Wells Fargo 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

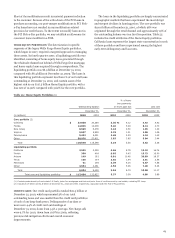

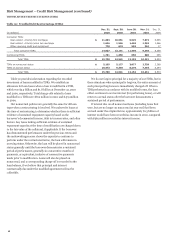

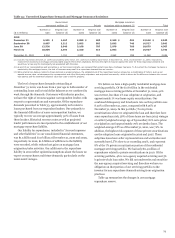

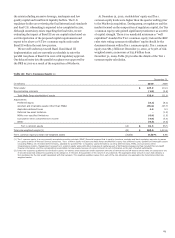

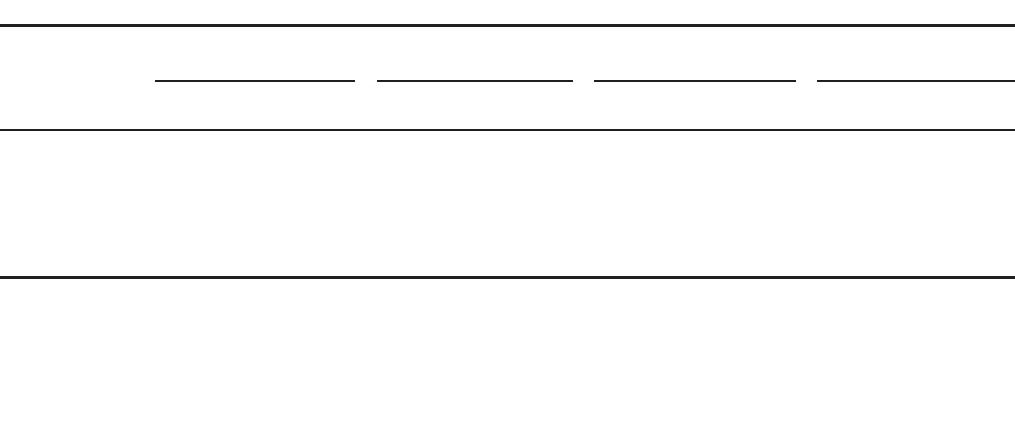

Table 33: Unresolved Repurchase Demands and Mortgage Insurance Recissions

Government

Mortgage insurance

sponsored entities (1)

Private

recissions with no demand (2)

Total

Number of

Original loan

Number of

Original loan

Number of

Original loan

Number of

Original loan

($ in millions) loans

balance (3)

loans

balance (3)

loans

balance (3)

loans

balance (3)

2010

December 31 6,501

$

1,467

2,899

$

680

3,248

$

801

12,648

$

2,948

September 30 9,887

2,212

3,605

882

3,035

748

16,527

3,842

June 30 12,536

2,840

3,160

707

2,979

760

18,675

4,307

March 31 10,804

2,499

2,320

519

2,843

737

15,967

3,755

December 31, 2009 8,354

1,911

2,929

886

2,965

859

14,248

3,656

(1)

Includes repurchase demands on 1,495 loans totaling $291 million and 1,536 loans totaling $322 million at December 31, 2010, and December 31, 2009, respectively,

received from investors on mortgage servicing rights acquired from other originators. We have the right of recourse against the seller for these repurchase demands and

would incur a loss only for counterparty risk associated with the seller.

(2) As part of our representations and warranties in our loan sales contracts, we represent that certain loans have mortgage insurance. To the extent the mortgage insurance is

rescinded by the mortgage insurer, the lack of insurance may result in a repurchase demand from an investor.

(3) While original loan balance related to these demands is presented above, the establishment of the repurchase reserve is based on a combination of factors, such as our

appeals success rates, reimbursement by correspondent and other third party originators, and projected loss severity, which is driven by the difference between the current

loan balance and the estimated collateral value less costs to sell the property.

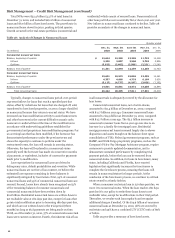

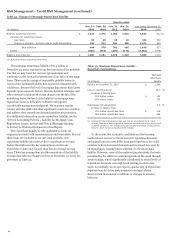

The level of repurchase demands outstanding at

December 31, 2010, was down from a year ago in both number of

outstanding loans and in total dollar balances as we continued to

work through the demands. Customary with industry practice,

we have the right of recourse against correspondent lenders with

respect to representations and warranties. Of the repurchase

demands presented in Table 33, approximately 20% relate to

loans purchased from correspondent lenders. Due primarily to

the financial difficulties of some correspondent lenders, we

typically recover on average approximately 50% of losses from

these lenders. Historical recovery rates as well as projected

lender performance are incorporated in the establishment of our

mortgage repurchase liability.

Our liability for repurchases, included in “Accrued expenses

and other liabilities” in our consolidated financial statements,

was $1.3 billion and $1.0 billion at December 31, 2010 and 2009,

respectively. In 2010, $1.6 billion of additions to the liability

were recorded, which reduced net gains on mortgage loan

origination/sales activities. Our additions to the repurchase

liability in 2010 reflect updated assumptions about the losses we

expect on repurchases and future demands, particularly on the

2006-2008 vintages.

We believe we have a high quality residential mortgage loan

servicing portfolio. Of the $1.8 trillion in the residential

mortgage loan servicing portfolio at December 31, 2010, 92%

was current, less than 2% was subprime at origination, and

approximately 1% was home equity securitizations. Our

combined delinquency and foreclosure rate on this portfolio was

8.02% at December 31, 2010, compared with 8.96% at

December 31, 2009. In this portfolio 7% are private

securitizations where we originated the loan and therefore have

some repurchase risk; 58% of these loans are from 2005 vintages

or earlier (weighted average age of 63 months); 81% were prime

at origination; and approximately 70% are jumbo loans. The

weighted-average LTV as of December 31, 2010, was 72%. In

addition, the highest risk segment of these private securitizations

are the subprime loans originated in 2006 and 2007. These

subprime loans have seller representations and warranties and

currently have LTVs close to or exceeding 100%, and represent

8% of the 7% private securitization portion of the residential

mortgage servicing portfolio. We had only $114 million of

repurchases related to private securitizations in 2010. Of the

servicing portfolio, 4% is non-agency acquired servicing and 3%

is private whole loan sales. We did not underwrite and securitize

the non-agency acquired servicing and therefore we have no

obligation on that portion of our servicing portfolio to the

investor for any repurchase demands arising from origination

practices.

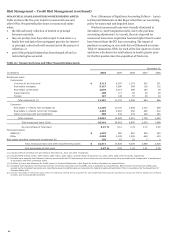

Table 34 summarizes the changes in our mortgage

repurchase reserve.

73