Wells Fargo 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

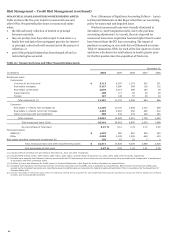

Most of the modifications result in material payment reduction

to the customer. Because of the write-down of the PCI loans in

purchase accounting, our post-merger modifications to PCI Pick-

a-Pay loans have not resulted in any modification-related

provision for credit losses. To the extent we modify loans not in

the PCI Pick-a-Pay portfolio, we may establish an allowance for

consumer loans modified in a TDR.

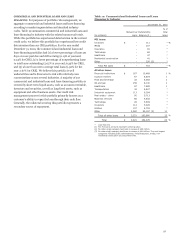

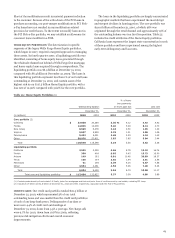

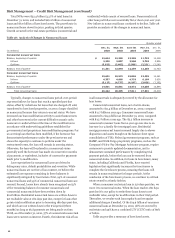

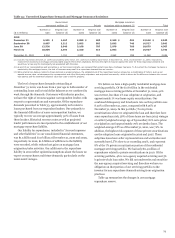

HOME EQUITY PORTFOLIOS The deterioration in specific

segments of the legacy Wells Fargo Home Equity portfolios,

which began in 2007, required a targeted approach to managing

these assets. In fourth quarter 2007, a liquidating portfolio was

identified, consisting of home equity loans generated through

the wholesale channel not behind a Wells Fargo first mortgage,

and home equity loans acquired through correspondents. The

liquidating portfolio was $6.9 billion at December 31, 2010,

compared with $8.4 billion at December 31, 2009. The loans in

this liquidating portfolio represent less than 1% of our total loans

outstanding at December 31, 2010, and contain some of the

highest risk in our $117.5 billion Home Equity portfolio, with a

loss rate of 10.90% compared with 3.62% for the core portfolio.

The loans in the liquidating portfolio are largely concentrated

in geographic markets that have experienced the most abrupt

and steepest declines in housing prices. The core portfolio was

$110.6 billion at December 31, 2010, of which 98% was

originated through the retail channel and approximately 19% of

the outstanding balance was in a first lien position. Table 25

includes the credit attributes of the Home Equity portfolios.

California loans represent the largest state concentration in each

of these portfolios and have experienced among the highest

early-term delinquency and loss rates.

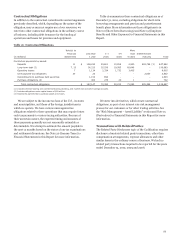

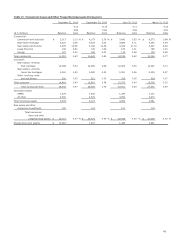

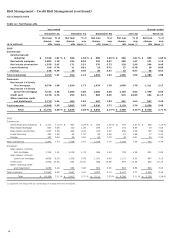

Table 25: Home Equity Portfolios (1)

% of loans

two payments

Outstanding balance

or more past due

Loss rate

December 31,

December 31,

December 31,

(in millions)

2010

2009

2010

2009

2010

2009

Core portfolio (2)

California $

27,850

30,264

3.30

%

4.12

4.92

5.42

Florida

12,036

12,038

5.46

5.48

6.13

4.73

New Jersey

8,629

8,379

3.44

2.50

1.95

1.30

Virginia

5,667

5,855

2.33

1.91

1.86

1.06

Pennsylvania

5,432

5,051

2.48

2.03

1.24

1.49

Other

50,976

53,811

2.83

2.85

3.04

2.44

Total

110,590

115,398

3.24

3.35

3.62

3.28

Liquidating portfolio

California

2,555

3,205

6.66

8.78

15.19

16.74

Florida

330

408

8.85

9.45

13.72

16.90

Arizona

149

193

6.91

10.46

20.89

18.57

Texas

125

154

2.02

1.94

2.81

2.56

Minnesota

91

108

5.39

4.15

9.57

7.58

Other

3,654

4,361

4.53

5.06

7.48

6.46

Total

6,904

8,429

5.54

6.74

10.90

11.17

Total core and liquidating portfolios $

117,494

123,827

3.37

3.58

4.08

3.88

(1)

Consists predominantly of real estate 1-4 family junior lien mortgages and first and junior lines of credit secured by real estate, excluding PCI loans.

(2) Includes $1.7 billion and $1.8 billion at December 31, 2010 and 2009, respectively, associated with the Pick-a-Pay portfolio.

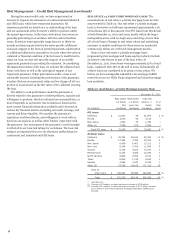

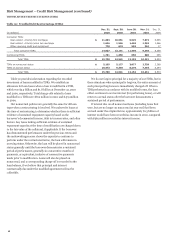

CREDIT CARDS Our credit card portfolio totaled $22.3 billion at

December 31, 2010, which represented 3% of our total

outstanding loans and was smaller than the credit card portfolios

of each of our large bank peers. Delinquencies of 30 days or

more were 4.4% of credit card outstandings at

December 31, 2010, down from 5.5% a year ago. Net charge-offs

were 9.7% for 2010, down from 10.8% in 2009, reflecting

previous risk mitigation efforts and overall economic

improvements.

63