Wells Fargo 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Wells Fargo & Company Annual Report 2010

Standing together.

Table of contents

-

Page 1

Wells Fargo & Company Annual Report 2010 Standing together. -

Page 2

...ï¬ed ï¬nancial services company - community-based and relationship-oriented - serving people across the nation and around the world. Our corporate headquarters is in San Francisco, but all our stores, regional commercial banking centers, ATMs, Wells Fargo PhoneBank,SM and internet sites are... -

Page 3

...help them buy a home. Pay for educating their children. Build a business. Save for retirement. Customers and communities want a friend who's there to help them succeed ï¬nancially. This is about relationships. This is about being there with more than just outstanding service and useful products. We... -

Page 4

... and Chief Executive Officer Wells Fargo & Company In 2010 we stood together with our customers. Seventy million of them. One of every three American households, in more communities than any other bank. One of every four U.S. home mortgage customers. Our customers worked harder than ever to... -

Page 5

... buy a home or refinance their mortgage at a lower rate, saving them hundreds of dollars a month on mortgage payments, money they can save, invest, or use to pay down other debt. We had loan growth in the last half of the year in many portfolios, including asset-backed finance, auto dealer services... -

Page 6

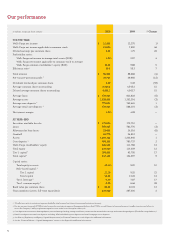

... stock to average Wells Fargo common stockholders' equity (ROE) Efficiency ratio 1 Total revenue Pre-tax pre-provision profit 2 Dividends declared per common share Average common shares outstanding Diluted average common shares outstanding Average loans Average assets Average core deposits 3 Average... -

Page 7

... checking account with us. When Wells Fargo and Wachovia merged two years ago, customers of the combined new bank had $745.4 billion of core deposits with us. At year-end 2010, despite the recent recession, our core deposits were $798.2 billion, up seven percent. Our two million Wachovia credit card... -

Page 8

.... Our Auto Dealer Services team grew its share of the used-vehicle lending market from 4.3 percent in the first quarter of 2009 to 5.4 percent at year-end 2010, retaining its #1 national ranking, and solidifying relationships with 11,000 dealers. In the West, eight of every ten new customers who... -

Page 9

... share for middle-market companies. Our Commercial Banking team attracted more new customers in 2010 than in any single year in our company's history. Our average Commercial Banking relationship in the West (legacy Wells Fargo) had eight products with us in 2010. In the East, where the Wachovia... -

Page 10

... Act of 2002 was 66 pages. Those were the good old days!) Its 240 rules will affect checking accounts, debit cards, credit cards, home loans, and brokerage accounts. We support any protection for customers nationally to ensure all financial services providers, not just banks, are held to the same... -

Page 11

.... In 2010, we closed our network of 638 Wells Fargo Financial stores because we now can serve those consumer and commercial finance customers through our national network, expanded through the Wachovia merger, of 6,314 Community Banking stores, and through other Wells Fargo businesses. In addition... -

Page 12

... build lifelong customer relationships that meet customers' needs through all stages of their lives. Here are a few stories about how Wells Fargo's 281,000 team members stand together with our customers. Phillip Schuman (right) and investment manager Adam Schwalb in Lighthouse Point, Florida. Story... -

Page 13

11 -

Page 14

12 -

Page 15

...bank of 30 years - Wachovia - didn't offer cross-border financing, so the business had to turn to a new lending partner. Then the merger with Wells Fargo happened and a new option opened. Glenn Loh (center), CMG's chief financial officer, worked with his business relationship manager at Wells Fargo... -

Page 16

63 years of service Bruce Holt's bank has stood by him since 1948. That's when he opened his first account with Birmingham (Alabama) Trust after his discharge from the Army. While the names on his bank changed over the years - including from Wachovia to Wells Fargo in 2010 - he puts a premium on one... -

Page 17

... as they can be. How? She's a trainer with Wells Fargo's Liability and Fraud Claims department, the team that stands behind customers when they call with a problem they have with a purchase made on their Wells Fargo® Debit Card. "Wilted flowers for a wedding, the wrong refrigerator delivered... -

