Wells Fargo 2010 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

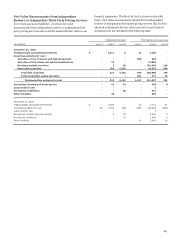

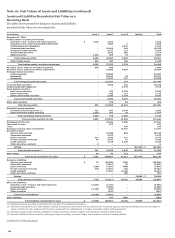

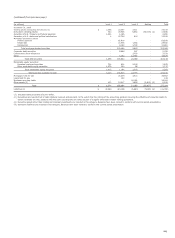

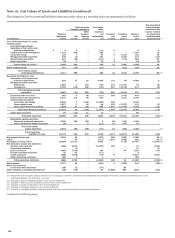

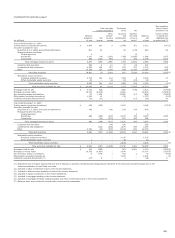

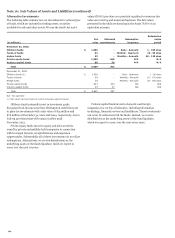

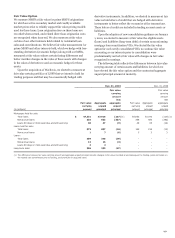

Note 16: Fair Values of Assets and Liabilities (continued)

Changes in Fair Value Levels

We monitor the availability of observable market data to assess

the appropriate classification of financial instruments within the

fair value hierarchy. Changes in economic conditions or model-

based valuation techniques may require the transfer of financial

instruments from one fair value level to another. The amounts

reported as transfers represent the fair value as of the beginning

of the quarter in which the transfer occurred.

We evaluate the significance of transfers between levels based

upon the nature of the financial instrument and size of the

transfer relative to total assets, total liabilities or total earnings.

For the year ended December 31, 2010, there were no significant

transfers in or out of Level 1.

Significant changes to Level 3 assets for the year ended

December 31, 2010 are described as follows:

• Our adoption of new consolidation accounting guidance on

January 1, 2010, impacted Level 3 balances for certain

financial instruments. Reductions in Level 3 balances,

which represent derecognition of existing investments in

newly consolidated VIEs, are reflected as transfers out for

the following categories: trading assets, $276 million;

securities available for sale, $1.9 billion; and mortgage

servicing rights, $118 million. Increases in Level 3 balances,

which represent newly consolidated VIE assets, are reflected

as transfers in for the following categories: securities

available for sale, $829 million; loans, $366 million; and

long-term debt, $359 million.

• We transferred $4.9 billion of securities available for sale

from Level 3 to Level 2 due to an increase in the volume of

trading activity for certain mortgage-backed and other

asset-backed securities, which resulted in increased

occurrences of observable market prices. We also

transferred $1.7 billion of debt securities available for sale

from Level 2 to Level 3, primarily due to a decrease in

liquidity for certain asset-backed securities.

For the year ended December 31, 2009, we transferred

$4.0 billion of debt securities available for sale from Level 3 to

Level 2 due to increased trading activity.

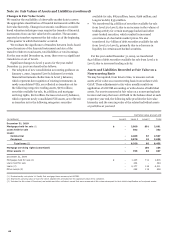

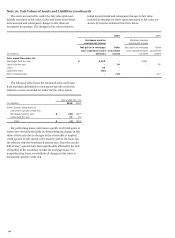

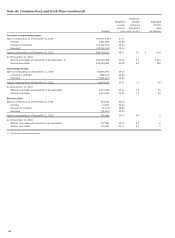

Assets and Liabilities Recorded at Fair Value on a

Nonrecurring Basis

We may be required, from time to time, to measure certain

assets at fair value on a nonrecurring basis in accordance with

GAAP. These adjustments to fair value usually result from

application of LOCOM accounting or write-downs of individual

assets. For assets measured at fair value on a nonrecurring basis

in 2010 and 2009 that were still held in the balance sheet at each

respective year end, the following table provides the fair value

hierarchy and the carrying value of the related individual assets

or portfolios at year end.

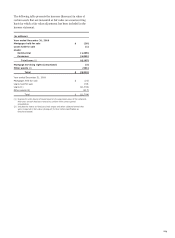

Carrying value at year end

(in millions)

Level 1

Level 2

Level 3

Total

December 31, 2010

Mortgages held for sale (1) $

-

2,000

891

2,891

Loans held for sale -

352

-

352

Loans:

Commercial -

2,480

67

2,547

Consumer -

5,870

18

5,888

Total loans (2) -

8,350

85

8,435

Mortgage servicing rights (amortized) -

-

104

104

Other assets (3) -

765

82

847

December 31, 2009

Mortgages held for sale (1) $ -

1,105

711

1,816

Loans held for sale

-

444

-

444

Loans (2)

-

6,177

134

6,311

Other assets (3)

-

289

119

408

(1) Predominantly real estate 1-4 family first mortgage loans measured at LOCOM.

(2) Represents carrying value of loans for which adjustments are based on the appraised value of the collateral.

(3) Includes the fair value of foreclosed real estate and other collateral owned that were measured at fair value subsequent to their initial classification as foreclosed assets.

188