Xcel Energy 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

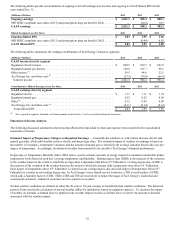

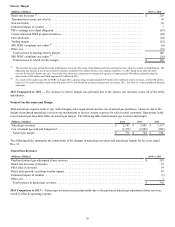

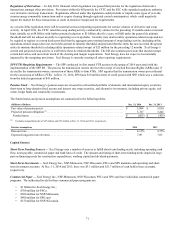

Costs charged to operating expenses for nuclear decommissioning and spent nuclear fuel disposal expenses, environmental monitoring

and disposal of hazardous materials and waste were approximately:

• $292 million in 2014;

• $275 million in 2013; and

• $263 million in 2012.

Xcel Energy estimates an average annual expense of approximately $339 million from 2015 through 2019 for similar costs. The

precise timing and amount of environmental costs, including those for site remediation and disposal of hazardous materials, are

unknown. Additionally, the extent to which environmental costs will be included in and recovered through rates may fluctuate.

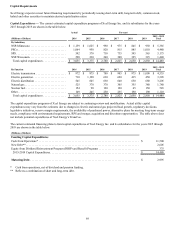

Capital expenditures for environmental improvements at regulated facilities were approximately:

• $373 million in 2014;

• $517 million in 2013; and

• $255 million in 2012.

See Item 7 — Capital Requirements for further discussion.

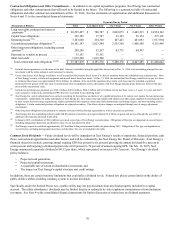

Xcel Energy’s operations are subject to federal and state laws and regulations related to air emissions, water discharges and waste

management from various sources. Such laws and regulations impose monitoring and reporting requirements and may require Xcel

Energy to obtain pre-approval for the construction or modification of projects that increase air emissions, water discharges or land

disposal of wastes, obtain and comply with permits that contain emission, discharge and operational limitations, or install or operate

pollution control equipment at facilities. Xcel Energy will likely be required to incur capital expenditures in the future to comply with

these requirements for remediation plans of MGP sites and various regulations for air emissions, water intake and discharge and waste

disposal. Actual expenditures could vary from the estimates presented. The scope and timing of these expenditures cannot be

determined until any new or revised regulations become final.

There are emission controls, known as BART, for industrial facilities releasing emissions that reduce visibility in certain national parks

and wilderness areas. Xcel Energy generating facilities in Minnesota and Colorado are subject to BART requirements. Further,

generating facilities throughout the Xcel Energy territory are subject to state and federal mercury reduction requirements. In addition,

the EPA has proposed to require installation of dry scrubbers on Tolk Units 1 and 2 under a federal visibility plan for Texas.

See Note 13 to the consolidated financial statements for further discussion of Xcel Energy’s environmental contingencies.

Inflation

Inflation at its current level is not expected to materially affect Xcel Energy’s prices or returns to shareholders. However, potential

future inflation could result from economic conditions or the economic and monetary policies of the U.S. Government and the Federal

Reserve. This could lead to future price increases for materials and services required to deliver electric and natural gas services to

customers. These potential cost increases could in turn lead to increased prices to customers. If current low oil prices lead to

sustained deflation, that could also reduce general economic activity although it may lead to lower electric and natural gas prices to

customers.

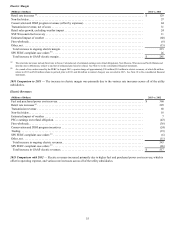

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Preparation of the consolidated financial statements and related disclosures in compliance with GAAP requires the application of

accounting rules and guidance, as well as the use of estimates. The application of these policies involves judgments regarding future

events, including the likelihood of success of particular projects, legal and regulatory challenges and anticipated recovery of costs.

These judgments could materially impact the consolidated financial statements and disclosures, based on varying assumptions. In

addition, the financial and operating environment also may have a significant effect on the operation of the business and on the results

reported. The following is a list of accounting policies and estimates that are most significant to the portrayal of Xcel Energy’s

financial condition and results, and require management’s most difficult, subjective or complex judgments. Each of these has a higher

likelihood of resulting in materially different reported amounts under different conditions or using different assumptions. Each critical

accounting policy has been reviewed and discussed with the Audit Committee of Xcel Energy Inc.’s Board of Directors on a quarterly

basis.