Wells Fargo 2010 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

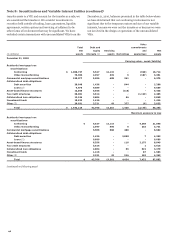

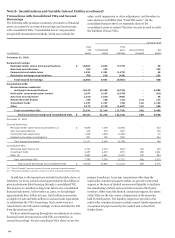

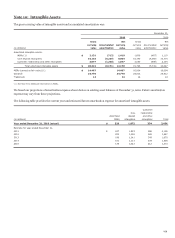

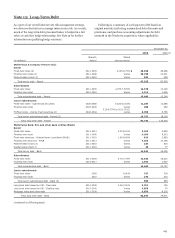

Note 8: Securitizations and Variable Interest Entities (continued)

Transactions with Consolidated VIEs and Secured

Borrowings

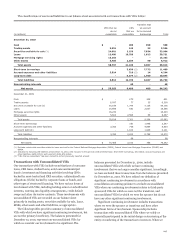

The following table presents a summary of transfers of financial

assets accounted for as secured borrowings and involvements

with consolidated VIEs. “Consolidated assets” are presented

using GAAP measurement methods, which may include fair

value, credit impairment or other adjustments, and therefore in

some instances will differ from “Total VIE assets.” On the

consolidated balance sheet, we separately disclose the

consolidated assets of certain VIEs that can only be used to settle

the liabilities of those VIEs.

Carrying value

Total

Third

VIE

Consolidated

party

Noncontrolling

Net

(in millions)

assets

assets

liabilities

interests

assets

December 31, 2010

Secured borrowings:

Municipal tender option bond securitizations $

10,687

7,874

(7,779)

-

95

Auto loan securitizations 154

154

-

-

154

Commercial real estate loans 1,321

1,321

(1,272)

-

49

Residential mortgage securitizations 700

618

(436)

-

182

Total secured borrowings 12,862

9,967

(9,487)

-

480

Consolidated VIEs:

Nonconforming residential

mortgage loan securitizations 14,518

13,529

(6,723)

-

6,806

Multi-seller commercial paper conduit 3,197

3,197

(3,279)

-

(82)

Auto loan securitizations 1,010

1,010

(955)

-

55

Structured asset finance 146

146

(21)

(11)

114

Investment funds 1,197

1,197

(54)

(14)

1,129

Other 2,173

2,170

(1,697)

(15)

458

Total consolidated VIEs 22,241

21,249

(12,729)

(40)

8,480

Total secured borrowings and consolidated VIEs $

35,103

31,216

(22,216)

(40)

8,960

December 31, 2009

Secured borrowings:

Municipal tender option bond securitizations (1) $ 9,649

7,189

(6,856)

-

333

Auto loan securitizations 274

274

(121)

-

153

Commercial real estate loans 1,309

1,309

(1,269)

-

40

Residential mortgage securitizations

901

792

(552)

-

240

Total secured borrowings

12,133

9,564

(8,798)

-

766

Consolidated VIEs:

Structured asset finance (2)

2,791

1,074

(919)

(10)

145

Investment funds

2,257

2,245

(271)

(33)

1,941

Other (2)

2,697

1,981

(1,032)

(25)

924

Total consolidated VIEs

7,745

5,300

(2,222)

(68)

3,010

Total secured borrowings and consolidated VIEs $ 19,878

14,864

(11,020)

(68)

3,776

(1) “Total VIE assets” has been revised to correct previously reported amount.

(2) “Third party liabilities” has been revised to correct previously reported amounts.

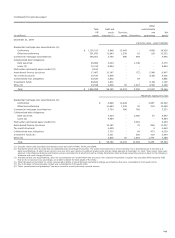

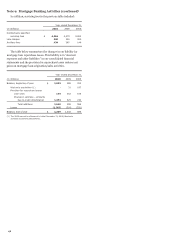

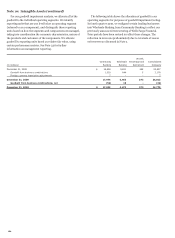

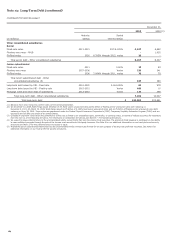

In addition to the transactions included in the table above, at

December 31, 2010, we had issued approximately $6.0 billion of

private placement debt financing through a consolidated VIE.

The issuance is classified as long-term debt in our consolidated

financial statements. At December 31, 2010, we had pledged

approximately $6.0 billion in loans, $478 million in securities

available for sale and $180 million in cash and cash equivalents

to collateralize the VIE’s borrowings. Such assets were not

transferred to the VIE and accordingly we have excluded the VIE

from the previous table.

We have raised financing through the securitization of certain

financial assets in transactions with VIEs accounted for as

secured borrowings. We also consolidate VIEs where we are the

primary beneficiary. In certain transactions other than the

multi-seller commercial paper conduit, we provide contractual

support in the form of limited recourse and liquidity to facilitate

the remarketing of short-term securities issued to third party

investors. Other than this limited contractual support, the assets

of the VIEs are the sole source of repayment of the securities

held by third parties. The liquidity support we provide to the

multi-seller commercial paper conduit ensures timely repayment

of commercial paper issued by the conduit and is described

further below.

154