Xcel Energy 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

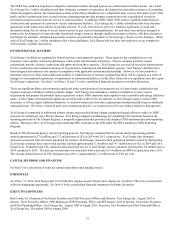

The profitability of our utility operations is dependent on our ability to recover the costs of providing energy and utility services to our

customers and earn a return on our capital investment in our utility operations. Our utility subsidiaries provide service at rates

approved by one or more regulatory commissions. These rates are generally regulated and based on an analysis of the utility’s costs

incurred in a test year. Our utility subsidiaries are subject to both future and historical test years depending upon the regulatory

mechanisms approved in each jurisdiction. Thus, the rates a utility is allowed to charge may or may not match its costs at any given

time. While rate regulation is premised on providing an opportunity to earn a reasonable rate of return on invested capital, in a

continued low interest rate environment there has been pressure pushing down ROE. There can also be no assurance that the

applicable regulatory commission will judge all the costs of our utility subsidiaries to have been prudent or that the regulatory process

in which rates are determined will always result in rates that will produce full recovery of such costs. Cost disallowances may arise as

a result of prudence investigations (e.g., Monticello LCM/EPU project or the recent investigation of our PSIA costs). Rising fuel costs

could increase the risk that our utility subsidiaries will not be able to fully recover their fuel costs from their customers. Furthermore,

there could be changes in the regulatory environment that would impair the ability of our utility subsidiaries to recover costs

historically collected from their customers.

Management currently believes these prudently incurred costs are recoverable given the existing regulatory mechanisms in place.

However, adverse regulatory rulings or the imposition of additional regulations, including additional environmental or climate change

regulation, could have an adverse impact on our results of operations and hence could materially and adversely affect our ability to

meet our financial obligations, including debt payments and the payment of dividends on our common stock.

Any reductions in our credit ratings could increase our financing costs and the cost of maintaining certain contractual

relationships.

We cannot be assured that any of our current ratings or our subsidiaries’ ratings will remain in effect for any given period of time or

that a rating will not be lowered or withdrawn entirely by a rating agency. In addition, our credit ratings may change as a result of the

differing methodologies or change in the methodologies used by the various rating agencies. Any downgrade could lead to higher

borrowing costs. Also, our utility subsidiaries may enter into certain procurement and derivative contracts that require the posting of

collateral or settlement of applicable contracts if credit ratings fall below investment grade.

We are subject to capital market and interest rate risks.

Utility operations require significant capital investment in property, plant and equipment. As a result, we frequently need to access the

debt and equity capital markets. Any disruption in capital markets could have a material impact on our ability to fund our operations.

Capital markets are global in nature and are impacted by numerous issues and events throughout the world economy. Capital market

disruption events and resulting broad financial market distress could prevent us from issuing new securities or cause us to issue

securities with less than ideal terms and conditions, such as higher interest rates.

Higher interest rates on short-term borrowings with variable interest rates or on incremental commercial paper issuances could also

have an adverse effect on our operating results. Changes in interest rates may also impact the fair value of the debt securities in the

nuclear decommissioning fund and master pension trust, as well as our ability to earn a return on short-term investments of excess

cash.

We are subject to credit risks.

Credit risk includes the risk that our retail customers will not pay their bills, which may lead to a reduction in liquidity and an eventual

increase in bad debt expense. Retail credit risk is comprised of numerous factors including the price of products and services

provided, the overall economy and local economies in the geographic areas we serve, including local unemployment rates.

Credit risk also includes the risk that various counterparties that owe us money or product will breach their obligations. Should the

counterparties to these arrangements fail to perform, we may be forced to enter into alternative arrangements. In that event, our

financial results could be adversely affected and we could incur losses.