Xcel Energy 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

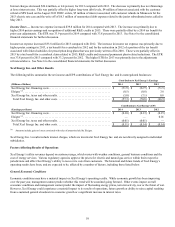

2014 Comparison to 2013 — The increase in O&M expenses for 2014 was largely driven by the following:

• Nuclear cost increases are related to the amortization of prior outages and initiatives designed to improve the operational

efficiencies of the plants; and

• Gain on sale of transmission assets relates to the 2013 gain associated with the sale of certain SPS’ transmission assets to

Sharyland.

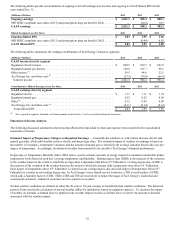

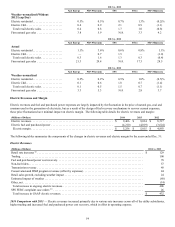

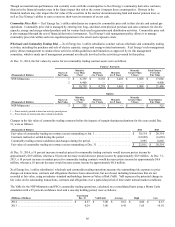

(Millions of Dollars) 2013 vs. 2012

Electric and gas distribution expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 44

Nuclear plant operations and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

Transmission costs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Employee benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Gain on sale of transmission assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (14)

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Total increase in O&M expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 97

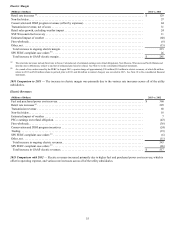

2013 Comparison to 2012 — The increase in O&M expenses for 2013 was largely driven by the following:

• Electric and gas distribution expenses were primarily driven by increased maintenance activities due to vegetation

management, storms and outages;

• Nuclear cost increases are related to the amortization of prior outages and initiatives designed to improve the operational

efficiencies of the plants;

• Increased transmission costs were related to higher substation maintenance expenditures and reliability costs;

• Higher employee benefits related primarily to increased pension expense; and

• See Note 12 to the consolidated financial statements for further discussion of the gain on sale of transmission assets.

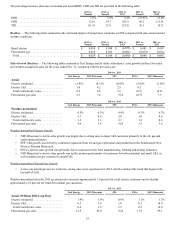

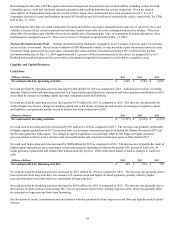

Conservation and DSM Program Expenses — Conservation and DSM program expenses increased $41.0 million, or 15.7 percent,

for 2014 compared with 2013. The increase was primarily attributable to higher electric recovery rates at NSP-Minnesota.

Conservation and DSM program expenses are generally recovered in our major jurisdictions concurrently through riders and base

rates.

Depreciation and Amortization — Depreciation and amortization increased $41.2 million, or 4.2 percent, for 2014 compared with

2013. The increase was primarily attributable to the PI steam generator replacement placed in service in December 2013 and normal

system expansion, partially offset by additional accelerated amortization of the excess depreciation reserve associated with certain

Minnesota assets. See further discussion within Note 12 to the consolidated financial statements.

Depreciation and amortization increased $51.8 million, or 5.6 percent, for 2013 compared with 2012. The increase is primarily

attributable to normal system expansion, which was partially offset by reductions related to the final rate order received for the 2013

Minnesota electric rate case that reduced depreciation expense by approximately $32 million for 2013.

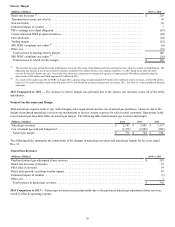

Taxes (Other Than Income Taxes) — Taxes (other than income taxes) increased $45.3 million, or 10.8 percent, for 2014 compared

with 2013. The increase was primarily due to higher property taxes in Colorado, Minnesota and Texas.

Taxes (other than income taxes) increased $11.6 million, or 2.8 percent, for 2013 compared with 2012. The annual increase is due to

higher property taxes primarily in Colorado and Texas.

AFUDC, Equity and Debt — AFUDC increased $1.3 million for 2014 compared with 2013. The increase was primarily due to

construction related to the CACJA and the expansion of transmission facilities, partially offset by the portion of the Monticello LCM/

EPU placed in service in July 2013 and the PI steam generator replacement placed in service in December 2013.

AFUDC increased $28.7 million for 2013 compared with 2012. The increase is primarily due to construction related to the CACJA

and the expansion of transmission facilities.

Interest Charges — Interest charges decreased $8.6 million, or 1.5 percent, for 2014 compared with 2013. The decrease was

primarily due to refinancings at lower interest rates, partially offset by higher long-term debt levels. In addition, interest charges in

2013 reflected $4 million of interest associated with the customer refund at SPS based on a FERC order, interest on customer refunds

in Minnesota and the write off of $6.3 million of unamortized debt expense related to the junior subordinated notes called in May

2013.