Wells Fargo 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Management – Credit Risk Management (continued)

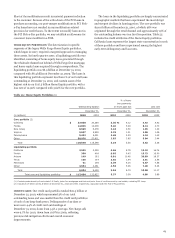

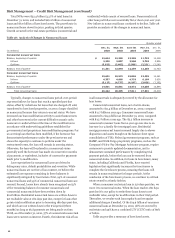

Total provision for credit losses was $15.8 billion in 2010,

$21.7 billion in 2009 and $16.0 billion in 2008. The 2010

provision was $2.0 billion less than credit losses, compared with

a provision that was $3.5 billion in excess of credit losses in

2009. Absent significant deterioration in the economy, we

expect future reductions in the allowance for credit losses.

Primary drivers of the 2010 provision reduction were

continued improvement in the consumer portfolios and related

loss estimates and improvement in management’s view of

economic conditions. These drivers were partially offset by an

increase in impaired loans and related allowance primarily

associated with increased consumer loan modification efforts

and a $693 million adjustment due to adoption of consolidation

accounting guidance on January 1, 2010.

In 2009, the provision of $21.7 billion included a provision in

excess of credit losses of $3.5 billion, which was primarily driven

by three factors: (1) deterioration in economic conditions that

increased the projected losses in our commercial portfolios,

(2) additional allowance associated with loan modification

programs designed to keep qualifying borrowers in their homes,

and (3) the establishment of additional allowance for PCI loans.

In 2008, the provision of $16.0 billion included a provision

in excess of credit losses of $8.1 billion, which included

$3.9 billion to conform loss emergence coverage periods to the

most conservative of legacy Wells Fargo and Wachovia within

Federal Financial Institutions Examination Council guidelines.

The remainder of the allowance build was attributable to higher

projected loss rates across the majority of the consumer credit

businesses, and some credit deterioration and growth in the

wholesale portfolios.

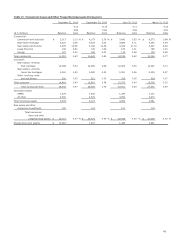

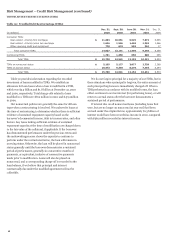

In determining the appropriate allowance attributable to our

residential real estate portfolios, the loss rates used in our

analysis include the impact of our established loan modification

programs. When modifications occur or are probable to occur,

our allowance considers the impact of these modifications,

taking into consideration the associated credit cost, including re-

defaults of modified loans and projected loss severity. The loss

content associated with existing and probable loan modifications

has been considered in our allowance reserving methodology.

Changes in the allowance reflect changes in statistically

derived loss estimates, historical loss experience, current trends

in borrower risk and/or general economic activity on portfolio

performance, and management’s estimate for imprecision and

uncertainty.

We believe the allowance for credit losses of $23.5 billion

was adequate to cover credit losses inherent in the loan

portfolio, including unfunded credit commitments, at December

31, 2010. The allowance for credit losses is subject to change and

considers existing factors at the time, including economic or

market conditions and ongoing internal and external

examination processes. Due to the sensitivity of the allowance

for credit losses to changes in the economic environment, it is

possible that unanticipated economic deterioration would create

incremental credit losses not anticipated as of the balance sheet

date. Our process for determining the allowance for credit losses

is discussed in the “Critical Accounting Policies – Allowance for

Credit Losses” section and Note 6 (Loans and Allowance for

Credit Losses) to Financial Statements in this Report.

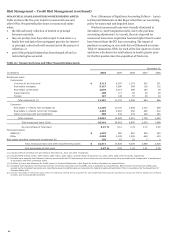

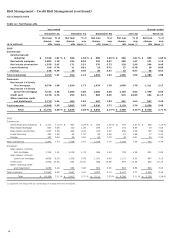

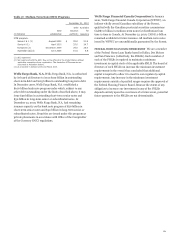

LIABILITY FOR MORTGAGE LOAN REPURCHASE LOSSES We

sell residential mortgage loans to various parties, including (1)

Freddie Mac and Fannie Mae (GSEs) who include the mortgage

loans in GSE-guaranteed mortgage securitizations, (2) SPEs that

issue private label MBS, and (3) other financial institutions that

purchase mortgage loans for investment or private label

securitization. In addition, we pool FHA-insured and VA-

guaranteed mortgage loans that back securities guaranteed by

GNMA. We may be required to repurchase these mortgage

loans, indemnify the securitization trust, investor or insurer, or

reimburse the securitization trust, investor or insurer for credit

losses incurred on loans (collectively “repurchase”) in the event

of a breach of such contractual representations or warranties

that is not remedied within a period (usually 90 days or less)

after we receive notice of the breach.

We establish mortgage repurchase liabilities related to

various representations and warranties that reflect

management’s estimate of losses for loans for which we could

have repurchase obligation, whether or not we currently service

those loans, based on a combination of factors. Currently,

repurchase demands primarily relate to 2006 through 2008

vintages and to GSE-guaranteed MBS.

During 2010, we continued to experience elevated levels of

repurchase activity measured by number of loans, investor

repurchase demands and our level of repurchases. We

repurchased or reimbursed investors for incurred losses on

mortgage loans with balances of $2.6 billion. Additionally, in

2010, we negotiated global settlements on pools of mortgage

loans of $675 million, which effectively eliminates the risk of

repurchase on these loans from our outstanding servicing

portfolio. We incurred net losses on repurchased loans, investor

reimbursements and loan pool global settlements totaling

$1.4 billion in 2010.

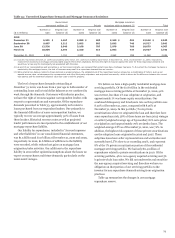

Adjustments made to our mortgage repurchase liability in

recent periods have incorporated the increase in repurchase

demands, mortgage insurance rescissions, and higher than

anticipated losses on repurchased loans that we have

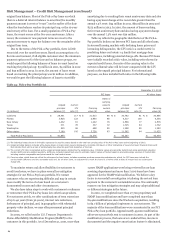

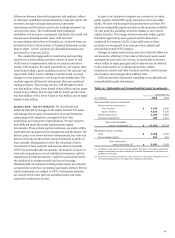

experienced. Table 33 provides the number of unresolved

repurchase demands and mortgage insurance rescissions. We

generally do not have unresolved repurchase demands from the

FHA and VA for loans in GNMA-guaranteed securities because

those demands are relatively few and we quickly resolve them.

72