Wells Fargo 2010 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

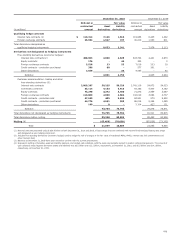

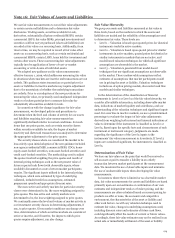

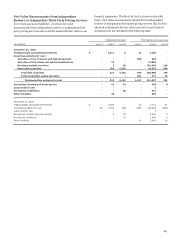

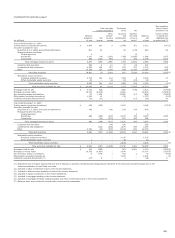

The following table provides details of sold and purchased credit derivatives.

Notional amount

Protection

Protection

sold -

purchased

Net

non-

with

protection

Other

Fair value

Protection

investment

identical

sold

protection

Range of

(in millions)

liability

sold (A)

grade

underlyings (B)

(A) - (B)

purchased

maturities

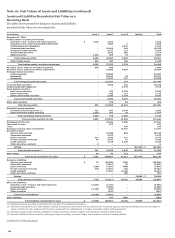

December 31, 2010

Credit default swaps on:

Corporate bonds $ 810

30,445

16,360

17,978

12,467

9,440

2011-2020

Structured products 4,145

5,825

5,246

4,948

877

2,482

2016-2056

Credit protection on:

Default swap index 12

2,700

909

2,167

533

1,106

2011-2017

Commercial mortgage-

backed securities index 717

1,977

612

924

1,053

779

2049-2052

Asset-backed securities index 128

144

144

46

98

142

2037-2046

Loan deliverable credit default swaps 2

481

456

391

90

261

2011-2014

Other 12

6,127

5,348

41

6,086

2,745

2011-2056

Total credit derivatives $ 5,826

47,699

29,075

26,495

21,204

16,955

December 31, 2009

Credit default swaps on:

Corporate bonds $ 2,419

55,511

23,815

44,159

11,352

12,634

2010-2018

Structured products 4,498

6,627

5,084

4,999

1,628

3,018

2014-2056

Credit protection on:

Default swap index 23

6,611

2,765

4,202

2,409

2,510

2010-2017

Commercial mortgage-backed securities index 1,987

5,188

453

4,749

439

189

2049-2052

Asset-backed securities index 637

830

660

696

134

189

2037-2046

Loan deliverable credit default swaps 12

510

494

423

87

287

2010-2014

Other (1) 16

9,264

8,657

32

9,232

4,757

2010-2020

Total credit derivatives $ 9,592

84,541

41,928

59,260

25,281

23,584

(1) Balances at December 31, 2009, have been revised to conform with the current presentation.

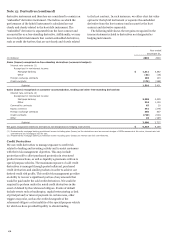

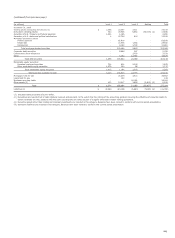

Protection sold represents the estimated maximum exposure

to loss that would be incurred under an assumed hypothetical

circumstance, where the value of our interests and any

associated collateral declines to zero, without any consideration

of recovery or offset from any economic hedges. We believe this

hypothetical circumstance to be an extremely remote possibility

and accordingly, this required disclosure is not an indication of

expected loss. The amounts under non-investment grade

represent the notional amounts of those credit derivatives on

which we have a higher risk of being required to perform under

the terms of the credit derivative and are a function of the

underlying assets.

We consider the risk of performance to be high if the

underlying assets under the credit derivative have an external

rating that is below investment grade or an internal credit

default grade that is equivalent thereto. We believe the net

protection sold, which is representative of the net notional

amount of protection sold and purchased with identical

underlyings, in combination with other protection purchased, is

more representative of our exposure to loss than either non-

investment grade or protection sold. Other protection purchased

represents additional protection, which may offset the exposure

to loss for protection sold, that was not purchased with an

identical underlying of the protection sold.

177