Wells Fargo 2010 Annual Report Download - page 73

Download and view the complete annual report

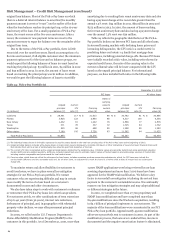

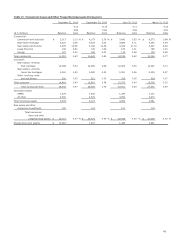

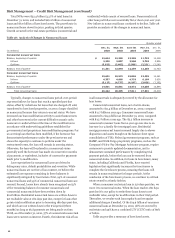

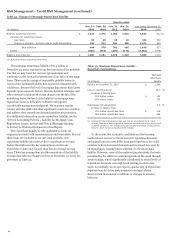

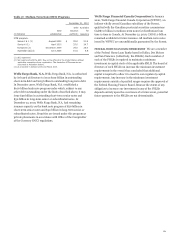

Please find page 73 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Table 32 presents net charge-offs for the four quarters and

full year of 2010 and 2009. Net charge-offs in 2010 were

$17.8 billion (2.30% of average total loans outstanding)

compared with $18.2 billion (2.21%) in 2009. Total net charge-

offs decreased in 2010 in part due to lower average loan balances

and as a result of modestly improving economic conditions,

aggressive loss mitigation activities aimed at working with our

customers through their financial challenges, and a depletion of

the pool of the most challenged vintages/relationships in the

portfolio. Total net charge-offs decreased each quarter

throughout the year from the peak loss level in fourth quarter of

2009. While loss levels remained elevated, the broad-based

improvement across the portfolio was an encouraging trend.

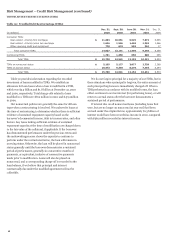

Net charge-offs in the 1-4 family first mortgage portfolio

totaled $4.4 billion in 2010. Our relatively high quality 1-4

family first mortgage portfolio continued to reflect relatively low

loss rates, although until housing prices fully stabilize, these

credit losses will continue to remain elevated.

Net charge-offs in the real estate 1-4 family junior lien

portfolio were $4.7 billion in 2010. Loss levels increased

throughout 2009 and peaked in the first quarter of 2010. Loss

levels will remain elevated, however, until conditions in the real

estate markets improve. More information about the Home

Equity portfolio, which includes substantially all of our real

estate 1-4 family junior lien mortgage loans, is available in

Table 25 in this Report and the related discussion.

Credit card charge-offs decreased $350 million to

$2.2 billion in 2010. Delinquency and loss levels improved in

2010 as the economy showed signs of stabilization.

Commercial and CRE net charge-offs were $4.8 billion in

2010 compared with $5.2 billion a year ago. Wholesale credit

results improved from 2009 as market liquidity and improving

market conditions helped stabilize performance results.

Increased lending activity in fourth quarter 2010 in the majority

of our commercial business lines further supported our belief of

a turn in the demand for credit.

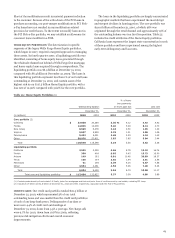

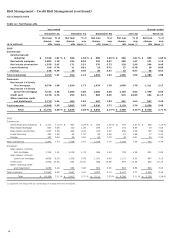

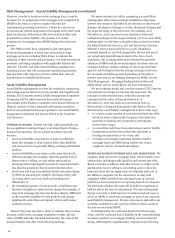

ALLOWANCE FOR CREDIT LOSSES The allowance for credit

losses, which consists of the allowance for loan losses and the

allowance for unfunded credit commitments, is management’s

estimate of credit losses inherent in the loan portfolio and

unfunded credit commitments at the balance sheet date,

excluding loans carried at fair value. The detail of the changes in

the allowance for credit losses by portfolio segment (including

charge-offs and recoveries by loan class) is in Note 6 (Loans and

Allowance for Credit Losses) to Financial Statements in this

Report.

We employ a disciplined process and methodology to

establish our allowance for credit losses each quarter. This

process takes into consideration many factors, including

historical and forecasted loss trends, loan-level credit quality

ratings and loan grade-specific loss factors. The process involves

subjective as well as complex judgments. In addition, we review

a variety of credit metrics and trends. However, these trends do

not solely determine the adequacy of the allowance as we use

several analytical tools in determining its adequacy. For

additional information on our allowance for credit losses, see the

“Critical Accounting Policies – Allowance for Credit Losses”

section and Note 6 (Loans and Allowance for Credit Losses) to

Financial Statements in this Report.

At December 31, 2010, the allowance for loan losses totaled

$23.0 billion (3.04% of total loans), compared with $24.5 billion

(3.13%), at December 31, 2009. The allowance for credit losses

was $23.5 billion (3.10% of total loans) at December 31, 2010,

and $25.0 billion (3.20%) at December 31, 2009. The allowance

for credit losses included $298 million and $333 million at

December 31, 2010 and 2009, respectively, related to PCI loans

acquired from Wachovia. The allowance for unfunded credit

commitments was $441 million and $515 million at

December 31, 2010 and 2009, respectively. In addition to the

allowance for credit losses there was $13.4 billion and

$22.9 billion of nonaccretable difference at December 31, 2010

and 2009, respectively, to absorb losses for PCI loans. For

additional information on PCI loans, see the “Risk Management

– Credit Risk Management – Purchased Credit-Impaired Loans”

section and Note 6 (Loans and Allowance for Credit Losses) to

Financial Statements in this Report.

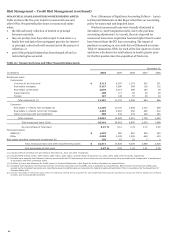

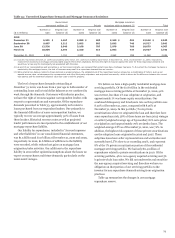

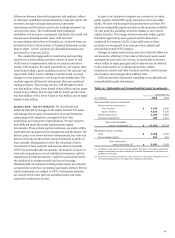

The ratio of the allowance for credit losses to total

nonaccrual loans was 89% and 103% at December 31, 2010 and

2009, respectively. This ratio may fluctuate significantly

from period to period due to such factors as the mix of loan

types in the portfolio, borrower credit strength and the value and

marketability of collateral. Over half of nonaccrual loans were

home mortgages, auto and other consumer loans at

December 31, 2010.

The ratio of the allowance for loan losses to annual net

charge-offs was 130% and 135% at December 31, 2010 and 2009,

respectively. The $1.5 billion decline in the allowance for loan

losses in 2010 reflected lower loan balances and lower levels of

inherent credit loss in the portfolio compared with previous

year-end levels. When anticipated charge-offs are projected to

decline from current levels, this ratio will decrease. As more of

the portfolio experiences charge-offs, charge-off levels continue

to increase and the remaining portfolio is anticipated to consist

of higher quality vintage loans subjected to tightened

underwriting standards administered during the downturn in

the credit cycle. As charge-off levels peak, we anticipate coverage

levels will decrease until charge-off levels return to more

normalized levels. This ratio may fluctuate significantly from

period to period due to many factors, including general

economic conditions, customer credit strength and the

marketability of collateral.

71