Xcel Energy 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

All credit facility bank borrowings, outstanding letters of credit and outstanding commercial paper reduce the available capacity under

the respective credit facilities. Xcel Energy Inc. and its subsidiaries had no direct advances on the credit facilities outstanding at Dec.

31, 2014 and 2013.

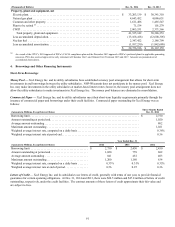

Long-Term Borrowings and Other Financing Instruments

Generally, all real and personal property of NSP-Minnesota, NSP-Wisconsin, PSCo and SPS are subject to the liens of their first

mortgage indentures. Debt premiums, discounts and expenses are amortized over the life of the related debt. The premiums,

discounts and expenses associated with refinanced debt are deferred and amortized over the life of the related new issuance, in

accordance with regulatory guidelines.

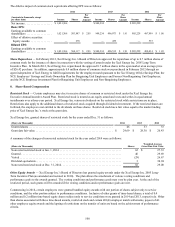

Maturities of long-term debt are as follows:

(Millions of Dollars)

2015. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 258

2016. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 656

2017. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 388

2018. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,206

2019. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 406

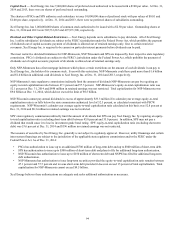

During 2014, Xcel Energy Inc. and its utility subsidiaries completed the following financings:

• In March 2014, PSCo issued $300 million of 4.3 percent first mortgage bonds due March 15, 2044;

• In May 2014, NSP-Minnesota issued $300 million of 4.125 percent first mortgage bonds due May 15, 2044;

• In June 2014, SPS issued $150 million of 3.30 percent first mortgage bonds due June 15, 2024; and

• In June 2014, NSP-Wisconsin issued $100 million of 3.30 percent first mortgage bonds due June 15, 2024.

In connection with SPS’ issuance of $150 million of 3.30 percent first mortgage bonds due June 15, 2024, SPS concurrently took

certain actions to secure its previously issued Series G Senior Notes due Dec. 1, 2018 equally and ratably with SPS’ first mortgage

bonds as required pursuant to the terms of the Series G notes.

To provide the required collateralization, SPS issued $250 million of collateral 8.75 percent first mortgage bonds due Dec. 1, 2018 to

the trustee under its senior unsecured indenture which secured the previously issued Series G Senior Notes, 8.75 percent due Dec. 1,

2018, equally and ratably with SPS’ first mortgage bonds.

During 2013, Xcel Energy Inc. and its utility subsidiaries completed the following financings:

• In March 2013, PSCo issued $250 million of 2.50 percent first mortgage bonds due March 15, 2023 and $250 million of 3.95

percent first mortgage bonds due March 15, 2043.

• In May 2013, Xcel Energy Inc. issued $450 million of 0.75 percent senior unsecured notes due May 9, 2016.

• In May 2013, NSP-Minnesota issued $400 million of 2.60 percent first mortgage bonds due May 15, 2023.

• In August 2013, SPS issued $100 million of 4.50 percent first mortgage bonds due Aug. 15, 2041. Including the $300 million

of this series previously issued, total principal outstanding for this series is $400 million.

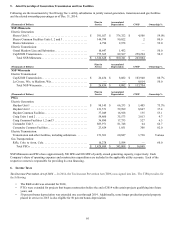

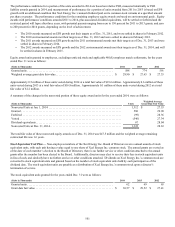

Issuances of Common Stock — Xcel Energy Inc. issued approximately 5.7 million shares of common stock through an at-the-market

(ATM) program and received cash proceeds of $172.7 million net of $1.9 million in fees and commissions during the first six months

of 2014. During the year ended Dec. 31, 2013, Xcel Energy Inc. issued approximately 7.7 million shares of common stock through

this program and received cash proceeds of $222.7 million net of $2.7 million in fees and commissions. Xcel Energy completed its

ATM program as of June 30, 2014. The proceeds from the issuances of common stock were used to repay short-term debt, infuse

equity into the utility subsidiaries and for other general corporate purposes.

Debt Redemption — On May 31, 2013, Xcel Energy Inc. redeemed the entire $400 million principal amount of its 7.60 percent junior

subordinated notes. Upon redemption, Xcel Energy Inc. recognized $6.3 million of related unamortized debt issuance costs as interest

charges.

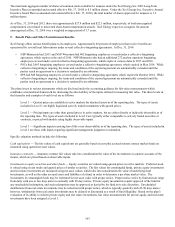

Deferred Financing Costs — Other assets included deferred financing costs of approximately $85 million and $83 million, net of

amortization, at Dec. 31, 2014 and 2013, respectively. Xcel Energy is amortizing these financing costs over the remaining maturity

periods of the related debt.