Wells Fargo 2010 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

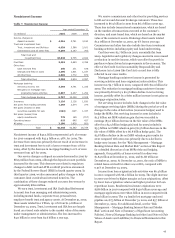

All financial institutions must manage and control a variety of

business risks that can significantly affect their financial

performance. Key among those are credit, asset/liability and

market risk.

Risk Management

Credit Risk Management

Our credit risk management process is governed centrally, but

provides for decentralized management and accountability by

our lines of business. Our overall credit process includes

comprehensive credit policies, judgmental or statistical credit

underwriting, frequent and detailed risk measurement and

modeling, extensive credit training programs, and a continual

loan review and audit process. In addition, banking regulatory

examiners review and perform detailed tests of our credit

underwriting, loan administration and allowance processes.

A key to our credit risk management is adhering to a well

controlled underwriting process, which we believe is

appropriate for the needs of our customers as well as investors

who purchase the loans or securities collateralized by the loans.

We approve applications and make loans only if we believe the

customer has the ability to repay the loan or line of credit

according to all its terms. Our underwriting of loans

collateralized by residential real property includes appraisals or

automated valuation models (AVMs) to support property

values. AVMs are computer-based tools used to estimate the

market value of homes. AVMs are a lower-cost alternative to

appraisals and support valuations of large numbers of

properties in a short period of time. AVMs estimate property

values based on processing large volumes of market data

including market comparables and price trends for local

market areas. The primary risk associated with the use of

AVMs is that the value of an individual property may vary

significantly from the average for the market area. We have

processes to periodically validate AVMs and specific risk

management guidelines addressing the circumstances when

AVMs may be used. Generally AVMs are used in underwriting

to support property values on loan originations only where the

loan amount is under $250,000. For underwriting residential

property loans of $250,000 or more, we require property

visitation appraisals by qualified independent appraisers.

We continually evaluate and modify our credit policies to

address appropriate levels of risk. Accordingly, from time to

time, we designate certain portfolios and loan products as non-

strategic or high risk to limit or cease their continued

origination as we actively work to limit losses and reduce our

exposures.

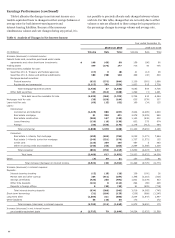

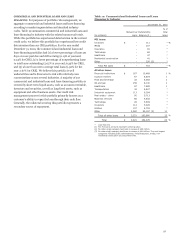

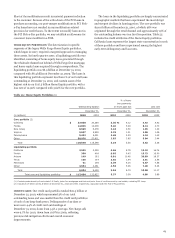

Table 17 identifies our non-strategic and liquidating loan

portfolios as of December 31, 2010, 2009 and 2008. These

portfolios have decreased 32% since the merger with Wachovia

at December 31, 2008, and decreased 19% from the end of

2009. The portfolios consist primarily of the Pick-a-Pay

mortgages portfolio and PCI loans acquired in our acquisition

of Wachovia as well as some portfolios from legacy Wells Fargo

home equity and Wells Fargo Financial. The legacy Wells Fargo

Financial debt consolidation portfolio included $1.2 billion and

$1.6 billion at December 31, 2010 and 2009, respectively, that

was considered prime based on secondary market standards.

The remainder is non-prime but was originated with standards

to reduce credit risk. These loans were originated through our

retail channel with documented income, LTV limits based on

credit quality and property characteristics, and risk-based

pricing. In addition, the loans were originated without teaser

rates, interest-only or negative amortization features. Credit

losses in the portfolio have increased in the current economic

environment compared with historical levels, but performance

has remained similar to prime portfolios in the industry with

overall loss rates of 4.15% in 2010 on the entire portfolio.

Analysis of the Pick-a-Pay and the commercial and industrial

and CRE domestic PCI portfolios is presented later in this

section.

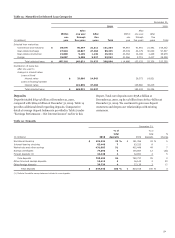

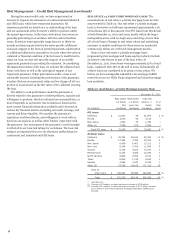

Table 17: Non-Strategic and Liquidating Loan Portfolios

Outstanding balance

December 31,

(in billions)

2010

2009

2008

Commercial and industrial, CRE

and foreign PCI loans (1)(2)

$

7.9

13.0

18.7

Pick-a-Pay mortgage (1)

74.8

85.2

95.3

Liquidating home equity 6.9

8.4

10.3

Legacy Wells Fargo Financial

indirect auto 6.0

11.3

18.2

Legacy Wells Fargo Financial

debt consolidation (2)(3) 19.0

22.4

25.3

Other PCI loans (1)(2) 1.1

1.7

2.5

Total non-strategic and

liquidating loan portfolios $ 115.7

142.0

170.3

(1)

Net of purchase accounting adjustments related to PCI loans.

(2) These portfolios were designated as non-strategic and liquidating in 2010.

Prior periods have been adjusted to reflect this change.

(3) In July 2010, we announced the restructuring of our Wells Fargo Financial

division and the exiting of the origination of non-prime portfolio mortgage

loans.

Measuring and monitoring our credit risk is an ongoing

process that tracks delinquencies, collateral values, FICO

scores, economic trends by geographic areas, loan-level risk

grading for certain portfolios (typically commercial) and other

indications of credit risk. Our credit risk monitoring process is

designed to enable early identification of developing risk and to

support our determination of an adequate allowance for credit

losses. The following analysis reviews the relevant

concentrations and certain credit metrics of our significant

portfolios. See Note 6 (Loans and Allowance for Credit Losses)

to Financial Statements in this Report for more analysis and

credit metric information.

54