Xcel Energy 2014 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.131

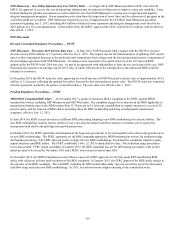

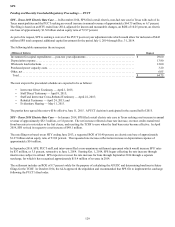

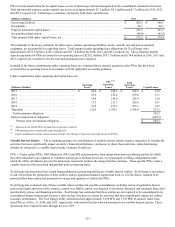

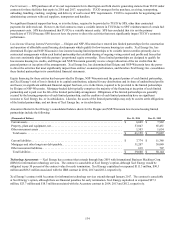

Golden Spread, along with certain New Mexico cooperatives and the West Texas Municipal Power Agency, separately filed a third rate

complaint in October 2014, requesting that the base ROE in the SPS production and transmission formula rates be reduced to 8.61

percent and 9.11 percent, respectively. The complainants requested a refund effective date of Oct. 20, 2014. In January 2015, the

FERC issued an order setting the third complaint for hearing procedures and granting the complainants’ requested refund effective

date.

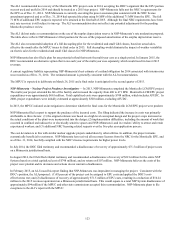

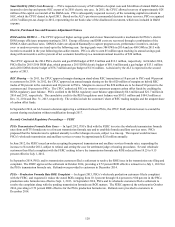

SPS – FERC Complaint Case Orders — In August 2013, the FERC issued an order on rehearing related to a 2004 complaint case

brought by Golden Spread and PNM and an Order on Initial Decision in a subsequent 2006 production rate case filed by SPS.

The original complaint included two key components: 1) PNM’s claim regarding inappropriate allocation of fuel costs and 2) a base

rate complaint, including the appropriate demand-related cost allocator. The FERC previously determined that the allocation of fuel

costs and the demand-related cost allocator utilized by SPS was appropriate.

In the August 2013 Orders, the FERC clarified its previous ruling on the allocation of fuel costs and reaffirmed that the refunds in

question should only apply to firm requirements customers and not PNM’s contractual load. The FERC also reversed its prior

demand-related cost allocator decision. The FERC stated that it had erred in its initial analysis and concluded that the SPS system was

a 3CP rather than a 12CP system.

In September 2013, SPS filed a request for rehearing of the FERC ruling on the CP allocation and refund decisions. SPS asserted that

the FERC applied an improper burden of proof and that precedent did not support retroactive refunds. PNM also requested rehearing

of the FERC decision not to reverse its prior ruling. In October 2013, the FERC issued orders further considering the requests for

rehearing, which are currently pending. As of Dec. 31, 2013, SPS had accrued $44.5 million related to the August 2013 Orders and an

additional $5.9 million of principal and interest was accrued during 2014.

On Jan. 30, 2015, SPS filed to revise the production formula rates for six of its wholesale customers, including Golden Spread,

effective Feb. 1, 2015. The filing proposes several modifications, including a reduction in wholesale depreciation rates and the use of

a 12CP demand-related cost allocator. If approved, principal and interest accruals from the August 2013 Orders would cease as of the

effective date. FERC action is pending.

Sale of Texas Transmission Assets — In March 2013, SPS reached an agreement to sell certain segments of SPS’ transmission lines

and two related substations to Sharyland. In 2013, SPS received all necessary regulatory approvals for the transaction. In December

2013, SPS received $37.1 million and recognized a pre-tax gain of $13.6 million and regulatory liabilities for jurisdictional gain

sharing of $7.2 million. The gain is reflected in the consolidated statement of income as a reduction to O&M expenses. In December

2014, Golden Spread submitted a preliminary challenge asserting that the gain should be shared with wholesale transmission

customers. SPS has disputed this claim. It is uncertain if the matter will result in a formal proceeding with the FERC.

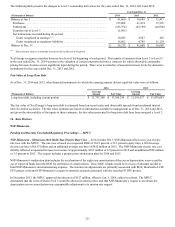

13. Commitments and Contingencies

Commitments

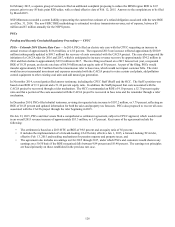

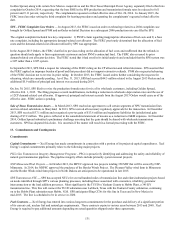

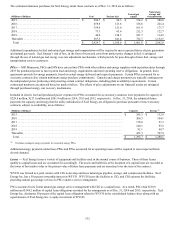

Capital Commitments — Xcel Energy has made commitments in connection with a portion of its projected capital expenditures. Xcel

Energy’s capital commitments primarily relate to the following major projects:

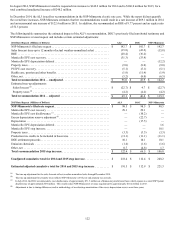

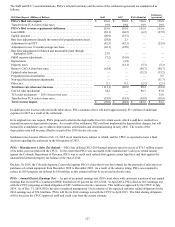

PSCo Gas Transmission Integrity Management Programs – PSCo is proactively identifying and addressing the safety and reliability of

natural gas transmission pipelines. The pipeline integrity efforts include primarily system renewal projects.

NSP-Minnesota Wind Projects — In October 2013, the MPUC approved two projects totaling 350 MW that will be owned by NSP-

Minnesota. In 2014, the NDPSC approved the prudence of the Border Winds Project. The Pleasant Valley wind farm in Minnesota

and the Border Winds wind farm projects in North Dakota are anticipated to be operational in late 2015.

SPS Transmission NTC — SPS has accepted NTCs for several hundred miles of transmission line and related substation projects based

on needs identified through SPP’s various planning processes, including those associated with economics, reliability, generator

interconnection or the load addition processes. Most significant is the TUCO to Yoakum County to Hobbs Plant, a 345 KV

transmission line. This line will connect the TUCO substation near Lubbock, Texas with the Yoakum County substation, continuing

on to the Hobbs Plant substation near Hobbs, N.M. SPS anticipates filing CCNs for this line in Texas and in New Mexico in

mid-2015. The line is scheduled to be in service in 2020.

Fuel Contracts — Xcel Energy has entered into various long-term commitments for the purchase and delivery of a significant portion

of its current coal, nuclear fuel and natural gas requirements. These contracts expire in various years between 2015 and 2060. Xcel

Energy is required to pay additional amounts depending on actual quantities shipped under these agreements.