Page 18

16 -

Page 19

... a customer-to-be in Norcross, Georgia, who needed fast help. "He didn't speak English and needed to open an account so he could send money to his family in China," Zhu said. She started the process, then - because the request was so urgent - asked him to go to a Wells Fargo banking store in... -

Page 20

... could help." More than 20 workshops are planned for 2011. "These workshops show that Wells Fargo is a caring, responsible member of our community," said Bill Sanchez, a counselor for the Tampa Bay Community Development Corporation, which partnered with Wells Fargo at the Tampa workshop in 2010. 18 -

Page 21

19 -

Page 22

..., California - use credit cards in a new way to better manage outgoing payments? Rather than spark and fade, however, he brought his question to Wells Fargo. Wilson was one of dozens of customers who took part in 22 Advisory Council forums that Wells Fargo hosted in 2010. The councils are day-long... -

Page 23

... for his father, whose health had worsened. That meant running a bunch of businesses and assets that were new to him. Enter Adam Schwalb (left) with Wells Fargo Advisors, who had been Schuman's investment manager since 2008. Schwalb, based in Lighthouse Point, Florida, connected Schuman to a team of... -

Page 24

... and business accounts with Wells Fargo through the merger, he's now turning to Wells Fargo for help launching a new business venture - Hotel California Restaurant & Cantina - that could employ 100 local people. "What's important to me is working with a bank that's there for the good times and... -

Page 25

23 -

Page 26

24 -

Page 27

... before in our company's history has our support for communities been so vital. Our team members volunteer tens of thousands of hours each year, sharing their time and talents to help nonproï¬ts. We also provide millions of dollars to support the good work of organizations large and small. It's all... -

Page 28

... Rader is on Junior Achievement's board for the region serving Minnesota, North Dakota, and Western Wisconsin where Wells Fargo has provided the most corporate volunteers for 15 consecutive years. "Wells Fargo has been an innovative partner, providing so much more than just volunteers," said Blayney... -

Page 29

...for a challenged Augusta, Georgia, neighborhood that's now home to Sharna Roundtree and her three children and the site of a new Salvation Army Kroc Community Center. Wells Fargo was instrumental to both. The Wells Fargo Housing Foundation partnered with the city, team members, and a local nonprofit... -

Page 30

28 -

Page 31

...1,500 churches at six sites across the U.S., where participants use the Wells Fargo Hands on Banking® curriculum. Dixon said, "It's all part of our commitment to the long-term economic development of the African American community." "Sometimes the best way to approach unfamiliar financial subjects... -

Page 32

Wells Fargo contributed Where we give Education • Community Development • Human Services • Arts and Culture • Civic • Environmental • • Other 30% 28% 25% 8% 6% 2% 1% $219 million $4.2 m to 19,000 non-profits in 2010, an average of: Our community commitment capital • Social ... -

Page 33

... A. Holschuh, Corporate Secretary David A. Hoyt, Wholesale Banking * Richard D. Levy, Controller * Michael J. Loughlin, Chief Risk Officer * Kevin McCabe, Chief Auditor 31 Kevin A. Rhein, Card Services and Consumer Lending * Joseph J. Rice, Chief Credit Officer James H. Rowe, Investor Relations Eric... -

Page 34

... Credit Card Business Debit Card/Prepaid Products Robert A. Ryan, Wells Fargo Rewards and Michael R. McCoy, Consumer Credit Card Enhancement Services Robert A. Ryan, Wells Fargo Rewards and R. Brent Vallat, Personal Credit Enhancement Services Management Norwest Equity Partners CORPORATE FINANCE... -

Page 35

... Consolidated Balance Sheet Consolidated Statement of Changes in Equity and Comprehensive Income Consolidated Statement of Cash Flows Notes to Financial Statements 111 121 1 2 Summary of Significant Accounting Policies Business Combinations 221 Report of Independent Registered Public Accounting... -

Page 36

...Annual Report on Form 10-K for the year ended December 31, 2010 (2010 Form 10-K). See the Glossary of Acronyms at the end of this Report for terms used throughout this Report. Financial Review Overview Wells Fargo & Company is a $1.3 trillion diversified financial services company providing banking... -

