Wells Fargo 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

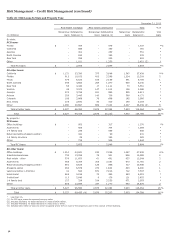

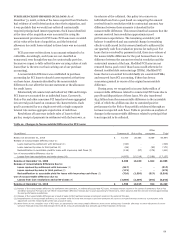

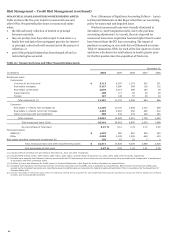

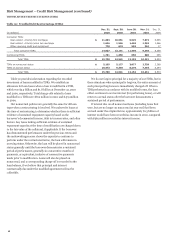

Risk Management – Credit Risk Management (continued)

Since the Wachovia acquisition, we have released $5.3 billion

in nonaccretable difference for certain PCI loans and pools of

loans, including $3.8 billion transferred from the nonaccretable

difference to the accretable yield and $1.5 billion released

through loan resolutions. We have provided $1.6 billion in the

allowance for credit losses for certain PCI loans or pools of loans

that have had loss-related decreases to cash flows expected to be

collected. The net result is a $3.7 billion improvement in our

initial projected losses on all PCI loans.

At December 31, 2010, the allowance for credit losses in

excess of nonaccretable difference on certain PCI loans was

$298 million. The allowance is necessary to absorb decreases in

cash flows expected to be collected since acquisition and

primarily relates to individual PCI loans. Table 22 analyzes the

actual and projected loss results on PCI loans since the

acquisition of Wachovia on December 31, 2008, through

December 31, 2010.

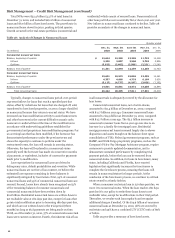

Table 22: Actual and Projected Loss Results on PCI Loans

Other

(in millions)

Commercial

Pick-a-Pay

consumer

Total

Release of unneeded nonaccretable difference due to:

Loans resolved by settlement with borrower (1) $ 1,147

-

-

1,147

Loans resolved by sales to third parties (2)

258

-

85

343

Reclassification to accretable yield for loans with improving cash flows (3)

864

2,383

593

3,840

Total releases of nonaccretable difference due to better than expected losses

2,269

2,383

678

5,330

Provision for worse than originally expected losses (4)

(1,562)

-

(62)

(1,624)

Actual and projected losses on PCI loans better than originally expected $ 707

2,383

616

3,706

(1)

Release of the nonaccretable difference for settlement with borrower, on individually accounted PCI loans, increases interest income in the period of settlement. Pick-a-Pay

and Other consumer PCI loans do not reflect nonaccretable difference releases due to pool

accounting for those loans, which assumes that the amount received approximates

the pool performance expectations.

(2)

Release of the nonaccretable difference as a result of sales to third parties increases noninterest income in the period of the sale.

(3) Reclassification of nonaccretable difference to accretable yield for loans with increased cash flow estimates will result in increased interest income as a prospective yield

adjustment over the remaining life of the loan or pool of loans.

(4) Provision for additional losses recorded as a charge to income, when it is estimated that the cash flows expected to be collected for a PCI loan or pool of loans have

decreased subsequent to the acquisition.

For further detail on PCI loans, see Note 1 (Summary of

Significant Accounting Policies – Loans) and Note 6 (Loans and

Allowance for Credit Losses) to Financial Statements in this

Report.

60