Wells Fargo 2010 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

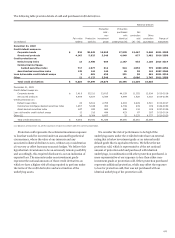

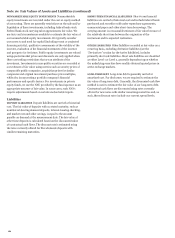

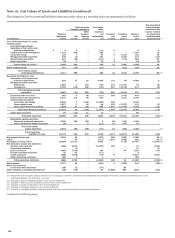

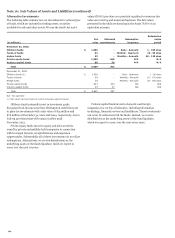

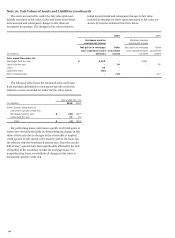

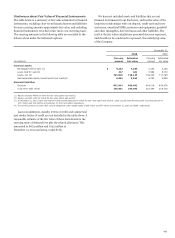

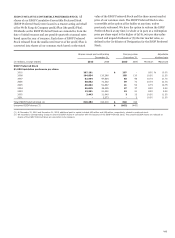

(continued from previous page)

Net unrealized

Total net gains

Purchases,

gains (losses)

(losses) included in

sales,

Net

included in net

Other

issuances

transfers

income related

Balance,

compre-

and

into and/

Balance,

to assets and

beginning

Net

hensive

settlements,

or out of

end

liabilities held

(in millions)

of year

income

income

net

Level 3

of year

at period end (1)

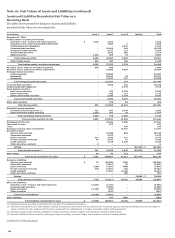

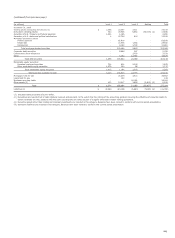

Year ended December 31, 2009

Trading assets (excluding derivatives) $ 3,495

202

2

(1,749)

361

2,311

276

(2)

Securities available for sale:

Securities of U.S. states and political subdivisions 903

23

-

25

(133)

818

(8)

Mortgage-backed securities:

Federal agencies 4

-

-

-

(4)

-

-

Residential 3,510

(74)

1,092

(759)

(2,685)

1,084

(227)

Commercial 286

(220)

894

41

798

1,799

(112)

Total mortgage-backed securities 3,800

(294)

1,986

(718)

(1,891)

2,883

(339)

Corporate debt securities 282

3

61

(7)

28

367

-

Collateralized debt obligations 2,083

125

577

623

317

3,725

(84)

Other 12,799

136

1,368

584

(2,300)

12,587

(94)

Total debt securities 19,867

(7)

3,992

507

(3,979)

20,380

(525)

(3)

Marketable equity securities:

Perpetual preferred securities 2,775

104

144

(723)

5

2,305

(1)

Other marketable equity securities 50

-

(2)

63

(23)

88

-

Total marketable equity securities 2,825

104

142

(660)

(18)

2,393

(1)

(4)

Total securities available for sale $ 22,692

97

4,134

(153)

(3,997)

22,773

(526)

Mortgages held for sale $ 4,718

(96)

-

(921)

(178)

3,523

(109)

(5)

Mortgage servicing rights 14,714

(4,970)

-

6,260

-

16,004

(1,534)

(5)

Net derivative assets and liabilities 37

1,439

-

(2,291)

(17)

(832)

(799)

(6)

Other assets (excluding derivatives) 1,231

10

-

132

-

1,373

12

(2)

Liabilities (excluding derivatives)(7)

(16)

(11)

-

1

(10)

(36)

14

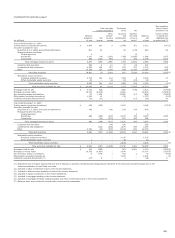

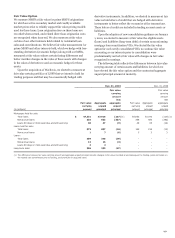

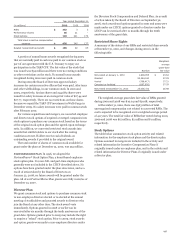

Year ended December 31, 2008

Trading assets (excluding derivatives) $ 418

(120)

-

3,197

-

3,495

(23)

(2)

Securities available for sale:

Securities of U.S. states and political subdivisions 168

-

(81)

538

278

903

-

Mortgage-backed securities:

Federal agencies -

-

-

-

4

4

-

Residential 486

(180)

(302)

3,307

199

3,510

(150)

Commercial -

(10)

(210)

163

343

286

-

Total mortgage-backed securities 486

(190)

(512)

3,470

546

3,800

(150)

Corporate debt securities -

-

(44)

326

-

282

-

Collateralized debt obligations -

(152)

(280)

1,679

836

2,083

-

Other 4,726

(15)

(572)

8,379

281

12,799

-

Total debt securities 5,380

(357)

(1,489)

14,392

1,941

19,867

(150)

(3)

Marketable equity securities:

Perpetual preferred securities -

-

-

2,775

-

2,775

-

Other marketable equity securities 1

-

-

49

-

50

-

Total marketable equity securities 1

-

-

2,824

-

2,825

-

(4)

Total securities available for sale $ 5,381

(357)

(1,489)

17,216

1,941

22,692

(150)

Mortgages held for sale $ 146

(280)

-

561

4,291

4,718

(268)

(5)

Mortgage servicing rights 16,763

(5,927)

-

3,878

-

14,714

(333)

(5)

Net derivative assets and liabilities 6

(275)

1

303

2

37

93

(6)

Other assets (excluding derivatives) -

-

-

1,231

-

1,231

-

(2)

Liabilities (excluding derivatives) (7)

(27)

6

-

5

-

(16)

6

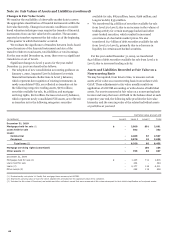

(1) Represents only net gains (losses) that are due to changes in economic conditions and management’s estimates of fair value and excludes changes due to the

collection/realization of cash flows over time.

(2) Included in other noninterest income in the income statement.

(3) Included in debt securities available for sale in the income statement.

(4) Included in equity investments in the income statement.

(5) Included in mortgage banking in the income statement.

(6) Included in mortgage banking, trading activities and other noninterest income in the income statement.

(7) Balances have been revised to conform with current period presentation.

187