Page 37

...well controlled operating environment as we complete the integration of the Wachovia businesses and grow the combined company. We manage our credit risk by establishing what we believe are sound credit policies for underwriting new business, while monitoring and reviewing the performance of our loan... -

Page 38

...interests Wells Fargo net income Earnings per common share Diluted earnings per common share Dividends declared per common share Balance sheet (at year end) Securities available for sale Loans Allowance for loan losses Goodwill Assets Core deposits (1) Long-term debt Wells Fargo stockholders' equity... -

Page 39

...2: Ratios and Per Common Share Data Year ended December 31, 2010 Profitability ratios Wells Fargo net income to average assets (ROA) Wells Fargo net income applicable to common stock to average Wells Fargo common stockholders' equity (ROE) Efficiency ratio (1) Capital ratios At year end: Wells Fargo... -

Page 40

... caused declining loan demand, solid deposit generation and continued elevated credit losses. Earnings for 2009 were influenced by the worsening of the recession that began in 2008, and low market rates. Both 2010 and 2009 were affected by merger integration costs. Revenue, the sum of net interest... -

Page 41

... Noninterest income Service charges on deposit accounts Trust and investment fees (1) Card fees Other fees (1) Mortgage banking (1) Insurance Net gains from trading activities Net gains (losses) on debt securities available for sale Net gains (losses) from equity investments Operating leases Other... -

Page 42

... of higher yielding mortgage-backed securities, relatively soft commercial loan demand, and planned runoff of liquidating loan portfolios. The impact of these factors was mitigated by disciplined deposit pricing and reduced market funding costs. For 2009, changes in net interest income from... -

Page 43

... junior lien mortgage Credit card Other revolving credit and installment Total consumer Total loans (2) Other Total earning assets Funding sources Deposits: Interest-bearing checking Market rate and other savings Savings certificates Other time deposits Deposits in foreign offices Total interest... -

Page 44

... junior lien mortgage Credit card Other revolving credit and installment Total consumer Total loans (6) Other Total earning assets Funding sources Deposits: Interest-bearing checking Market rate and other savings Savings certificates Other time deposits Deposits in foreign offices Total interest... -

Page 45

... loans and securities. The federal statutory tax rate utilized was 35% for the periods presented. (8) See Note 7 (Premises, Equipment, Lease Commitments and Other Assets) to Financial Statements in this Report for detail of balances of other noninterest-earning assets at December 31, 2010 and 2009... -

Page 46

... and rate changes during any period, it is Table 6: Analysis of Changes in Net Interest Income Year ended December 31, 2010 over 2009 (in millions) Increase (decrease) in interest income: Federal funds sold, securities purchased under resale agreements and other short-term investments Trading assets... -

Page 47

...increased for the year. This decrease was related to regulatory changes to debit card and ATM overdraft practices announced by the Federal Reserve Board (FRB) in fourth quarter 2009. In third quarter 2009, we also announced policy changes to help customers limit overdraft and returned item fees. The... -

Page 48

...and long-term benefits to our customers, we added platform team members in the Eastern market to align Wachovia's banking stores with Wells Fargo's sales and service model. We completed the second year of our merger integration, converting 749 Wachovia stores in Alabama, Arizona, California, Georgia... -

Page 49

...retail securities, brokerage and mortgage businesses. Federal Deposit Insurance Corporation (FDIC) and other deposit assessments decreased in 2010 from 2009, predominantly due to a midyear 2009 FDIC special assessment of $565 million. Problem loans and foreclosures increased workout-related salaries... -

Page 50

... of merger synergies. To benefit our customers we continued to add platform team members in regional banking's Eastern markets as we aligned Wachovia banking stores with the Wells Fargo sales and service model. The provision for credit losses decreased $4.1 billion from 2009 and credit quality... -

Page 51

... fees and net interest income. Net interest income growth was dampened by the continued low short-term interest rate environment. Equity market gains helped drive growth in fee income. During 2010 client assets grew 6% from a year ago, including managed account asset growth of 20%. Deposit balances... -

Page 52

.... Year-end balances and other loan related information are in Note 6 (Loans and Allowance for Credit Losses) to Financial Statements in this Report. Effective June 30, 2010, real estate construction outstanding balances and all other related data include certain commercial real estate (CRE) secured... -

