Wells Fargo 2010 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

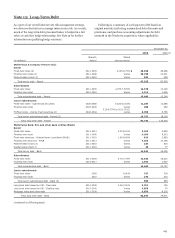

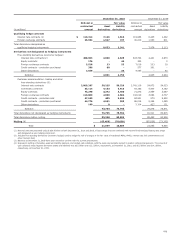

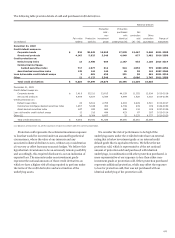

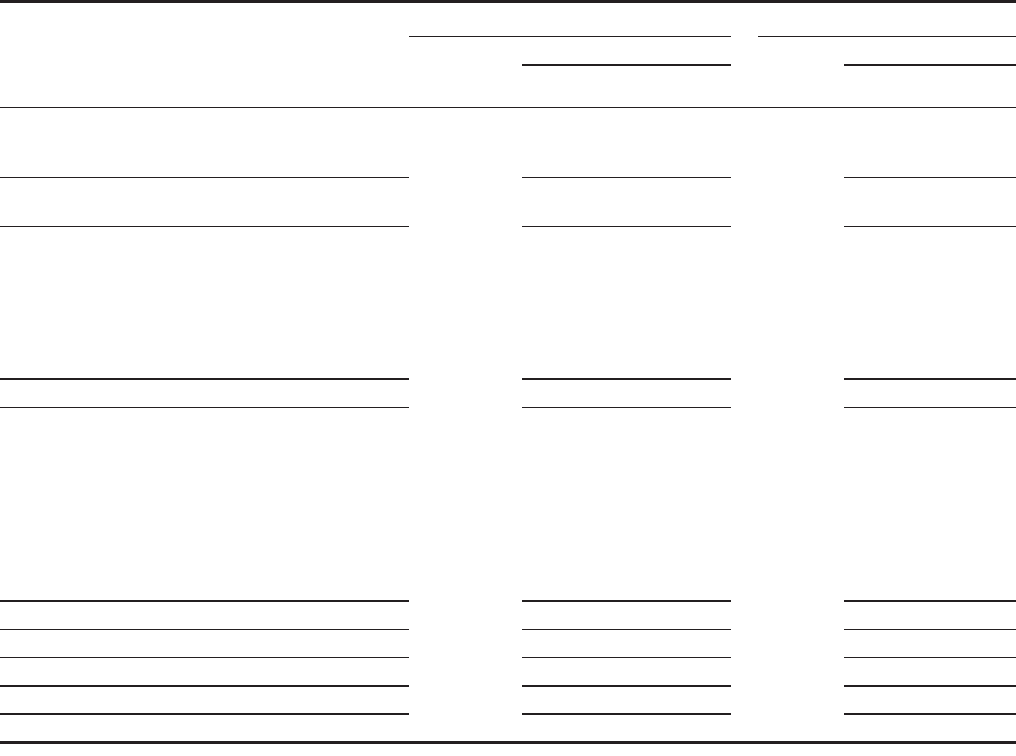

December 31, 2010

December 31, 2009

Notional or

Fair value

Notional or

Fair value

contractual

Asset

Liability

contractual

Asset

Liability

(in millions)

amount

derivatives

derivatives

amount

derivatives

derivatives

Qualifying hedge contracts

Interest rate contracts (1) $

110,314

7,126

1,614

119,966

6,425

1,302

Foreign exchange contracts

25,904

1,527

727

30,212

1,553

811

Total derivatives designated as

qualifying hedging instruments

8,653

2,341

7,978

2,113

Derivatives not designated as hedging instruments

Free-standing derivatives (economic hedges):

Interest rate contracts (2)

408,563

2,898

2,625

633,734

4,441

4,873

Equity contracts

176

-

46

300

-

2

Foreign exchange contracts

5,528

23

53

7,019

233

29

Credit contracts - protection purchased

396

80

-

577

261

-

Other derivatives

2,538

-

35

4,583

-

40

Subtotal

3,001

2,759

4,935

4,944

Customer accommodation, trading and other

free-standing derivatives (3):

Interest rate contracts

2,809,387

58,225

59,329

2,741,119

54,873

54,033

Commodity contracts

83,114

4,133

3,918

92,182

5,400

5,182

Equity contracts

73,278

3,272

3,450

71,572

2,459

3,067

Foreign exchange contracts

110,889

2,800

2,682

142,012

3,084

2,737

Credit contracts - protection sold

47,699

605

5,826

84,541

979

9,592

Credit contracts - protection purchased

44,776

4,661

588

86,014

9,354

1,089

Other derivatives

190

8

-

2,314

427

171

Subtotal

73,704

75,793

76,576

75,871

Total derivatives not designated as hedging instruments

76,705

78,552

81,511

80,815

Total derivatives before netting

85,358

80,893

89,489

82,928

Netting (4)

(63,469)

(70,009)

(65,926)

(73,303)

Total

$

21,889

10,884

23,563

9,625

(1) Notional amounts presented exclude $20.9 billion at both December 31, 2010 and 2009, of basis swaps that are combined with receive fixed-rate/pay floating-rate swaps

and designated as one hedging instrument.

(2) Includes free-standing derivatives (economic hedges) used to hedge the risk of changes in the fair value of residential MSRs, MHFS, interest rate lock commitments and

other interests held.

(3) Balances at December 31, 2009 have been revised to conform with the current presentation.

(4) Represents netting of derivative asset and liability balances, and related cash collateral, with the same counterparty subject to master netting arrangements. The amount of

cash collateral netted against derivative assets and liabilities was $5.5 billion and $12.1 billion, respectively, at December 31, 2010, and $5.3 billion and $14.1 billion,

respectively, at December 31, 2009.

173