Wells Fargo 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

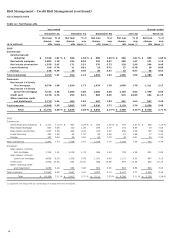

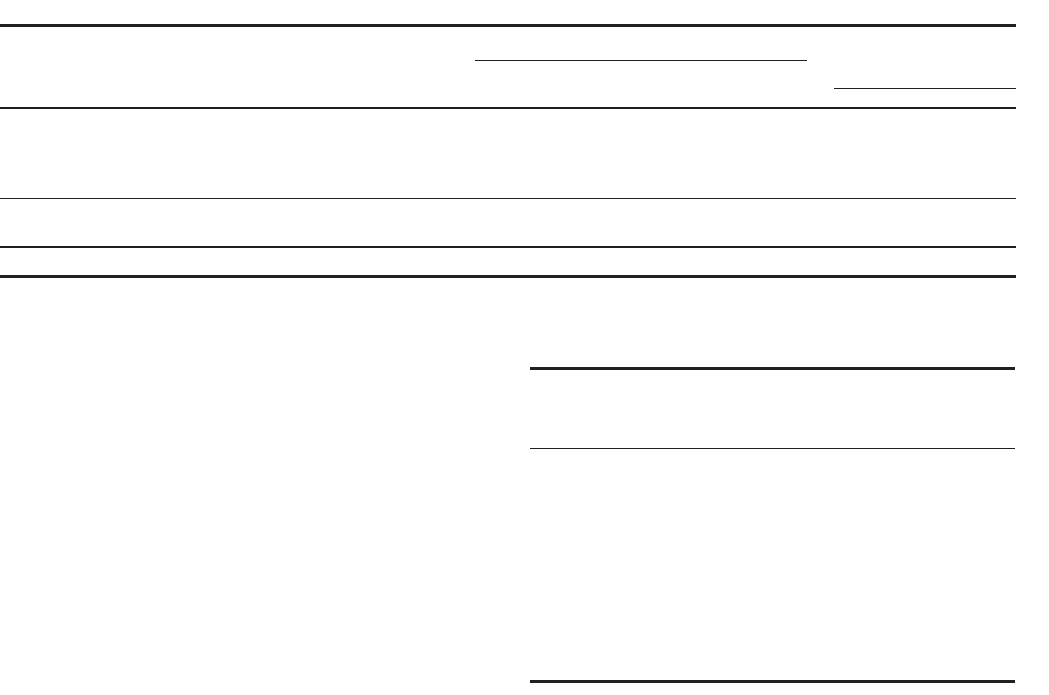

Risk Management – Credit Risk Management (continued)

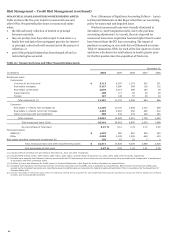

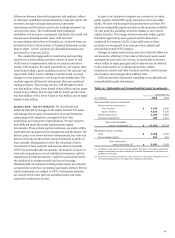

Table 34: Changes in Mortgage Repurchase Liability

Quarter ended

Dec. 31,

Sept. 30,

June 30,

Mar. 31,

Year ended December 31,

(in millions) 2010

2010

2010

2010

2010

2009

Balance, beginning of period $ 1,331

1,375

1,263

1,033

1,033

620

(1)

Provision for repurchase losses:

Loan sales 35

29

36

44

144

302

Change in estimate - primarily due to credit deterioration 429

341

346

358

1,474

625

Total additions 464

370

382

402

1,618

927

Losses (506)

(414)

(270)

(172)

(1,362)

(514)

Balance, end of period $ 1,289

1,331

1,375

1,263

1,289

1,033

(1) Reflects purchase accounting refinements.

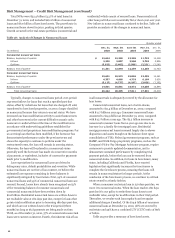

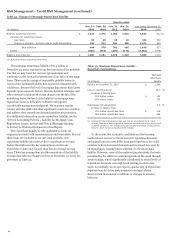

The mortgage repurchase liability of $1.3 billion at

December 31, 2010, represents our best estimate of the probable

loss that we may incur for various representations and

warranties in the contractual provisions of our sales of mortgage

loans. There may be a range of reasonably possible losses in

excess of the estimated liability that cannot be estimated with

confidence. Because the level of mortgage loan repurchase losses

depends upon economic factors, investor demand strategies and

other external conditions that may change over the life of the

underlying loans, the level of the liability for mortgage loan

repurchase losses is difficult to estimate and requires

considerable management judgment. We maintain regular

contact with the GSEs and other significant investors to monitor

and address their repurchase demand practices and concerns.

For additional information on our repurchase liability, see the

“Critical Accounting Policies – Liability for Mortgage Loan

Repurchase Losses” section and Note 9 (Mortgage Banking

Activities) to Financial Statements in this Report.

The repurchase liability is only applicable to loans we

originated and sold with representations and warranties. Most of

these loans are included in our servicing portfolio. Our

repurchase liability estimate involves consideration of many

factors that influence the key assumptions of what our

repurchase volume may be and what loss on average we may

incur. Those key assumptions and the sensitivity of the liability

to immediate adverse changes in them at December 31, 2010, are

presented in Table 35.

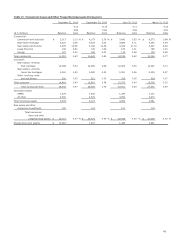

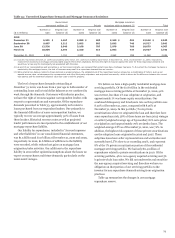

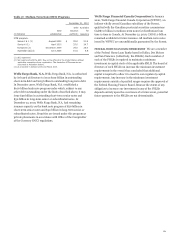

Table 35: Mortgage Repurchase Liability –

Sensitivity/Assumptions

Mortgage

repurchase

(in millions) liability

Balance at December 31, 2010 $ 1,289

Loss on repurchases (1) 36.0

%

Increase in liability from:

10% higher losses $ 145

25% higher losses 362

Repurchase rate assumption 0.3

%

Increase in liability from:

10% higher repurchase rates $ 108

25% higher repurchase rates 269

(1) Represents total estimated average loss rate on repurchased loans, net of

recovery from third party originators, based on historical experience and current

economic conditions. The average loss rate includes the impact of repurchased

loans for which no loss is expected to be realized.

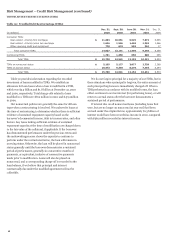

To the extent that economic conditions and the housing

market do not recover or future investor repurchase demands

and appeals success rates differ from past experience, we could

continue to have increased demands and increased loss severity

on repurchases, causing future additions to the repurchase

liability. However, some of the underwriting standards that were

permitted by the GSEs for conforming loans in the 2006 through

2008 vintages, which significantly contributed to recent levels of

repurchase demands, were tightened starting in mid to late

2008. Accordingly, we do not expect a similar rate of repurchase

requests from the 2009 and prospective vintages, absent

deterioration in economic conditions or changes in investor

behavior.

74