Page 53

... 31, 2010, up $17.5 billion from $780.7 billion at December 31, 2009. We continued to gain new deposit customers and deepen our relationships with existing customers. December 31, % of (in millions) Noninterest-bearing Interest-bearing checking Market rate and other savings Savings certificates... -

Page 54

... of customers, (2) manage our credit, market or liquidity risks, (3) diversify our funding sources, and/or (4) optimize capital. In accordance with the transition provisions of the new consolidation accounting guidance, we initially recorded newly consolidated VIE assets and liabilities on a basis... -

Page 55

...market rate and other savings accounts. (2) Includes obligations under capital leases of $26 million. (3) Represents agreements to purchase goods or services. We are subject to the income tax laws of the U.S., its states and municipalities, and those of the foreign jurisdictions in which we operate... -

Page 56

... from legacy Wells Fargo home equity and Wells Fargo Financial. The legacy Wells Fargo Financial debt consolidation portfolio included $1.2 billion and $1.6 billion at December 31, 2010 and 2009, respectively, that 54 (1) Net of purchase accounting adjustments related to PCI loans. (2) These... -

Page 57

... loan reviews and appraisal updates. As issues are identified, management is engaged and dedicated workout groups are put in place to manage problem assets. At December 31, 2010, the recorded investment in PCI CRE loans totaled $5.8 billion, down from $12.3 billion since the Wachovia acquisition... -

Page 58

... balance (1) Total Nonaccrual Outstanding loans balance (1) % of total loans (in millions) By state: PCI loans: Florida California Georgia North Carolina New York Other Total PCI loans All other loans: California Florida Texas North Carolina New York Virginia Georgia Arizona Colorado New Jersey... -

Page 59

... of our commercial and industrial loans and lease financing portfolio is secured by short-term liquid assets, such as accounts receivable, inventory and securities, as well as long-lived assets, such as equipment and other business assets. Our credit risk management process for this portfolio... -

Page 60

...than 3% of total loans. Changes in real estate values and underlying economic or market conditions for these areas are monitored continuously within our credit risk management process. Some of our real estate 1-4 family mortgage loans (representing first mortgage and home equity products) include an... -

Page 61

... payments. Such loans identified at the time of the acquisition were accounted for using the measurement provisions for PCI loans. PCI loans were recorded at fair value at the date of acquisition, and the historical allowance for credit losses related to these loans was not carried over. PCI loans... -

Page 62

... expected to be collected for a PCI loan or pool of loans have decreased subsequent to the acquisition. For further detail on PCI loans, see Note 1 (Summary of Significant Accounting Policies - Loans) and Note 6 (Loans and Allowance for Credit Losses) to Financial Statements in this Report. 60 -

Page 63

... the projected timing of cash flow events, including loan liquidations, modifications and short sales, can also affect the accretable yield percentage and the estimated weighted-average life of the portfolio. Pick-a-Pay option payment loans may be adjustable or fixed rate. They are home mortgages on... -

Page 64

... on reaching the principal cap was $1 million. In addition, we would expect the following balances of loans to start fully Table 24: Pick-a-Pay Portfolio (1) December 31, 2010 PCI loans Ratio of carrying Unpaid principal (in millions) California Florida New Jersey Texas Washington Other states Total... -

Page 65

... the highest early-term delinquency and loss rates. % of loans two payments Outstanding balance December 31, (in millions) Core portfolio (2) California Florida New Jersey Virginia Pennsylvania Other Total Liquidating portfolio California Florida Arizona Texas Minnesota Other Total Total core and... -

Page 66

... well-secured and in the process of collection; or • part of the principal balance has been charged off and no restructuring has occurred. Table 26: Nonaccrual Loans and Other Nonperforming Assets Note 1 (Summary of Significant Accounting Policies - Loans) to Financial Statements in this Report... -

Page 67

... and industrial Real estate mortgage Real estate construction Lease financing Foreign Total commercial Consumer: Real estate 1-4 family first mortgage Real estate 1-4 family junior lien mortgage Other revolving credit and installment Total consumer Total nonaccrual loans Foreclosed assets: GNMA All... -

