Wells Fargo 2010 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

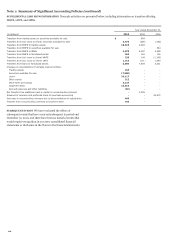

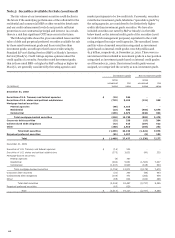

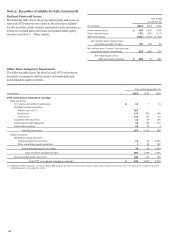

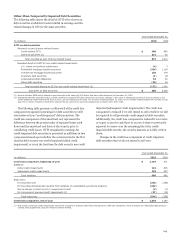

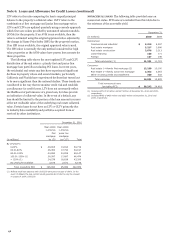

Other-Than-Temporarily Impaired Debt Securities

The following table shows the detail of OTTI write-downs on

debt securities available for sale included in earnings and the

related changes in OCI for the same securities.

Year ended December 31,

(in millions)

2010

2009

OTTI on debt securities

Recorded as part of gross realized losses:

Credit-related OTTI $

400

982

Intent-to-sell OTTI (1)

272

30

Total recorded as part of gross realized losses

672

1,012

Recorded directly to OCI for non-credit-related impairment:

U.S. states and political subdivisions

(4)

3

Residential mortgage-backed securities

(326)

1,124

Commercial mortgage-backed securities

138

179

Corporate debt securities

(1)

(2)

Collateralized debt obligations

54

20

Other debt securities

(33)

16

Total recorded directly to OCI for non-credit-related impairment (2)

(172)

1,340

Total OTTI on debt securities $

500

2,352

(1) Amount includes $252 million related to securities with a fair value of $14.5 billion that were sold subsequent to December 31, 2010.

(2) Represents amounts recorded to OCI on debt securities in periods OTTI write-downs have occurred. Changes in fair value in subsequent periods on such securities, to the

extent additional credit-related OTTI did not occur, are not reflected in this total. For the year ended December 31, 2010, the non-credit-related impairment recorded to OCI

was a $172 million reduction in total OTTI because the fair value of the security increased due to factors other than credit.

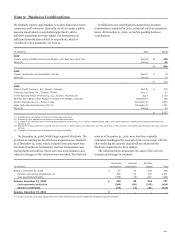

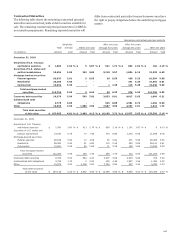

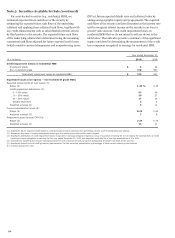

The following table presents a rollforward of the credit loss

component recognized in earnings for debt securities we still

own (referred to as “credit-impaired” debt securities). The

credit loss component of the amortized cost represents the

difference between the present value of expected future cash

flows and the amortized cost basis of the security prior to

considering credit losses. OTTI recognized in earnings for

credit-impaired debt securities is presented as additions in two

components based upon whether the current period is the first

time the debt security was credit-impaired (initial credit

impairment) or is not the first time the debt security was credit

impaired (subsequent credit impairments). The credit loss

component is reduced if we sell, intend to sell or believe we will

be required to sell previously credit-impaired debt securities.

Additionally, the credit loss component is reduced if we receive

or expect to receive cash flows in excess of what we previously

expected to receive over the remaining life of the credit-

impaired debt security, the security matures or is fully written

down.

Changes in the credit loss component of credit-impaired

debt securities that we do not intend to sell were:

Year ended December 31,

(in millions)

2010

2009

Credit loss component, beginning of year $

1,187

471

Additions:

Initial credit impairments 122

625

Subsequent credit impairments

278

357

Total additions

400

982

Reductions:

For securities sold

(263)

(255)

For securities derecognized resulting from adoption of consolidation accounting guidance

(242)

-

Due to change in intent to sell or requirement to sell

(2)

(1)

For recoveries of previous credit impairments (1)

(37)

(10)

Total reductions

(544)

(266)

Credit loss component, end of year $

1,043

1,187

(1) Recoveries of previous credit impairments result from increases in expected cash flows subsequent to credit loss recognition. Such recoveries are reflected prospectively as

interest yield adjustments using the effective interest method.

129