terms and conditions of the expired agreement are automatically extended until the

parties reach an agreement or a decision is rendered by an arbitrator.

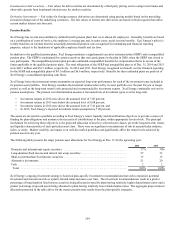

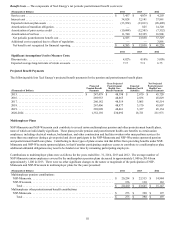

The plans invest in various instruments which are disclosed under the accounting guidance for fair value measurements which

establishes a hierarchical framework for disclosing the observability of the inputs utilized in measuring fair value. The three levels in

the hierarchy and examples of each level are as follows:

Level 1 — Quoted prices are available in active markets for identical assets as of the reporting date. The types of assets

included in Level 1 are highly liquid and actively traded instruments with quoted prices.

Level 2 — Pricing inputs are other than quoted prices in active markets, but are either directly or indirectly observable as of

the reporting date. The types of assets included in Level 2 are typically either comparable to actively traded securities or

contracts, or priced with models using highly observable inputs.

Level 3 — Significant inputs to pricing have little or no observability as of the reporting date. The types of assets included in

Level 3 are those with inputs requiring significant management judgment or estimation.

Specific valuation methods include the following:

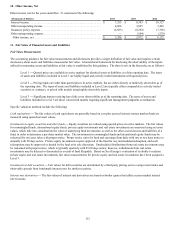

Cash equivalents — The fair values of cash equivalents are generally based on cost plus accrued interest; money market funds are

measured using quoted net asset values.

Insurance contracts — Insurance contract fair values take into consideration the value of the investments in separate accounts of the

insurer, which are priced based on observable inputs.

Investments in equity securities and other funds — Equity securities are valued using quoted prices in active markets. Preferred stock

is valued using recent trades and quoted prices of similar securities. The fair values for commingled funds, private equity investments

and real estate investments are measured using net asset values, which take into consideration the value of underlying fund

investments, as well as the other accrued assets and liabilities of a fund, in order to determine a per share market value. The

investments in commingled funds may be redeemed for net asset value with proper notice. Proper notice varies by fund and can range

from daily with one or two days notice to annually with 90 days notice. Private equity investments require approval of the fund for

any unscheduled redemption, and such redemptions may be approved or denied by the fund at its sole discretion. Unscheduled

distributions from real estate investments may be redeemed with proper notice, which is typically quarterly with 45-90 days notice;

however, withdrawals from real estate investments may be delayed or discounted as a result of fund illiquidity. Based on the plan’s

evaluation of its ability to redeem private equity and real estate investments, fair value measurements for private equity and real estate

investments have been assigned a Level 3.