Page 68

... and assets brought on the balance sheet upon consolidation of VIEs. Federal government programs, such as HAMP, and Wells Fargo proprietary programs, such as the Company's Pick-a-Pay Mortgage Assistance program, require customers to provide updated documentation, and to demonstrate sustained... -

Page 69

... "Risk Management - Allowance for Credit Losses" section in this Report for additional information. We process foreclosures on a regular basis for the loans we service for others as well as those we hold in our loan portfolio. However, we utilize foreclosure only as a last resort for dealing with... -

Page 70

... December 31, 2010 and 2009, respectively. Total charge-offs related to loans modified in a TDR were $812 million in 2010 and $479 million in 2009. Our nonaccrual policies are generally the same for all loan types when a restructuring is involved. We underwrite loans at the time of restructuring to... -

Page 71

...accretable yield and not based on consideration given to contractual interest payments. Non-PCI loans 90 days or more past due and still accruing were $18.5 billion at December 31, 2010, and $22.2 billion at December 31, 2009. Those balances include $14.7 billion and $15.3 billion, respectively, in... -

Page 72

Risk Management - Credit Risk Management (continued) NET CHARGE-OFFS Table 32: Net Charge-offs Year ended December 31, Net loan charge($ in millions) 2010 Commercial: Commercial and industrial Real estate mortgage Real estate construction Lease financing Foreign Total commercial Consumer: Real ... -

Page 73

... in the real estate markets improve. More information about the Home Equity portfolio, which includes substantially all of our real estate 1-4 family junior lien mortgage loans, is available in Table 25 in this Report and the related discussion. Credit card charge-offs decreased $350 million to... -

Page 74

... balance sheet date. Our process for determining the allowance for credit losses is discussed in the "Critical Accounting Policies - Allowance for Credit Losses" section and Note 6 (Loans and Allowance for Credit Losses) to Financial Statements in this Report. LIABILITY FOR MORTGAGE LOAN REPURCHASE... -

Page 75

... between the current loan balance and the estimated collateral value less costs to sell the property. The level of repurchase demands outstanding at December 31, 2010, was down from a year ago in both number of outstanding loans and in total dollar balances as we continued to work through the... -

Page 76

.... For additional information on our repurchase liability, see the "Critical Accounting Policies - Liability for Mortgage Loan Repurchase Losses" section and Note 9 (Mortgage Banking Activities) to Financial Statements in this Report. The repurchase liability is only applicable to loans we originated... -

Page 77

... and Exchange Commission (SEC), (4) if required by the securitization documents, calculate distributions and loss allocations on the mortgage-backed securities, (5) prepare tax and information returns of the securitization trust, and (6) advance amounts required by non-affiliated servicers who fail... -

Page 78

... may subsequently change our intent to hold loans for investment and sell some or all of our ARMs or fixed-rate mortgages as part of our corporate asset/liability management. We may also acquire and add to our securities available for sale a portion of the securities issued at the time we securitize... -

Page 79

... for managing interest rate risk. Under this method, the MSRs are recorded at fair value at the time we sell or securitize the related mortgage loans. The carrying value of MSRs carried at fair value reflects changes in fair value at the end of each quarter and changes are included in net servicing... -

Page 80

... rates, credit spreads, foreign exchange rates, equity and commodity prices and their implied volatilities. The primary purpose of our trading businesses is to accommodate customers in the management of their market price risks. Also, we take positions based on market expectations or to benefit... -

Page 81

...7,624 5,254 305 3,808 5,138 5,985 1,423 2010 2009 indirectly affected by changes in the equity markets. We make and manage direct equity investments in start-up businesses, emerging growth companies, management buy-outs, acquisitions and corporate recapitalizations. We also invest in non-affiliated... -

Page 82

.... Core customer deposits have historically provided a sizeable source of relatively stable and low-cost funds. Average core deposits funded 62.9% and 60.4% of average total assets in 2010 and 2009, respectively. Additional funding is provided by long-term debt (including trust preferred securities... -

