Wells Fargo 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

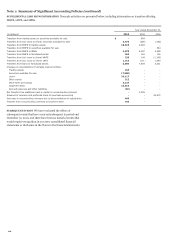

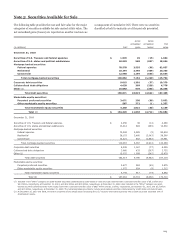

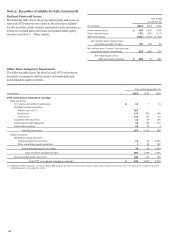

Note 5: Securities Available for Sale (continued)

As part of our liquidity management strategy, we pledge

securities to secure borrowings from the FHLB and the Federal

Reserve Bank. We also pledge securities to secure trust and

public deposits and for other purposes as required or permitted

by law. Securities pledged where the secured party does not have

the right to sell or repledge totaled $94.2 billion and

$98.9 billion at December 31, 2010 and 2009, respectively. We

did not pledge any securities where the secured party has the

right to sell or repledge the collateral as of the same periods,

respectively.

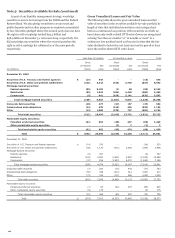

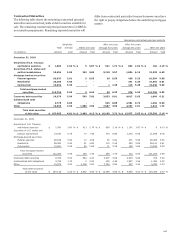

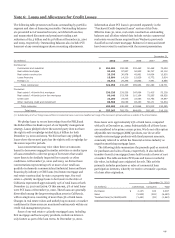

Gross Unrealized Losses and Fair Value

The following table shows the gross unrealized losses and fair

value of securities in the securities available-for-sale portfolio by

length of time that individual securities in each category had

been in a continuous loss position. Debt securities on which we

have taken only credit-related OTTI write-downs are categorized

as being “less than 12 months” or “12 months or more” in a

continuous loss position based on the point in time that the fair

value declined to below the cost basis and not the period of time

since the credit-related OTTI write-down.

Less than 12 months

12 months or more

Total

Gross

Gross

Gross

unrealized

Fair

unrealized

Fair

unrealized

Fair

(in millions) losses

value

losses

value

losses

value

December 31, 2010

Securities of U.S. Treasury and federal agencies $ (15)

544

-

-

(15)

544

Securities of U.S. states and political subdivisions (322)

6,242

(515)

2,720

(837)

8,962

Mortgage-backed securities:

Federal agencies (95)

8,103

(1)

60

(96)

8,163

Residential (35)

1,023

(454)

4,440

(489)

5,463

Commercial (9)

441

(626)

5,141

(635)

5,582

Total mortgage-backed securities (139)

9,567

(1,081)

9,641

(1,220)

19,208

Corporate debt securities (10)

477

(27)

157

(37)

634

Collateralized debt obligations (13)

679

(216)

456

(229)

1,135

Other (13)

1,985

(270)

757

(283)

2,742

Total debt securities (512)

19,494

(2,109)

13,731

(2,621)

33,225

Marketable equity securities:

Perpetual preferred securities (41)

962

(48)

467

(89)

1,429

Other marketable equity securities -

-

(1)

7

(1)

7

Total marketable equity securities (41)

962

(49)

474

(90)

1,436

Total $ (553)

20,456

(2,158)

14,205

(2,711)

34,661

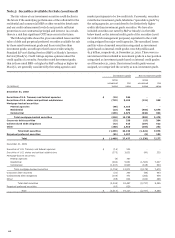

December 31, 2009

Securities of U.S. Treasury and federal agencies $ (14)

530

-

-

(14)

530

Securities of U.S. states and political subdivisions (55)

1,120

(310)

2,826

(365)

3,946

Mortgage-backed securities:

Federal agencies (9)

767

-

-

(9)

767

Residential (243)

2,991

(1,800)

9,697

(2,043)

12,688

Commercial (37)

816

(1,825)

6,370

(1,862)

7,186

Total mortgage-backed securities (289)

4,574

(3,625)

16,067

(3,914)

20,641

Corporate debt securities (7)

281

(70)

442

(77)

723

Collateralized debt obligations (55)

398

(312)

512

(367)

910

Other (73)

746

(172)

286

(245)

1,032

Total debt securities (493)

7,649

(4,489)

20,133

(4,982)

27,782

Marketable equity securities:

Perpetual preferred securities (1)

93

(64)

527

(65)

620

Other marketable equity securities (9)

175

-

-

(9)

175

Total marketable equity securities (10)

268

(64)

527

(74)

795

Total $ (503)

7,917

(4,553)

20,660

(5,056)

28,577

124