Wells Fargo 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

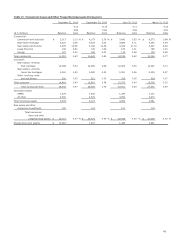

PICK-A-PAY PORTFOLIO The Pick-a-Pay portfolio was one of

the consumer residential first mortgage portfolios we acquired

from Wachovia. We considered a majority of the Pick-a-Pay

loans to be PCI loans.

The Pick-a-Pay portfolio had an outstanding balance of

$84.2 billion and a carrying value of $74.8 billion at

December 31, 2010. It is a liquidating portfolio, as Wachovia

ceased originating new Pick-a-Pay loans in 2008.

Real estate 1-4 family junior lien mortgages and lines of

credit associated with Pick-a-Pay loans are reported in the Home

Equity core portfolio. The Pick-a-Pay portfolio includes loans

that offer payment options (Pick-a-Pay option payment loans),

loans that were originated without the option payment feature,

loans that no longer offer the option feature as a result of our

modification efforts since the acquisition, and loans where the

customer voluntarily converted to a fixed-rate product. The Pick-

a-Pay portfolio is included in the consumer real estate 1-4 family

first mortgage class of loans in Note 6 (Loans and Allowance for

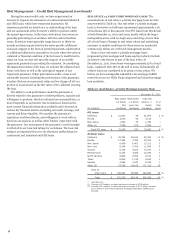

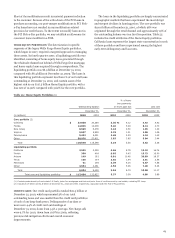

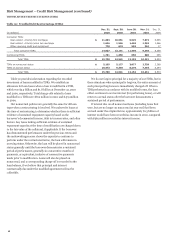

Credit Losses) to Financial Statements in this Report. Table 23

provides balances over time related to the types of loans

included in the portfolio.

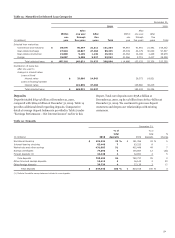

Table 23: Pick-a-Pay Portfolio - Balances Over Time

December 31,

2010

2009

2008

Unpaid

Unpaid

Unpaid

principal

principal

principal

(in millions) balance

% of total

balance

% of total

balance

% of total

Option payment loans (1) $ 49,958

59

%

$ 67,170

69

% $ 99,937

86

%

Non-option payment adjustable-rate

and fixed-rate loans (1) 11,070

13

13,926

14

15,763

14

Full-term loan modifications (1) 23,132

28

16,378

17

-

-

Total unpaid principal balance (1) $ 84,160

100

%

$ 97,474

100

% $ 115,700

100

%

Total carrying value $ 74,815

$ 85,238

$ 95,315

(1)

Unpaid principal balance includes write-downs taken on loans where severe delinquency (normally 180 days) or other indications of severe borrower financial stress exist

that indicate there will be a loss of contractually due amounts upon final resolution of the loan.

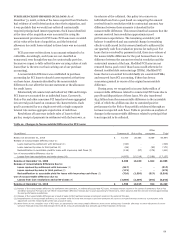

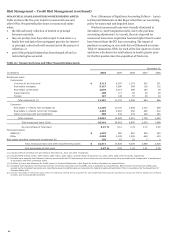

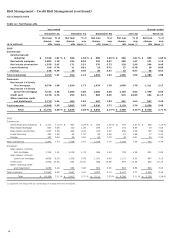

PCI loans in the Pick-a-Pay portfolio had an outstanding

balance of $41.9 billion and a carrying value of $32.4 billion at

December 31, 2010. The carrying value of the PCI loans is net of

remaining purchase accounting write-downs, which reflected

their fair value at acquisition. Upon acquisition, we recorded a

$22.4 billion write-down in purchase accounting on Pick-a-Pay

loans that were impaired.

Due to the sustained positive performance observed on the

Pick-a-Pay portfolio compared to the original acquisition

estimates, we have reclassified $2.4 billion from the

nonaccretable difference to the accretable yield since the

Wachovia merger. This improvement in the lifetime credit

outlook for this portfolio is primarily attributable to the

significant modification efforts as well as the portfolio’s

delinquency stabilization. This improvement in the credit

outlook is expected to be realized over the remaining life of the

portfolio, which is estimated to have a weighted-average life of

approximately nine years. The accretable yield percentage at the

end of 2010 was 4.54% compared with 5.34% at the end of 2009.

Fluctuations in the accretable yield are driven by changes in

interest rate indices for variable rate PCI loans, prepayment

assumptions, and expected principal and interest payments over

the estimated life of the portfolio. Changes in the projected

timing of cash flow events, including loan liquidations,

modifications and short sales, can also affect the accretable yield

percentage and the estimated weighted-average life of the

portfolio.

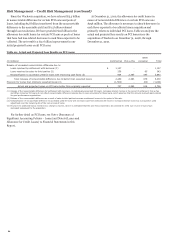

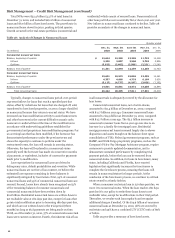

Pick-a-Pay option payment loans may be adjustable or fixed

rate. They are home mortgages on which the customer has the

option each month to select from among four payment options:

(1) a minimum payment as described below, (2) an interest-only

payment, (3) a fully amortizing 15-year payment, or (4) a fully

amortizing 30-year payment.

The minimum monthly payment for substantially all of our

Pick-a-Pay loans is reset annually. The new minimum monthly

payment amount usually cannot increase by more than 7.5% of

the then-existing principal and interest payment amount. The

minimum payment may not be sufficient to pay the monthly

interest due and in those situations a loan on which the

customer has made a minimum payment is subject to “negative

amortization,” where unpaid interest is added to the principal

balance of the loan. The amount of interest that has been added

to a loan balance is referred to as “deferred interest.” Total

deferred interest of $2.7 billion at December 31, 2010, was down

from $3.7 billion at December 31, 2009, due to loan modification

efforts as well as falling interest rates resulting in the minimum

payment option covering the interest and some principal on

many loans. At December 31, 2010, approximately 75% of

customers choosing the minimum payment option did not defer

interest.

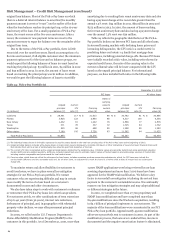

Deferral of interest on a Pick-a-Pay loan may continue as

long as the loan balance remains below a pre-defined principal

cap, which is based on the percentage that the current loan

balance represents to the original loan balance. Loans with an

original loan-to-value (LTV) ratio equal to or below 85% have a

cap of 125% of the original loan balance, and these loans

represent substantially all the Pick-a-Pay portfolio. Loans with

an original LTV ratio above 85% have a cap of 110% of the

61