Page 83

... accordance with Office of the Comptroller of the Currency (OCC) regulations. of the Federal Home Loan Banks based in Dallas, Des Moines and San Francisco (collectively, the FHLBs). Each member of each of the FHLBs is required to maintain a minimum investment in capital stock of the applicable FHLB... -

Page 84

...Statements in this Report for additional information. Current regulatory RBC rules are based primarily on broad credit-risk considerations and limited market-related risks, but do not take into account other types of risk a financial company may be exposed to. Our capital adequacy assessment process... -

Page 85

... the acquisition of Wachovia. At December 31, 2010, stockholders' equity and Tier 1 common equity levels were higher than the quarter ending prior to the Wachovia acquisition. During 2009, as regulators and the market focused on the composition of regulatory capital, the Tier 1 common equity ratio... -

Page 86

... purchased credit-impaired (PCI) loans; • the valuation of residential mortgage servicing rights (MSRs); • liability for mortgage loan repurchase losses; • the fair valuation of financial instruments; and • income taxes. Management has reviewed and approved these critical accounting policies... -

Page 87

... purchase date using indicators such as past due and nonaccrual status, commercial risk ratings, recent borrower credit scores and recent loan-to-value percentages. The fair value at acquisition was based on an estimate of cash flows, both principal and interest, expected to be collected, discounted... -

Page 88

... group operating in accordance with Company policies. Senior management reviews all significant assumptions quarterly. Mortgage loan prepayment speed - a key assumption in the model - is the annual rate at which borrowers are forecasted to repay their mortgage loan principal. The discount rate used... -

Page 89

... securing the loan, compliance with applicable origination laws, and other matters. For more information about these loan sales and the related risks that may result in liability see the "Risk Management - Credit Risk Management - Liability for Mortgage Loan Repurchase Losses" section in this Report... -

Page 90

... include securities traded in functioning dealer or broker markets, plain-vanilla interest rate derivatives and MHFS that are valued based on prices for other mortgage whole loans with similar characteristics. • Level 3 - Valuation is generated primarily from modelbased techniques that use... -

Page 91

collateralized by auto leases or loans and cash reserves, private collateralized mortgage obligations (CMOs), collateralized debt obligations (CDOs), collateralized loan obligations (CLOs), auction-rate securities, certain derivative contracts such as credit default swaps related to CMO, CDO and CLO... -

Page 92

...on our revenue and businesses, including the DoddFrank Act and legislation and regulation relating to overdraft fees (and changes to our overdraft practices as a result thereof), debit card interchange fees, credit cards, and other bank services; legislative proposals to allow mortgage cram-downs in... -

Page 93

...; the effect of the fall in stock market prices on our investment banking business and our fee income from our brokerage, asset and wealth management businesses; our election to provide support to our mutual funds for structured credit products they may hold; changes in the value of our venture... -

Page 94

... Company. We refer you to the Financial Review and "Forward-Looking Statements" sections and Financial Statements (and related Notes) in this Report for more information about credit, interest rate, market, litigation and other risks and to the "Regulation and Supervision" section of our 2010 Form... -

Page 95

... review process and public disclosure. In 2010, the FRB issued guidelines for evaluating proposals by large bank holding companies, including the Company, to undertake capital actions in 2011, such as increasing dividend payments or repurchasing or redeeming stock. Pursuant to those FRB guidelines... -

Page 96

... businesses of Wachovia and Wells Fargo. The integration process may result in the loss of key employees, the disruption of ongoing businesses and the loss of customers and their business and deposits. It may also divert management attention and resources from other operations and limit the Company... -

Page 97

... the Company's business and financial results, are uncertain. Changes in interest rates could reduce our net interest income and earnings. Our net interest income is the interest we earn on loans, debt securities and other assets we hold less the interest we pay on our deposits, long-term and short... -

Page 98

... Management - Mortgage Banking Interest Rate and Market Risk" and "Critical Accounting Policies" sections in this Report. Our mortgage banking revenue can be volatile from quarter to quarter. We earn revenue from fees we receive for originating mortgage loans and for servicing mortgage loans... -

Page 99

...for Mortgage Loan Repurchase Losses" and "- Risks Relating to Servicing Activities," and "Critical Accounting Policies - Valuation of Residential Mortgage Servicing Rights" sections in this Report. We could recognize OTTI on securities held in our available-for-sale portfolio if economic and market... -

