Wells Fargo 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Management –Asset/Liability Management (continued)

LIQUIDITY AND FUNDING The objective of effective liquidity

management is to ensure that we can meet customer loan

requests, customer deposit maturities/withdrawals and other

cash commitments efficiently under both normal operating

conditions and under unpredictable circumstances of industry or

market stress. To achieve this objective, the Corporate ALCO

establishes and monitors liquidity guidelines that require

sufficient asset-based liquidity to cover potential funding

requirements and to avoid over-dependence on volatile, less

reliable funding markets. We set these guidelines for both the

consolidated balance sheet and for the Parent to ensure that the

Parent is a source of strength for its regulated, deposit-taking

banking subsidiaries.

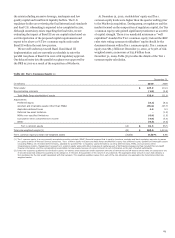

Unencumbered debt and equity securities in the securities

available-for-sale portfolio provide asset liquidity, in addition to

the immediately liquid resources of cash and due from banks

and federal funds sold, securities purchased under resale

agreements and other short-term investments. The weighted-

average expected remaining maturity of the debt securities

within this portfolio was 6.1 years at December 31, 2010. Of the

$160.1 billion (cost basis) of debt securities in this portfolio at

December 31, 2010, $32.6 billion (20%) is expected to mature or

be prepaid in 2011 and an additional $20.4 billion (13%) in 2012.

Asset liquidity is further enhanced by our ability to sell or

securitize loans in secondary markets and to pledge loans to

access secured borrowing facilities through the Federal Home

Loan Banks (FHLB) and the FRB. In 2010, we sold mortgage

loans of $363 billion. The amount of mortgage loans and other

consumer loans available to be sold, securitized or pledged was

approximately $236 billion at December 31, 2010.

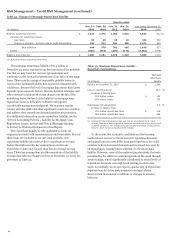

Core customer deposits have historically provided a sizeable

source of relatively stable and low-cost funds. Average core

deposits funded 62.9% and 60.4% of average total assets in 2010

and 2009, respectively.

Additional funding is provided by long-term debt (including

trust preferred securities), other foreign deposits, and short-

term borrowings. Long-term debt averaged $185.4 billion in

2010 and $231.8 billion in 2009. Short-term borrowings

averaged $46.8 billion in 2010 and $52.0 billion in 2009.

We anticipate making capital expenditures of approximately

$1.5 billion in 2011 for our stores, relocation and remodeling of

our facilities, and routine replacement of furniture, equipment

and servers. We fund expenditures from various sources,

including retained earnings and borrowings.

Liquidity is also available through our ability to raise funds in

a variety of domestic and international money and capital

markets. We access capital markets for long-term funding

through issuances of registered debt securities, private

placements and asset-backed secured funding. Investors in the

long-term capital markets generally will consider, among other

factors, a company’s debt rating in making investment decisions.

Rating agencies base their ratings on many quantitative and

qualitative factors, including capital adequacy, liquidity, asset

quality, business mix, the level and quality of earnings, and

rating agency assumptions regarding the probability and extent

of Federal financial assistance or support for certain large

financial institutions. Adverse changes in these factors could

result in a reduction of our credit rating; however, a reduction in

credit rating would not cause us to violate any of our debt

covenants. See the “Risk Factors” section of this Report for

additional information regarding recent legislative developments

and our credit ratings.

We continue to evaluate the potential impact on liquidity

management of regulatory proposals, including Basel III and

those required under the Dodd-Frank Act, as they move closer to

the final rule-making process.

Parent Under SEC rules, the Parent is classified as a “well-

known seasoned issuer,” which allows it to file a registration

statement that does not have a limit on issuance capacity. “Well-

known seasoned issuers” generally include those companies with

a public float of common equity of at least $700 million or those

companies that have issued at least $1 billion in aggregate

principal amount of non-convertible securities, other than

common equity, in the last three years. In June 2009, the

Parent filed a registration statement with the SEC for the

issuance of senior and subordinated notes, preferred stock and

other securities. The Parent’s ability to issue debt and other

securities under this registration statement is limited by the debt

issuance authority granted by the Board. The Parent is currently

authorized by the Board to issue $60 billion in outstanding

short-term debt and $170 billion in outstanding long-term debt.

During 2010, the Parent issued $1.3 billion in non-guaranteed

registered senior notes. In February 2011, the Parent remarketed

$2.5 billion of junior subordinated notes in connection with

Wachovia’s 2006 issuance of 5.80% Fixed-to-floating rate

Wachovia Income Trust hybrid securities. The junior

subordinated notes were exchanged with Wells Fargo for newly

issued senior notes.

The proceeds from securities issued in 2010 were used for

general corporate purposes, and we expect that the proceeds

from securities issued in the future will also be used for the same

purposes. The Parent also issues commercial paper from time to

time, subject to its short-term debt limit.

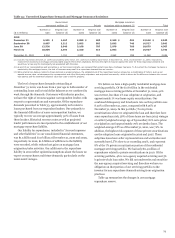

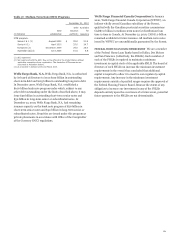

Table 37 provides information regarding the Parent’s

medium-term note (MTN) programs. The Parent may issue

senior and subordinated debt securities under Series I & J, and

the European and Australian programmes. Under Series K, the

Parent may issue senior debt securities linked to one or more

indices.

80