Xcel Energy 2014 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

147

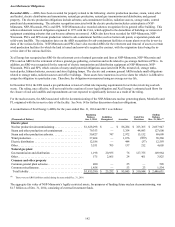

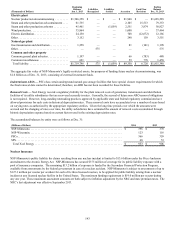

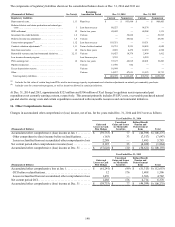

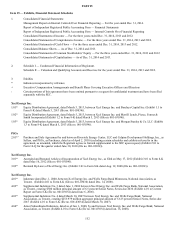

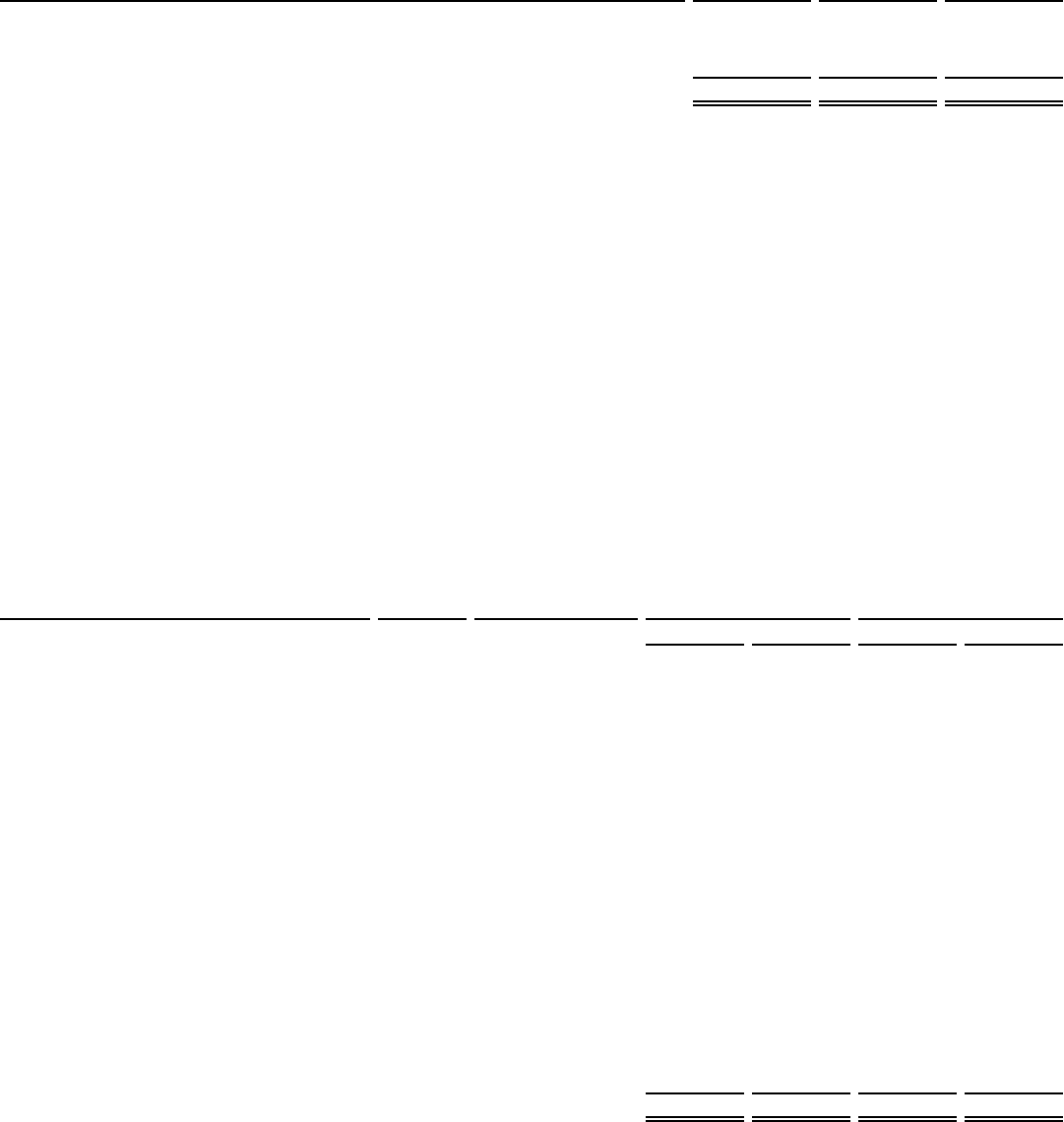

Decommissioning expenses recognized as a result of regulation include the following components:

(Thousands of Dollars) 2014 2013 2012

Annual decommissioning recorded as depreciation expense: (a)

Externally funded. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7,138 $ 6,402 $ —

Internally funded (including interest costs) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (1,251)

Net decommissioning expense recorded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 7,138 $ 6,402 $ (1,251)

(a) Decommissioning expense does not include depreciation of the capitalized nuclear asset retirement costs.

