Wells Fargo 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232

|

|

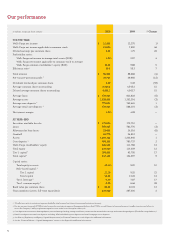

Our performance

inmillionsexceptpershareamounts Change

FORTHEYEAR

WellsFargonetincome

WellsFargonetincomeapplicabletocommonstock

Dilutedearningspercommonshare

Profitabilityratios

WellsFargonetincometoaveragetotalassets(ROA)

WellsFargonetincomeapplicabletocommonstocktoaverage

WellsFargocommonstockholders’equity(ROE)

Eciencyratio

Totalrevenue ()

Pretaxpreprovisionprofit ()

Dividendsdeclaredpercommonshare ()

Averagecommonsharesoutstanding

Dilutedaveragecommonsharesoutstanding

Averageloans ()

Averageassets ()

Averagecoredeposits

Averageretailcoredeposits ()

Netinterestmargin —

ATYEAREND

Securitiesavailableforsale —

Loans ()

Allowanceforloanlosses ()

Goodwill —

Assets

Coredeposits

WellsFargostockholders’equity

Totalequity

Tiercapital

Totalcapital

Capitalratios

Totalequitytoassets

Riskbasedcapital

Tiercapital

Totalcapital

Tierleverage

Tiercommonequity

Bookvaluepercommonshare

Teammembers(activefulltimeequivalent)

1 The eciency ratio is noninterest expense divided by total revenue (net interest income and noninterest income).

2 Pre-tax pre-provision profit (PTPP) is total revenue less noninterest expense. Management believes that PTPP is a useful financial measure because it enables investors and others to

assess the Company’s ability to generate capital to cover credit losses through a credit cycle.

3 Core deposits are noninterest-bearing deposits, interest-bearing checking, savings certificates, certain market rate and other savings, and certain foreign deposits (Eurodollar sweep balances).

4 Retail core deposits are total core deposits excluding Wholesale Banking core deposits and retail mortgage escrow deposits.

5 See Note 25 (Regulatory and Agency Capital Requirements) to Financial Statements in this Report for additional information.

6 See the “Financial Review – Capital Management” section in this Report for additional information.