Xcel Energy 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

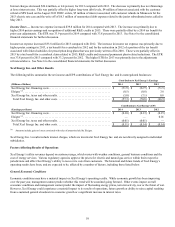

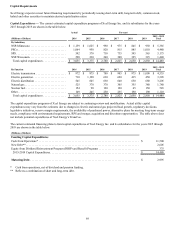

Capital Requirements

Xcel Energy expects to meet future financing requirements by periodically issuing short-term debt, long-term debt, common stock,

hybrid and other securities to maintain desired capitalization ratios.

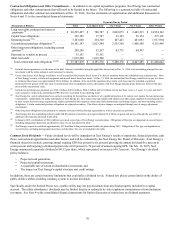

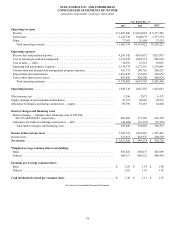

Capital Expenditures — The current estimated capital expenditure programs of Xcel Energy Inc. and its subsidiaries for the years

2015 through 2019 are shown in the table below.

Actual Forecast

(Millions of Dollars) 2014 2015 2016 2017 2018 2019 2015 - 2019

Total

By Subsidiary

NSP-Minnesota . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,159 $ 1,625 $ 990 $ 975 $ 845 $ 950 $ 5,385

PSCo. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,064 950 820 815 885 1,010 4,480

SPS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 542 570 710 735 595 565 3,175

NSP-Wisconsin. . . . . . . . . . . . . . . . . . . . . . . . . . 290 230 260 300 325 325 1,440

Total capital expenditures . . . . . . . . . . . . . . . . $ 3,055 $ 3,375 $ 2,780 $ 2,825 $ 2,650 $ 2,850 $ 14,480

By Function 2014 2015 2016 2017 2018 2019 2015 - 2019

Total

Electric transmission . . . . . . . . . . . . . . . . . . . . . $ 972 $ 875 $ 780 $ 905 $ 975 $ 1,000 $ 4,535

Electric generation . . . . . . . . . . . . . . . . . . . . . . . 710 1,190 630 620 415 450 3,305

Electric distribution . . . . . . . . . . . . . . . . . . . . . . 545 605 630 640 650 680 3,205

Natural gas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 525 370 370 305 355 380 1,780

Nuclear fuel . . . . . . . . . . . . . . . . . . . . . . . . . . . . 154 90 120 120 65 150 545

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 149 245 250 235 190 190 1,110

Total capital expenditures . . . . . . . . . . . . . . . . $ 3,055 $ 3,375 $ 2,780 $ 2,825 $ 2,650 $ 2,850 $ 14,480

The capital expenditure programs of Xcel Energy are subject to continuing review and modification. Actual utility capital

expenditures may vary from the estimates due to changes in electric and natural gas projected load growth, regulatory decisions,

legislative initiatives, reserve margin requirements, the availability of purchased power, alternative plans for meeting long-term energy

needs, compliance with environmental requirements, RPS and merger, acquisition and divestiture opportunities. The table above does

not include potential expenditures of Xcel Energy’s TransCos.

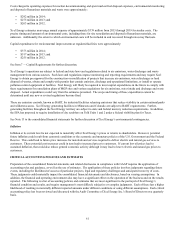

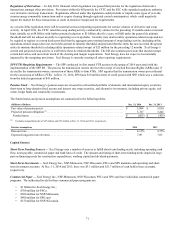

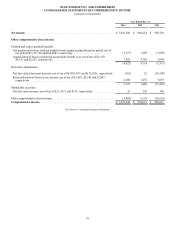

The current estimated financing plans to fund capital expenditures of Xcel Energy Inc. and its subsidiaries for the years 2015 through

2019 are shown in the table below.

(Millions of Dollars)

Funding Capital Expenditures

Cash from Operations* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 11,500

New Debt** . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,605

Equity from Dividend Reinvestment Program (DRIP) and Benefit Programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . 375

2015-2019 Capital Expenditures. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 14,480

Maturing Debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,995

* Cash from operations, net of dividend and pension funding.

** Reflects a combination of short and long-term debt.