Wells Fargo 2010 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

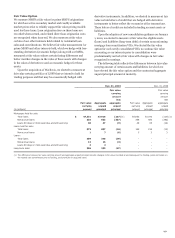

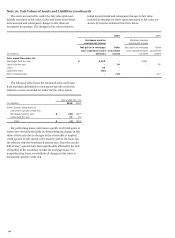

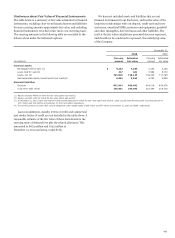

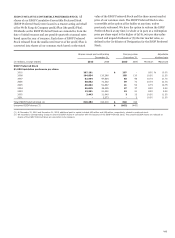

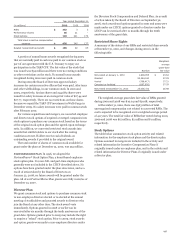

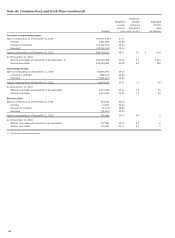

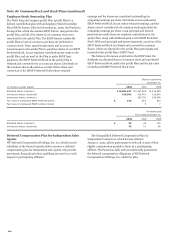

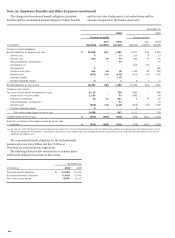

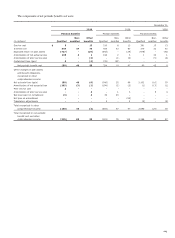

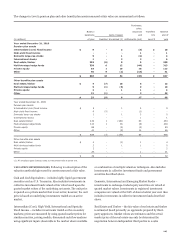

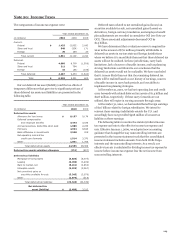

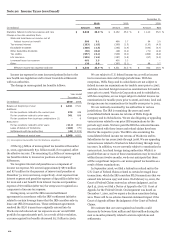

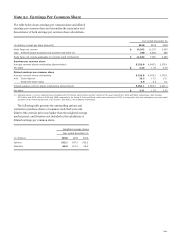

Pension and Postretirement Plans

Note 19: Employee Benefits and Other Expenses

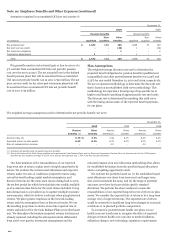

We sponsor a noncontributory qualified defined benefit

retirement plan, the Wells Fargo & Company Cash Balance Plan

(Cash Balance Plan), which covers eligible employees of

Wells Fargo; the benefits earned under the Cash Balance Plan

were frozen effective July 1, 2009.

On April 28, 2009, the Board of Directors approved

amendments to freeze the benefits earned under the Wells Fargo

qualified and supplemental Cash Balance Plans and the

Wachovia Corporation Pension Plan, a cash balance plan that

covered eligible employees of the legacy Wachovia Corporation,

and to merge the Wachovia Pension Plan into the qualified Cash

Balance Plan. These actions became effective on July 1, 2009.

Prior to July 1, 2009, eligible employees' cash balance plan

accounts were allocated a compensation credit based on a

percentage of their qualifying compensation. The compensation

credit percentage was based on age and years of credited service.

The freeze discontinues the allocation of compensation credit for

services after June 30, 2009. Investment credits continue to be

allocated to participants based on their accumulated balances.

Employees become vested in their Cash Balance Plan accounts

after completing three years of vesting service.

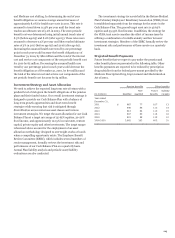

Freezing and merging the above plans effective July 1, 2009,

resulted in a re-measurement of the pension obligations and

plan assets as of April 30, 2009. Freezing and re-measuring

decreased the pension obligations by approximately

$945 million and decreased a cumulative loss in OCI by

approximately $725 million pre tax ($456 million after tax) in

second quarter 2009. The re-measurement resulted in a

decrease in the fair value of plan assets of approximately

$150 million. We used a discount rate of 7.75% for the

April 30, 2009, re-measurement based on our consistent

methodology of determining our discount rate based on an

established yield curve developed by our outside actuarial firm.

This methodology incorporates a broad group of top quartile Aa

or higher rated bonds.

As a result of freezing our pension plans, we revised our

amortization life for actuarial gains and losses from 5 years to 13

years to reflect the estimated average remaining participation

period.

These actions lowered pension cost by approximately

$500 million for 2009, including $67 million of one-time

curtailment gains.

We did not make a contribution to our Cash Balance Plan in

2010. We do not expect that we will be required to make a

contribution to the Cash Balance Plan in 2011; however, this is

dependent on the finalization of the actuarial valuation. Our

decision of whether to make a contribution in 2011 will be based

on various factors including the actual investment performance

of plan assets during 2011. Given these uncertainties, we cannot

estimate at this time the amount, if any, that we will contribute

in 2011 to the Cash Balance Plan. For the nonqualified pension

plans and postretirement benefit plans, there is no minimum

required contribution beyond the amount needed to fund benefit

payments; we may contribute more to our postretirement benefit

plans dependent on various factors.

We provide health care and life insurance benefits for certain

retired employees and reserve the right to terminate, modify or

amend any of the benefits at any time.

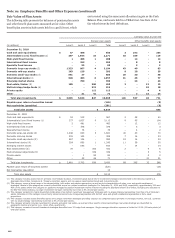

The information set forth in the following tables is based on

current actuarial reports using the measurement date of

December 31 for our pension and postretirement benefit plans.

201