Wells Fargo 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

This Annual Report, including the Financial Review and the Financial Statements and related Notes, contains forward-looking

statements, which may include forecasts of our financial results and condition, expectations for our operations and business, and our

assumptions for those forecasts and expectations. Do not unduly rely on forward-looking statements. Actual results may differ

materially from our forward-looking statements due to several factors. Some of these factors are described in the Financial Review

and in the Financial Statements and related Notes. For a discussion of other factors, refer to the “Forward-Looking Statements” and

“Risk Factors” sections in this Report and the “Regulation and Supervision” section of our Annual Report on Form 10-K for the year

ended December 31, 2010 (2010 Form 10-K).

See the Glossary of Acronyms at the end of this Report for terms used throughout this Report.

Financial Review

Wells Fargo & Company is a $1.3 trillion diversified financial

services company providing banking, insurance, trust and

investments, mortgage banking, investment banking, retail

banking, brokerage and consumer finance through banking

stores, the internet and other distribution channels to

individuals, businesses and institutions in all 50 states, the

District of Columbia (D.C.) and in other countries. We ranked

fourth in assets and second in the market value of our common

stock among our large bank peers at December 31, 2010. When

we refer to “Wells Fargo,” “the Company,” “we,” “our” or “us” in

this Report, we mean Wells Fargo & Company and Subsidiaries

(consolidated). When we refer to the “Parent,” we mean

Wells Fargo & Company. When we refer to “legacy Wells Fargo,”

we mean Wells Fargo excluding Wachovia Corporation

(Wachovia).

Overview

Our vision is to satisfy all our customers’ financial needs,

help them succeed financially, be recognized as the premier

financial services company in our markets and be one of

America’s great companies. Our primary strategy to achieve this

vision is to increase the number of products our customers buy

from us and to offer them all of the financial products that fulfill

their needs. Our cross-sell strategy, diversified business model

and the breadth of our geographic reach facilitate growth in both

strong and weak economic cycles, as we can grow by expanding

the number of products our current customers have with us, gain

new customers in our extended markets, and increase market

share in many businesses. We continued to earn more of our

customers’ business in 2010 in both our retail and commercial

banking businesses and in our equally customer-centric

securities brokerage and investment banking businesses.

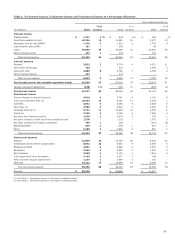

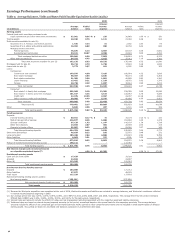

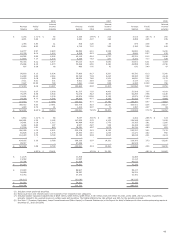

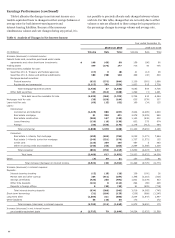

Reflecting solid growth in a variety of businesses, Wells Fargo

net income was a record $12.4 billion in 2010. Diluted earnings

per common share were $2.21. Pre-tax pre-provision profit

(PTPP) was $34.8 billion in 2010, which covered almost

2.o times annual net charge-offs. PTPP is total revenue less

noninterest expense. Management believes that PTPP is a useful

financial measure because it enables investors and others to

assess the Company's ability to generate capital to cover credit

losses through a credit cycle.

Our combined company retail bank household cross-sell,

reported for the first time in December 2010, was 5.70 products

per household, up from 5.47 a year ago. Cross-sell for the

combined company, which is lower than legacy Wells Fargo

stand-alone cross-sell, indicates the opportunity to earn more

business from our Wachovia customers. The cross-sell for

customers in the West was 6.14 products, compared with 5.11 for

customers in the East. Our goal is eight products per customer,

which is approximately half of our estimate of potential demand

for an average U.S. household. One of every four of our retail

banking households has eight or more products. Business

banking cross-sell offers another potential opportunity for

growth, with cross-sell of 4.04 products in our Western footprint

(including legacy Wells Fargo and converted Wachovia

customers).

Wells Fargo remained one of the largest providers of credit to

the U.S. economy. We continued to lend to creditworthy

customers and, during 2010, made $665 billion in new loan

commitments to consumer, small business and commercial

customers, including $386 billion of residential mortgage

originations. We are an industry leader in loan modifications for

homeowners. As of December 31, 2010, more than

620,000 Wells Fargo mortgage customers were in active trial or

had completed the loan modifications since the beginning of

2009. We also continued to support our communities by making

a $400 million charitable contribution to the Wells Fargo

Foundation in 2010, covering three years of estimated future

funding.

Our core deposits grew 2% from December 31, 2009. Average

core deposits funded 100% of total average loans in 2010, up

from 93% in 2009. We continue to attract high quality core

deposits in the form of checking and savings deposits, which

grew 6% to $720.9 billion at December 31, 2010, from

$679.9 billion a year ago, as we continued to gain new customers

and deepen our relationships with existing customers.

On December 31, 2008, Wells Fargo acquired Wachovia, one

of the nation’s largest diversified financial services companies.

Wachovia’s assets and liabilities were included in the

December 31, 2008, consolidated balance sheet at their

respective fair values on the acquisition date. Because the

acquisition was completed on December 31, 2008, Wachovia’s

results of operations were not included in our 2008 income

statement. Beginning in 2009, our consolidated results and

associated financial information, as well as our consolidated

average balances, include Wachovia.

We are beginning our third year of the Wachovia integration,

which we expect to substantially complete by the end of 2011.

34