Xcel Energy 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

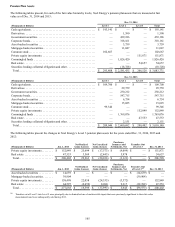

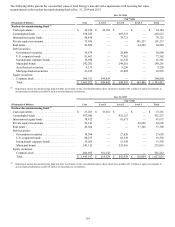

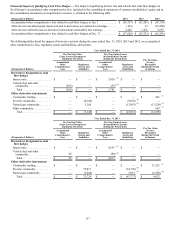

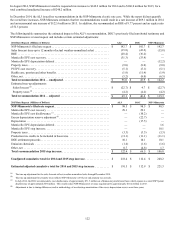

The following tables present the changes in Level 3 nuclear decommissioning fund investments:

(Thousands of Dollars) Jan. 1, 2014 Purchases Settlements

Gains

Recognized as

Regulatory

Assets (a) Transfers Out

of Level 3 Dec. 31, 2014

Private equity investments . . . . . . . $ 62,696 $ 22,078 $ (286) $ 16,749 $ — $ 101,237

Real estate . . . . . . . . . . . . . . . . . . . 57,368 8,088 (9,794) 8,587 — 64,249

Total. . . . . . . . . . . . . . . . . . . . . . . $ 120,064 $ 30,166 $ (10,080) $ 25,336 $ — $ 165,486

(Thousands of Dollars) Jan. 1, 2013 Purchases Settlements

Gains

Recognized as

Regulatory

Assets (a) Transfers Out

of Level 3 (b) Dec. 31, 2013

Private equity investments . . . . . . . $ 33,250 $ 24,201 $ — $ 5,245 $ — $ 62,696

Real estate . . . . . . . . . . . . . . . . . . . 39,074 31,626 (18,622) 5,290 — 57,368

Asset-backed securities . . . . . . . . . 2,067 — — — (2,067) —

Mortgage-backed securities . . . . . . 30,209 — — — (30,209) —

Total. . . . . . . . . . . . . . . . . . . . . . . $ 104,600 $ 55,827 $ (18,622) $ 10,535 $ (32,276) $ 120,064

(Thousands of Dollars) Jan. 1, 2012 Purchases Settlements

Gains (Losses)

Recognized as

Regulatory

Assets (a) Transfers Out

of Level 3 Dec. 31, 2012

Private equity investments . . . . . . . $ 9,203 $ 20,671 $ (1,931) $ 5,307 $ — $ 33,250

Real estate . . . . . . . . . . . . . . . . . . . 26,395 9,777 (3,611) 6,513 — 39,074

Asset-backed securities . . . . . . . . . 16,501 — (14,450) 16 — 2,067

Mortgage-backed securities . . . . . . 78,664 33,016 (79,899)(1,572) — 30,209

Total. . . . . . . . . . . . . . . . . . . . . . . $ 130,763 $ 63,464 $ (99,891) $ 10,264 $ — $ 104,600

(a) Gains and losses are deferred as a component of the regulatory asset for nuclear decommissioning.

(b) Transfers out of Level 3 into Level 2 were principally due to diminished use of unobservable inputs that were previously significant to these fair value

measurements and were subsequently sold during 2013.

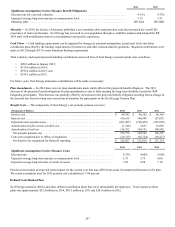

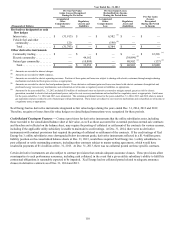

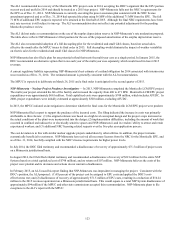

The following table summarizes the final contractual maturity dates of the debt securities in the nuclear decommissioning fund, by

asset class, at Dec. 31, 2014:

Final Contractual Maturity

(Thousands of Dollars) Due in 1 Year

or Less Due in 1 to 5

Years Due in 5 to 10

Years Due after 10

Years Total

Government securities. . . . . . . . . . . . . . . $ — $ — $ — $ 28,808 $ 28,808

U.S. corporate bonds . . . . . . . . . . . . . . . . 300 15,530 62,838 (1,106) 77,562

International corporate bonds . . . . . . . . . — 4,212 12,129 — 16,341

Municipal bonds . . . . . . . . . . . . . . . . . . . 1,893 35,048 41,530 170,730 249,201

Asset-backed securities . . . . . . . . . . . . . . — — 6,389 2,861 9,250

Mortgage-backed securities. . . . . . . . . . . — — — 23,895 23,895

Debt securities. . . . . . . . . . . . . . . . . . . . $ 2,193 $ 54,790 $ 122,886 $ 225,188 $ 405,057

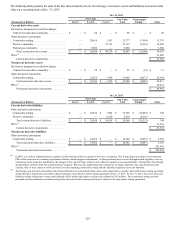

Derivative Instruments Fair Value Measurements

Xcel Energy enters into derivative instruments, including forward contracts, futures, swaps and options, for trading purposes and to

manage risk in connection with changes in interest rates, utility commodity prices and vehicle fuel prices.

Interest Rate Derivatives — Xcel Energy enters into various instruments that effectively fix the interest payments on certain floating

rate debt obligations or effectively fix the yield or price on a specified benchmark interest rate for an anticipated debt issuance for a

specific period. These derivative instruments are generally designated as cash flow hedges for accounting purposes.

At Dec. 31, 2014, accumulated other comprehensive losses related to interest rate derivatives included $2.8 million of net losses

expected to be reclassified into earnings during the next 12 months as the related hedged interest rate transactions impact earnings,

including forecasted amounts for unsettled hedges, as applicable.