Wells Fargo 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

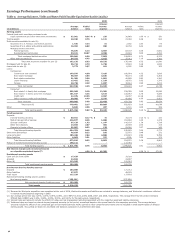

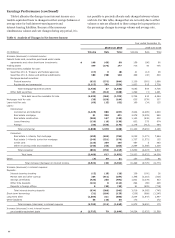

Earnings Performance (continued)

Operating Segment Results

We define our operating segments by product and customer. In

first quarter 2010, we conformed certain funding and allocation

methodologies of Wachovia to those of Wells Fargo; in addition

integration expense related to mergers other than the Wachovia

merger is now included in the segment results. In fourth quarter

2010, we aligned certain lending businesses into Wholesale

Banking from Community Banking to reflect our previously

announced restructuring of Wells Fargo Financial. Prior periods

have been revised to reflect these changes. Table 9 and the

following discussion present our results by operating segment.

For a more complete description of our operating segments,

including additional financial information and the underlying

management accounting process, see Note 23 (Operating

Segments) to Financial Statements in this Report.

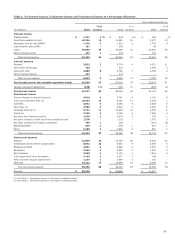

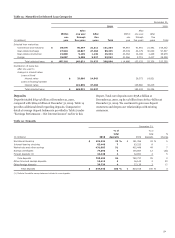

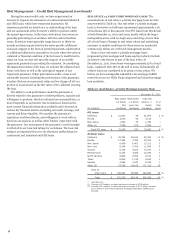

Table 9: Operating Segment Results – Highlights

Year ended December 31,

Wealth, Brokerage

(in billions)

Community Banking

Wholesale Banking

and Retirement

2010

2009

2010

2009

2010

2009

Revenue $ 54.7

60.5

22.2

20.6

11.7

10.8

Net income

7.1

8.9

5.8

3.9

1.0

0.5

Average loans

530.1

552.7

230.5

260.2

43.0

45.7

Average core deposits

536.4

552.8

170.0

147.3

121.2

114.2

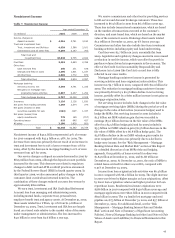

Community Banking offers a complete line of diversified

financial products and services for consumers and small

businesses including investment, insurance and trust services in

39 states and D.C., and mortgage and home equity loans in all

50 states and D.C. through its Regional Banking and Wells Fargo

Home Mortgage business units.

Community Banking reported net income of $7.1 billion and

revenue of $54.7 billion in 2010. Revenue declined from 2009

driven primarily by a decrease in mortgage banking income

compared with a record year in 2009 (originations of

$420 billion in 2009 compared with $384 billion in 2010), as

well as lower deposit service charges due to changes to

Regulation E and the planned reduction in certain liquidating

loan portfolios. Core deposits declined due to planned

certificates of deposit (CD) run-off; however, we continued to

grow low cost deposits. We saw strong growth in the number of

consumer and business checking accounts (up 7.5% and 4.8%,

respectively, from December 31, 2009). Noninterest expense was

flat from 2009, with Wells Fargo Financial restructuring costs

and higher charitable contributions offset by continued expense

management and realization of merger synergies. To benefit our

customers we continued to add platform team members in

regional banking’s Eastern markets as we aligned Wachovia

banking stores with the Wells Fargo sales and service model.

The provision for credit losses decreased $4.1 billion from 2009

and credit quality indicators in most of our consumer and

commercial loan portfolios were either stable or continued to

improve. Net credit losses declined in almost all portfolios and

we released $1.4 billion in reserves in 2010 compared with a

$2.2 billion reserve build in 2009.

Wholesale Banking provides financial solutions across the

U.S. and globally to middle market and large corporate

customers with annual revenue generally in excess of

$20 million. Products and businesses include commercial

banking, investment banking and capital markets, securities

investment, government and institutional banking, corporate

banking, commercial real estate, treasury management, capital

finance, international, insurance, real estate capital markets,

commercial mortgage servicing, corporate trust, equipment

finance, asset backed finance, and asset management.

On the strength of increasing credit demands from middle

market and international businesses, solid investment banking

and capital markets performance, and a modest rebound in

commercial mortgages, Wholesale Banking generated earnings

of $5.8 billion, up 49% from 2009, with revenue of $22.2 billion,

up 8% from 2009. Growth in core deposits, up 15% from 2009,

and the related increase in fees and commissions, helped offset

the impact of lower loan balances in 2010. Total noninterest

expense increased 5% as continued focus on expense

management helped keep the rate of expense growth below the

rate of revenue growth, resulting in an overall operating

efficiency ratio of 51% versus 52% in 2009. Loan loss rates also

improved from 2009 levels, which allowed for a $561 million

release of the allowance for loan losses in 2010.

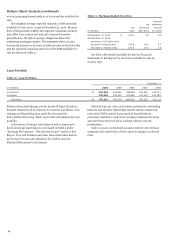

Our financial results in 2010 were driven by the performance

of our many diverse businesses, including the real estate capital

markets group, which re-entered the commercial MBS

securitization market with its first deal in three years;

investment banking, which helped drive more than $172 million

of growth in trust and investment fees; commercial mortgage

servicing, which capitalized on its strong competitive position to

win the servicing rights on more than 70% of new commercial

MBS deals; and commercial real estate, where re-pricing efforts

lifted loan portfolio yields 49 basis points to add $180 million in

revenue growth.

Wholesale Banking’s performance was also supported by

additional efficiencies created by the merger with Wachovia. Key

achievements included funds management group

consolidations, leasing and equipment finance system

migrations, Commercial Electronic Office® (CEO®) access for

Wachovia Global Connect customers, and building of treasury

product solutions to prepare for full customer migrations in

2011.

48