Wells Fargo 2010 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

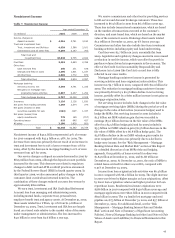

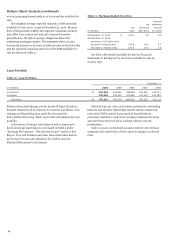

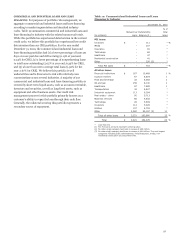

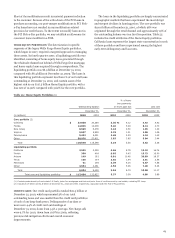

Contractual Obligations

In addition to the contractual commitments and arrangements

previously described, which, depending on the nature of the

obligation, may or may not require use of our resources, we

enter into other contractual obligations in the ordinary course

of business, including debt issuances for the funding of

operations and leases for premises and equipment.

Table 16 summarizes these contractual obligations as of

December 31, 2010, excluding obligations for short-term

borrowing arrangements and pension and postretirement

benefit plans. More information on those obligations is in

Note 12 (Short-Term Borrowings) and Note 19 (Employee

Benefits and Other Expenses) to Financial Statements in this

Report.

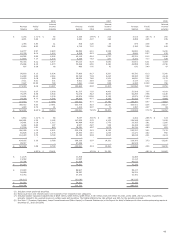

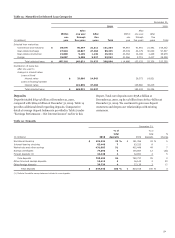

Table 16: Contractual Obligations

Note(s) to

More

Financial

Less than

1-3

3-5

than

Indeterminate

(in millions) Statements

1 year

years

years

5 years

maturity

Total

Contractual payments by period:

Deposits 11

$

108,232

33,601

10,855

2,500

692,754

(1)

847,942

Long-term debt (2) 7, 13

36,223

35,529

19,585

65,646

-

156,983

Operating leases 7

1,134

2,334

1,732

3,405

-

8,605

Unrecognized tax obligations 20

22

-

-

-

2,630

2,652

Commitments to purchase debt securities

1,153

650

-

-

-

1,803

Purchase obligations (3)

383

278

40

1

-

702

Total contractual obligations $

147,147

72,392

32,212

71,552

695,384

1,018,687

(1)

Includes interest-bearing and noninterest-bearing checking, and market rate and other savings accounts.

(2) Includes obligations under capital leases of $26 million.

(3) Represents agreements to purchase goods or services.

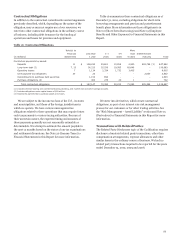

We are subject to the income tax laws of the U.S., its states

and municipalities, and those of the foreign jurisdictions in

which we operate. We have various unrecognized tax

obligations related to these operations that may require future

cash tax payments to various taxing authorities. Because of

their uncertain nature, the expected timing and amounts of

these payments generally are not reasonably estimable or

determinable. We attempt to estimate the amount payable in

the next 12 months based on the status of our tax examinations

and settlement discussions. See Note 20 (Income Taxes) to

Financial Statements in this Report for more information.

We enter into derivatives, which create contractual

obligations, as part of our interest rate risk management

process for our customers or for other trading activities. See

the “Risk Management – Asset/Liability” section and Note 15

(Derivatives) to Financial Statements in this Report for more

information.

Transactions with Related Parties

The Related Party Disclosures topic of the Codification requires

disclosure of material related party transactions, other than

compensation arrangements, expense allowances and other

similar items in the ordinary course of business. We had no

related party transactions required to be reported for the years

ended December 31, 2010, 2009 and 2008.

53