Wells Fargo 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

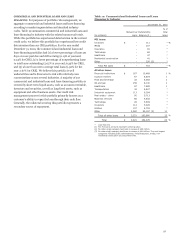

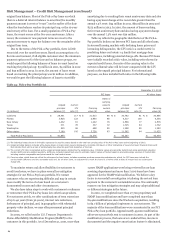

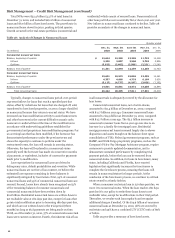

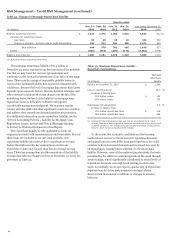

Table 29: Foreclosed Assets

Dec. 31,

Sept. 30,

June 30,

Mar. 31,

Dec. 31,

(in millions)

2010

2010

2010

2010

2009

GNMA $

1,479

1,492

1,344

1,111

960

PCI loans:

Commercial

967

1,043

940

697

405

Consumer

1,068

1,109

722

490

336

Total PCI loans

2,035

2,152

1,662

1,187

741

All other loans:

Commercial

1,412

1,343

1,087

820

655

Consumer

1,083

1,140

901

963

803

Total all other loans

2,495

2,483

1,988

1,783

1,458

Total foreclosed assets $

6,009

6,127

4,994

4,081

3,159

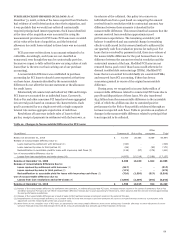

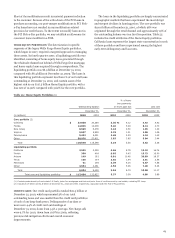

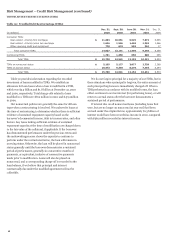

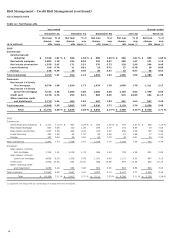

NPAs at December 31, 2010, included $1.5 billion of

foreclosed real estate that is FHA insured or VA guaranteed

and expected to have little to no loss content, and $4.5 billion

of foreclosed assets, which have been written down to the value

of the underlying collateral. Foreclosed assets increased

$2.9 billion, or 90%, in 2010 from the prior year. Of this

increase, $1.3 billion were foreclosed loans from the PCI

portfolio that are now recorded as foreclosed assets. At

December 31, 2010, substantially all of our foreclosed assets of

$6.0 billion have been in the portfolio one year or less.

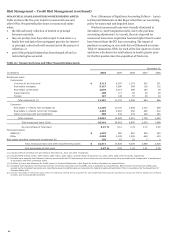

Given our real estate-secured loan concentrations and

current economic conditions, we anticipate continuing to hold

a high level of NPAs on our balance sheet. The loss content in

the nonaccrual loans has been recognized through charge-offs

or provided for in the allowance for credit losses at

December 31, 2010. The performance of any one loan can be

affected by external factors, such as economic or market

conditions, or factors affecting a particular borrower. We

increased staffing in our workout and collection organizations

to ensure troubled borrowers receive the attention and help

they need. See the “Risk Management – Allowance for Credit

Losses” section in this Report for additional information.

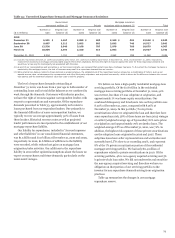

We process foreclosures on a regular basis for the loans we

service for others as well as those we hold in our loan portfolio.

However, we utilize foreclosure only as a last resort for dealing

with borrowers who are experiencing financial hardships. We

employ extensive contact and restructuring procedures to

attempt to find other solutions for our borrowers, and on

average we attempt to contact borrowers over 75 times by

phone and nearly 50 times by letter during the period from

first delinquency to foreclosure sale.

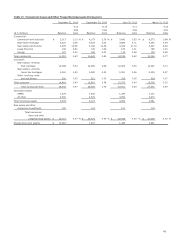

We employ the same foreclosure procedures for loans we

service for others as we use for loans that we hold in our

portfolio. We transmit customer and loan data directly from

our system of record to outside foreclosure counsel to help

ensure the quality of the customer and loan data included in

our foreclosure affidavits. We continuously test this process to

confirm the proper transmission of the data. Completed

foreclosure affidavits that are submitted to the courts are

reviewed, signed, and notarized as one of the last steps in a

multi-step process intended to comply with applicable law and

help ensure the quality of customer and loan data. As

previously disclosed, in the course of completing a thorough

review of our foreclosure affidavit preparation and execution

procedures, we did identify practices where final steps relating

to the execution of foreclosure affidavits, as well as some

aspects of the notarization process were not adhered to.

However, we do not believe that any of these practices led to

unwarranted foreclosures. In addition, we have enhanced those

procedures to help ensure that foreclosure affidavits are

properly prepared, reviewed, and signed.

67