Wells Fargo 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

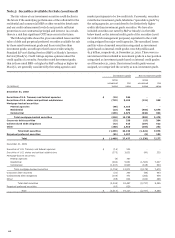

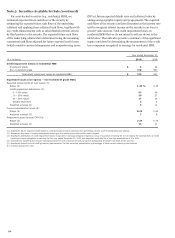

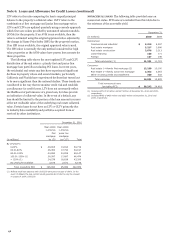

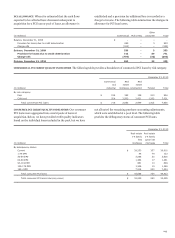

Note 6: Loans and Allowance for Credit Losses (continued)

Credit Quality

We monitor credit quality as indicated by evaluating various

attributes and utilize such information in our evaluation of the

adequacy of the allowance for credit losses. The following

sections provide the credit quality indicators we most closely

monitor. The majority of credit quality indicators are based on

December 31, 2010, information, with the exception of updated

FICO and updated loan-to-value (LTV)/combined LTV (CLTV),

which are obtained at least quarterly. Generally, these indicators

are updated in the second month of each quarter, with updates

no older than September 30, 2010.

COMMERCIAL CREDIT QUALITY INDICATORS In addition to

monitoring commercial loan concentration risk, we manage a

consistent process for assessing commercial loan credit quality.

Commercial loans are subject to individual risk assessment using

our internal borrower and collateral quality ratings. Our ratings

are aligned to Pass and Criticized categories. The Criticized

category includes Special Mention, Substandard, and Doubtful

categories which are defined by banking regulatory agencies.

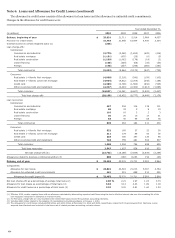

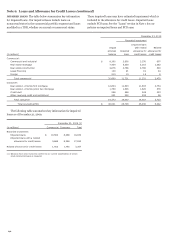

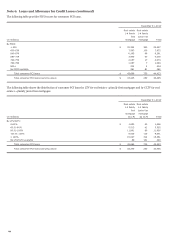

The table below provides a breakdown of outstanding

commercial loans (excluding PCI loans) by risk category. Both

the CRE mortgage and construction criticized totals are

relatively high as a result of the current conditions in the real

estate market. Of the $37.1 billion in criticized CRE loans,

$7.9 billion has been placed on nonaccrual status and written

down to net realizable value. Loans in both populations have a

high level of surveillance and monitoring in place to manage

these assets and mitigate any loss exposure. See the “Purchased

Credit-Impaired Loans” section of this Note for credit quality

information on our commercial PCI portfolio.

December 31, 2010

Commercial

Real

Real

and

estate

estate

Lease

(in millions) industrial

mortgage

construction

financing

Foreign

Total

By risk category:

Pass $ 126,058

70,597

11,256

12,411

30,341

250,663

Criticized 24,508

25,983

11,128

683

1,158

63,460

Total commercial loans (excluding PCI) $ 150,566

96,580

22,384

13,094

31,499

314,123

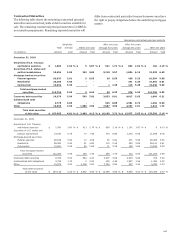

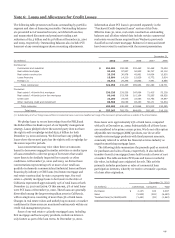

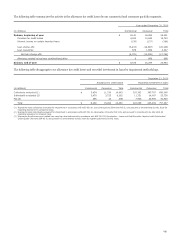

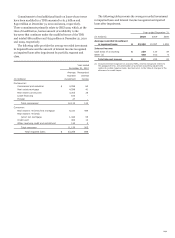

In addition, while we monitor past due status, we do not

consider it a key driver of our credit risk management practices

for commercial loans. The following table provides past due

information for commercial loans, excluding PCI loans.

December 31, 2010

Commercial

Real

Real

and

estate

estate

Lease

(in millions) industrial

mortgage

construction

financing

Foreign

Total

By delinquency status:

Current or 1-29 DPD $ 146,135

90,233

19,005

12,927

31,350

299,650

30-89 DPD 910

1,016

510

59

-

2,495

90+ DPD and still accruing 308

104

193

-

22

627

Nonaccrual loans 3,213

5,227

2,676

108

127

11,351

Total commercial loans (excluding PCI) $ 150,566

96,580

22,384

13,094

31,499

314,123

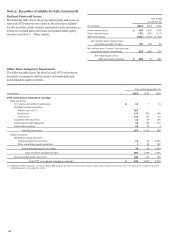

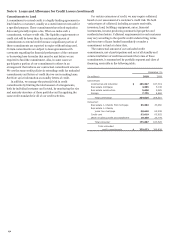

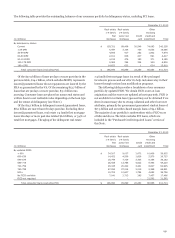

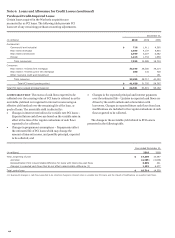

CONSUMER CREDIT QUALITY INDICATORS We have various

classes of consumer loans that present respective unique risks.

Loan delinquency, FICO credit scores and LTV for loan types are

common credit quality indicators that we monitor and utilize in

our evaluation of the adequacy of the allowance for credit losses

for the consumer portfolio segment.

The majority of our loss estimation techniques used for the

allowance for credit losses rely on delinquency matrix models or

delinquency roll rate models. Therefore, delinquency is an

important indicator of credit quality and the establishment of

our allowance for credit losses.

136