Wells Fargo 2010 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

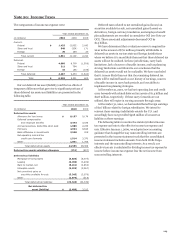

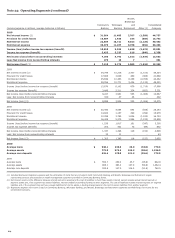

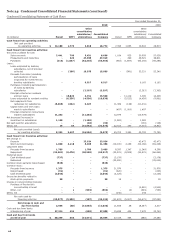

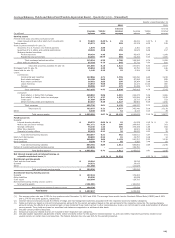

Note 24: Condensed Consolidated Financial Statements (continued)

Condensed Consolidating Statements of Cash Flows

Year ended December 31,

2010

2009

Other

Other

consolidating

consolidating

subsidiaries/

Consolidated

subsidiaries/

Consolidated

(in millions) Parent

WFFI

eliminations

Company

Parent

WFFI

eliminations

Company

Cash flows from operating activities:

Net cash provided

by operating activities $ 14,180

1,774

2,818

18,772

7,356

1,655

19,602

28,613

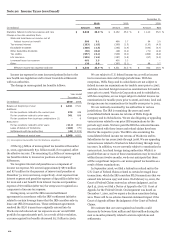

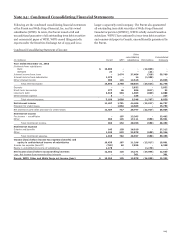

Cash flows from investing activities:

Securities available for sale:

Sales proceeds 2,441

796

5,431

8,668

1,184

925

50,929

53,038

Prepayments and maturities -

229

47,690

47,919

-

290

38,521

38,811

Purchases (119)

(1,037)

(52,310)

(53,466)

(463)

(1,667)

(93,155)

(95,285)

Loans:

Loans originated by banking

subsidiaries, net of principal

collected -

(206)

16,075

15,869

-

(981)

53,221

52,240

Proceeds from sales (including

participations) of loans

originated for investment by

banking subsidiaries -

-

6,517

6,517

-

-

6,162

6,162

Purchases (including participations)

of loans by banking

subsidiaries -

-

(2,297)

(2,297)

-

-

(3,363)

(3,363)

Principal collected on nonbank

entities' loans -

10,829

4,731

15,560

-

11,119

3,309

14,428

Loans originated by nonbank entities -

(6,336)

(4,500)

(10,836)

-

(5,523)

(4,438)

(9,961)

Net repayments from

(advances to) subsidiaries (5,485)

(842)

6,327

-

11,369

(138)

(11,231)

-

Capital notes and term loans

made to subsidiaries -

-

-

-

(497)

(1,000)

1,497

-

Principal collected on notes/loans

made to subsidiaries 11,282

-

(11,282)

-

12,979

-

(12,979)

-

Net decrease (increase) in

investment in subsidiaries 1,198

-

(1,198)

-

(1,382)

-

1,382

-

Net cash paid for acquisitions -

-

(36)

(36)

-

-

(138)

(138)

Other, net 15

64

(31,652)

(31,573)

22,513

355

(7,015)

15,853

Net cash provided (used)

by investing activities 9,332

3,497

(16,504)

(3,675)

45,703

3,380

22,702

71,785

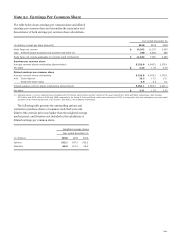

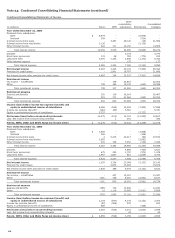

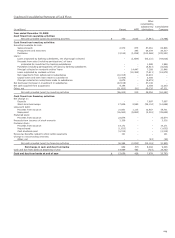

Cash flows from financing activities:

Net change in:

Deposits -

-

23,924

23,924

-

-

42,473

42,473

Short-term borrowings 1,860

4,118

5,330

11,308

(19,100)

2,158

(52,166)

(69,108)

Long-term debt:

Proceeds from issuance 1,789

-

1,700

3,489

8,297

1,347

(1,248)

8,396

Repayment (23,281)

(9,478)

(30,558)

(63,317)

(22,931)

(8,508)

(34,821)

(66,260)

Preferred stock:

Cash dividends paid (737)

-

-

(737)

(2,178)

-

-

(2,178)

Redeemed -

-

-

-

(25,000)

-

-

(25,000)

Common stock warrants repurchased (545)

-

-

(545)

-

-

-

-

Common stock:

Proceeds from issuance 1,375

-

-

1,375

21,976

-

-

21,976

Repurchased (91)

-

-

(91)

(220)

-

-

(220)

Cash dividends paid (1,045)

-

-

(1,045)

(2,125)

-

-

(2,125)

Excess tax benefits related to

stock option payments 98

-

-

98

18

-

-

18

Change in noncontrolling interests:

Purchase of Prudential's

noncontrolling interest -

-

-

-

-

-

(4,500)

(4,500)

Other, net -

1

(593)

(592)

-

(4)

(549)

(553)

Other, net -

-

-

-

(140)

-

140

-

Net cash used by

financing activities (20,577)

(5,359)

(197)

(26,133)

(41,403)

(5,007)

(50,671)

(97,081)

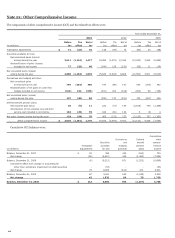

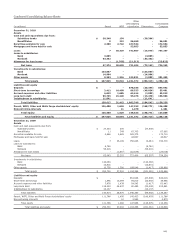

Net change in cash and

due from banks 2,935

(88)

(13,883)

(11,036)

11,656

28

(8,367)

3,317

Cash and due from banks

at beginning of year 27,314

454

(688)

27,080

15,658

426

7,679

23,763

Cash and due from banks

at end of year $ 30,249

366

(14,571)

16,044

27,314

454

(688)

27,080

218