Wells Fargo 2010 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

identified more opportunities to serve them, and this benefits

communities and our shareholders. In 2010, we facilitated

hundreds of transactions to support municipalities, hospitals

and universities, including a $300 million credit facility for

the Los Angeles Department of Water & Power, part of a

comprehensive, long-term relationship with the city.

Helping American business grow

We serve thousands of companies across America that have

annual revenue from $10 million to $750 million. Bankers may

call this the “middle market,” but it’s really The Big Middle.

Companies such as this are at the forefront of the U.S. economic

recovery. They employ tens of millions of Americans. They

make things people use every day. They’re the lifeblood of

the tax base in our communities. Their shop floors are where

America gets things done, makes things better and makes

better things. As CEO of Wells Fargo, I’m privileged to visit

the plants and oces of many of our commercial customers

every year across the country. They appreciate our relationship

approach, consistent underwriting through the business

cycle, local decision-making, and the depth and breadth of our

products, which we believe are the best in our industry.

The CEOs and CFOs of many of our commercial customers,

and many of our large corporate customers, are telling us

they see the economy improving. Many are adding inventory,

expanding operations, using lines of credit and qualifying

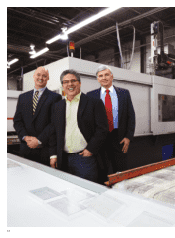

for new credit. One example is Aetna Plywood, a wholesale

distributor of wood and composite products based in Maywood,

Illinois. It’s been a loyal customer of Wells Fargo for several

years. Its sales declined during the recession, but its owner

and president, Larry Rassin, says sales picked up in 2010 as its

clients began making delayed improvements in their stores.

“It’s a slow progression of continued growth,” he says, “and we

believe it will continue.”

We want to be the commercial bank of choice for companies

like Aetna Plywood in every one of our markets. We want to

have more lead relationships than any competitor in every

market we serve. We want to satisfy every financial need of

commercial customers, large and small. We made significant

progress toward these ambitious goals in 2010. We’re already

#1 in market share for middle-market companies. Our

Commercial Banking team attracted more new customers in

2010 than in any single year in our company’s history.

Our average Commercial Banking relationship in the West

(legacy Wells Fargo) had eight products with us in 2010. In the

East, where the Wachovia conversion is in the home stretch,

customer relationships are strong and we’re earning more

of their business.

Average core deposits for Wholesale Banking customers

rose 15 percent. Loan balances grew in asset-backed finance

and global financial institutions. New loan commitments rose

in commercial real estate. Our commercial customers have

scanned, sent and deposited from their oces more than

$1 trillion of checks with us the last three years securely via the

internet through our Desktop Deposit service. This saved them,

and our environment, 1.64 million miles driving back and forth

to the bank, and 91,000 gallons of gas.

we forgave $3.8 billion in principal (by far, the industry leader

in this measure). That was an average reduction of $51,000 per

loan. To do this work, we hired 10,000 home preservation sta

for a total of 16,000. We assign one specialist to work with

a customer from start-to-finish on a modification.

In 2010 however, we didn’t always measure up. For example,

when we became aware we hadn’t managed some aspects of

the foreclosure adavit process well, our first concern was

to confirm that no customer experienced an unwarranted

foreclosure because of an incorrect adavit. We then reviewed

certain pending foreclosure adavits, and enhanced our

policies and processes to help ensure full consistency and

compliance.

We plan to double in 2011 the number of home preservation

events we hosted last year. Through 19 large-scale events since

the beginning of 2009, we’ve worked face-to-face with 19,000

customers struggling to make their mortgage payments. We

met with 31,000 more customers at our 27 home preservation

centers across the country.

Our commitment to our customers and our country in

managing home loan challenges has been unwavering, and it

will continue in 2011.

Wholesale Banking: Ripe with opportunity

Our Wholesale bankers were careful planners and stewards

of their businesses during the economic downturn. As a

result, they’re now earning even more of our customers’

business as the economy revives. For example, they managed

Microsoft’s $4.7 billion senior notes oering. They’re providing

$750 million to finance LEED® certified commercial buildings

and community development projects. They’re providing

insurance to help reduce customers’ business risks. They’re

satisfying the global financial needs of more of our clients

through our international group’s 36 oces in 34 countries.

Investment Banking

Helping our corporate and middle market clients raise capital

to grow their businesses is an art and a science. You have to

focus on what’s best for the customer. You have to provide

extensive research and deep, thoughtful knowledge about the

client’s industry. You have to have a very experienced team that

can provide superior execution. All this has to be supported by

a strong capital position. Because of our strength in all these

areas many large companies are now entrusting billions of

dollars of bond and equity financing with Wells Fargo, including

MetLife, HSBC, Walmart, Hewlett Packard and Hertz. Many

other companies turned to Wells Fargo Securities in 2010

for their mergers and acquisitions, including Penske, Capital

Source, Snyder’s of Hanover, Lance, Inergy, and Atlas Pipeline.

Supporting municipalities, healthcare and education

Many banks are averse to doing business with governments,

education, healthcare and non-profits because of what they

perceive as high risk and low returns. We’re proud to serve

these sectors. We provide a wide range of financial solutions

for our 4,400 government, education, healthcare and non-

profit clients. Our loans to these institutions rose 40 percent

for the year. Their deposits with us rose 35 percent. We also