Xcel Energy 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

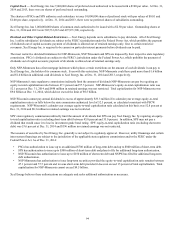

104

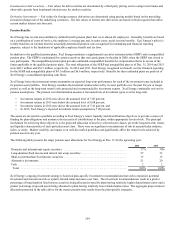

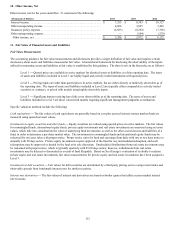

Investments in debt securities — Fair values for debt securities are determined by a third party pricing service using recent trades and

observable spreads from benchmark interest rates for similar securities.

Derivative Instruments — Fair values for foreign currency derivatives are determined using pricing models based on the prevailing

forward exchange rate of the underlying currencies. The fair values of interest rate derivatives are based on broker quotes that utilize

current market interest rate forecasts.

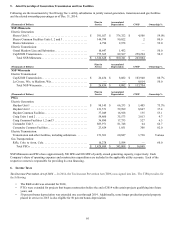

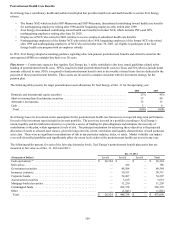

Pension Benefits

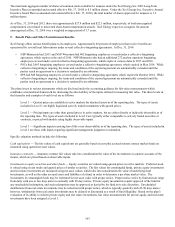

Xcel Energy has several noncontributory, defined benefit pension plans that cover almost all employees. Generally, benefits are based

on a combination of years of service, the employee’s average pay and, in some cases, social security benefits. Xcel Energy’s policy is

to fully fund into an external trust the actuarially determined pension costs recognized for ratemaking and financial reporting

purposes, subject to the limitations of applicable employee benefit and tax laws.

In addition to the qualified pension plans, Xcel Energy maintains a supplemental executive retirement plan (SERP) and a nonqualified

pension plan. The SERP is maintained for certain executives that were participants in the plan in 2008, when the SERP was closed to

new participants. The nonqualified pension plan provides unfunded, nonqualified benefits for compensation that is in excess of the

limits applicable to the qualified pension plans. The total obligations of the SERP and nonqualified plan as of Dec. 31, 2014 and 2013

were $46.5 million and $36.5 million, respectively. In 2014 and 2013, Xcel Energy recognized net benefit cost for financial reporting

for the SERP and nonqualified plans of $4.7 million and $6.6 million, respectively. Benefits for these unfunded plans are paid out of

Xcel Energy’s consolidated operating cash flows.

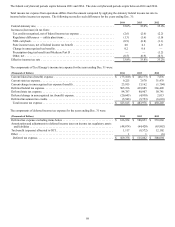

Xcel Energy bases the investment-return assumption on expected long-term performance for each of the investment types included in

its pension asset portfolio. Xcel Energy considers the historical returns achieved by its asset portfolio over the past 20-year or longer

period, as well as the long-term return levels projected and recommended by investment experts. Xcel Energy continually reviews its

pension assumptions. The pension cost determination assumes a forecasted mix of investment types over the long-term.

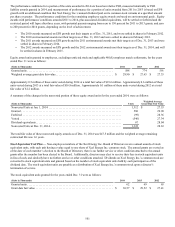

• Investment returns in 2014 were above the assumed level of 7.05 percent;

• Investment returns in 2013 were below the assumed level of 6.88 percent;

• Investment returns in 2012 were above the assumed level of 7.10 percent; and

• In 2015, Xcel Energy’s expected investment return assumption is 7.09 percent.

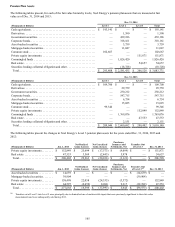

The assets are invested in a portfolio according to Xcel Energy’s return, liquidity and diversification objectives to provide a source of

funding for plan obligations and minimize the necessity of contributions to the plan, within appropriate levels of risk. The principal

mechanism for achieving these objectives is the projected allocation of assets to selected asset classes, given the long-term risk, return,

and liquidity characteristics of each particular asset class. There were no significant concentrations of risk in any particular industry,

index, or entity. Market volatility can impact even well-diversified portfolios and significantly affect the return levels achieved by

pension assets in any year.

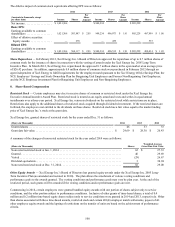

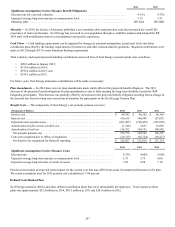

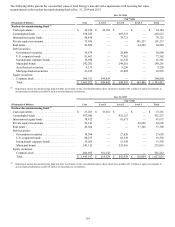

The following table presents the target pension asset allocations for Xcel Energy at Dec. 31 for the upcoming year:

2014 2013

Domestic and international equity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37% 30%

Long-duration fixed income and interest rate swap securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27 33

Short-to-intermediate fixed income securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 15

Alternative investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 20

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 2

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100% 100%

Xcel Energy’s ongoing investment strategy is based on plan-specific investment recommendations that seek to minimize potential

investment and interest rate risk as a plan’s funded status increases over time. The investment recommendations result in a greater

percentage of long-duration fixed income securities being allocated to specific plans having relatively higher funded status ratios and a

greater percentage of growth assets being allocated to plans having relatively lower funded status ratios. The aggregate projected asset

allocation presented in the table above for the master pension trust results from the plan-specific strategies.