The reduction to expense for internally-funded portions in 2012 was a direct result of the 2008 decommissioning study jurisdictional

allocation and 100 percent external funding approval, effectively unwinding the remaining internal fund over the previously licensed

operating life of the unit (2010 for Monticello, 2013 for PI Unit 1 and 2014 for PI Unit 2). Due to the immaterial amount remaining in

the internal fund, the entire remaining amount was unwound for PI 1 and 2 in 2012. As of Dec. 31, 2013, there was no balance

remaining in the internally funded decommissioning account. The 2011 nuclear decommissioning filing approved in 2012 has been

used for the regulatory presentation.

15. Regulatory Assets and Liabilities

Xcel Energy Inc. and subsidiaries prepare their consolidated financial statements in accordance with the applicable accounting

guidance, as discussed in Note 1. Under this guidance, regulatory assets and liabilities are created for amounts that regulators may

allow to be collected, or may require to be paid back to customers in future electric and natural gas rates. Any portion of Xcel

Energy’s business that is not regulated cannot establish regulatory assets and liabilities. If changes in the utility industry or the

business of Xcel Energy no longer allow for the application of regulatory accounting guidance under GAAP, Xcel Energy would be

required to recognize the write-off of regulatory assets and liabilities in net income or OCI.

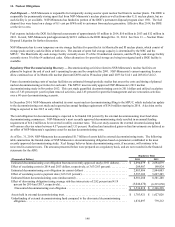

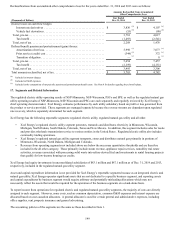

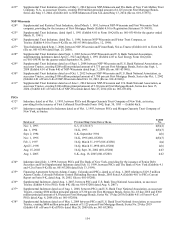

The components of regulatory assets shown on the consolidated balance sheets at Dec. 31, 2014 and 2013 are:

(Thousands of Dollars) See Note(s) Remaining

Amortization Period Dec. 31, 2014 Dec. 31, 2013

Regulatory Assets Current Noncurrent Current Noncurrent

Pension and retiree medical obligations (a) . . . . . . . . . . . . 9 Various $ 95,054 $ 1,402,360 $ 118,179 $ 1,192,808

Recoverable deferred taxes on AFUDC recorded in plant 1 Plant lives — 395,329 — 359,215

Contract valuation adjustments (b). . . . . . . . . . . . . . . . . . . 1, 11 Term of related contract 17,730 144,273 3,620 153,393

Net AROs (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1, 13, 14 Plant lives — 189,056 — 160,544

Conservation programs (d) . . . . . . . . . . . . . . . . . . . . . . . . . 1 One to six years 61,866 58,174 55,088 63,275

Environmental remediation costs . . . . . . . . . . . . . . . . . . . 1, 13 Various 4,594 149,812 4,735 119,175

Renewable resources and environmental initiatives. . . . . 13 One to four years 24,891 29,902 46,076 37,858

Depreciation differences. . . . . . . . . . . . . . . . . . . . . . . . . . 1 One to seventeen years 10,700 104,743 10,918 95,844

Purchased power contract costs . . . . . . . . . . . . . . . . . . . . 13 Term of related contract 858 69,908 — 68,182

Losses on reacquired debt. . . . . . . . . . . . . . . . . . . . . . . . . 4 Term of related debt 5,258 31,276 5,525 36,534

Nuclear refueling outage costs . . . . . . . . . . . . . . . . . . . . . 1 One to two years 62,499 19,745 86,333 36,477

Gas pipeline inspection and remediation costs. . . . . . . . . 12 Various 9,981 21,869 5,416 33,884

Recoverable purchased natural gas and electric energy

costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 One to two years 68,841 4,745 42,288 15,495

State commission adjustments . . . . . . . . . . . . . . . . . . . . . 1 Plant lives 571 26,092 444 14,204

PI EPU (e). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 Pending rate cases 8,743 67,379 — 69,668

Property tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . One to three years 28,024 31,429 18,427 30,626

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Various 44,448 28,124 20,752 22,036

Total regulatory assets . . . . . . . . . . . . . . . . . . . . . . . . . . $ 444,058 $ 2,774,216 $ 417,801 $ 2,509,218

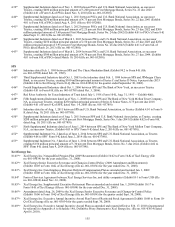

(a) Includes $282.4 million and $303.3 million for the regulatory recognition of the NSP-Minnesota pension expense of which $23.8 million and $23.2 million is

included in the current asset at Dec. 31, 2014 and 2013, respectively. Also included are $26.1 million and $17.7 million of regulatory assets related to the

nonqualified pension plan of which $2.5 million and $2.2 million is included in the current asset at Dec. 31, 2014 and 2013, respectively.

(b) Includes the fair value of certain long-term PPAs used to meet energy capacity requirements and valuation adjustments on natural gas commodity purchases.

(c) Includes amounts recorded for future recovery of AROs, less amounts recovered through nuclear decommissioning accruals and gains from decommissioning

investments.

(d) Includes costs for conservation programs, as well as incentives allowed in certain jurisdictions.

(e) For the canceled PI EPU project, NSP-Minnesota has addressed recovery of incurred costs in the pending multi-year rate case.