Page 100

... to Financial Statements in this Report. Our bank customers could take their money out of the bank and put it in alternative investments, causing us to lose a lower cost source of funding. Checking and savings account balances and other forms of customer deposits may decrease when customers perceive... -

Page 101

... and "-Holding Company Structure" sections in our 2010 Form 10-K and to Note 3 (Cash, Loan and Dividend Restrictions) and Note 25 (Regulatory and Agency Capital Requirements) to Financial Statements in this Report. Changes in accounting policies or accounting standards, and changes in how accounting... -

Page 102

... our cost of doing business, limiting the activities we may pursue or affecting the competitive balance among banks, savings associations, credit unions, and other financial institutions. For more information, refer to the "Regulation and Supervision" section in our 2010 Form 10-K and to "Report of... -

Page 103

...: • general business and economic conditions; • recommendations by securities analysts; • new technology used, or services offered, by our competitors; • operating and stock price performance of other companies that investors deem comparable to us; • news reports relating to trends... -

Page 104

... management concluded that as of December 31, 2010, the Company's internal control over financial reporting was effective. KPMG LLP, the independent registered public accounting firm that audited the Company's financial statements included in this Annual Report, issued an audit report on the Company... -

Page 105

...), the consolidated balance sheet of the Company as of December 31, 2010 and 2009, and the related consolidated statements of income, changes in equity and comprehensive income, and cash flows for each of the years in the three-year period ended December 31, 2010, and our report dated February 25... -

Page 106

... for credit losses Noninterest income Service charges on deposit accounts Trust and investment fees Card fees Other fees Mortgage banking Insurance Net gains from trading activities Net gains (losses) on debt securities available for sale (1) Net gains (losses) from equity investments (2) Operating... -

Page 107

Wells Fargo & Company and Subsidiaries Consolidated Balance Sheet December 31, (in millions, except shares) Assets Cash and due from banks Federal funds sold, securities purchased under resale agreements and other short-term investments Trading assets Securities available for sale Mortgages held for... -

Page 108

Wells Fargo & Company and Subsidiaries Consolidated Statement of Changes in Equity and Comprehensive Income (in millions, except shares) Balance December 31, 2007 Cumulative effect from change in accounting for postretirement benefits Adjustment for change of measurement date related to pension and... -

Page 109

Additional paid-in capital 8,212 Retained earnings 38,970 (20) (8) 38,942 2,655 Cumulative other comprehensive income 725 Treasury stock (6,035) Wells Fargo stockholders' equity Total Unearned Wells Fargo ESOP stockholders' shares equity (482) 47,628 (20) (8) 47,600 2,655 Noncontrolling ... -

Page 110

... pages) Wells Fargo & Company and Subsidiaries Consolidated Statement of Changes in Equity and Comprehensive Income (in millions, except shares) Balance December 31, 2009 Shares 9,980,940 Preferred stock Amount $ 8,485 Shares 5,178,624,593 Common stock Amount $ 8,743 Balance January 1, 2010... -

Page 111

Additional paid-in capital 52,878 Retained earnings 41,563 Cumulative other comprehensive income 3,009 Treasury stock (2,450) Wells Fargo stockholders' equity Total Unearned Wells Fargo ESOP stockholders' shares equity (442) 111,786 Noncontrolling interests 2,573 Total equity 114,359 52,878 ... -

Page 112

...benefits related to stock option payments Change in noncontrolling interests: Purchase of Prudential's noncontrolling interest Other, net Net cash provided (used) by financing activities Net change in cash and due from banks Cash and due from banks at beginning of year Cash and due from banks at end... -

Page 113

...Acronyms at the end of this Report for terms used throughout the Financial Statements and related Notes of this Form 10-K. Note 1: Summary of Significant Accounting Policies Wells Fargo & Company is a nation-wide diversified, community-based financial services company. We provide banking, insurance... -

Page 114

...2010. ASU 2009-17 (FAS 167) amends several key consolidation provisions related to variable interest entities (VIEs), which are included in ASC 810, Consolidation. The scope of the new guidance includes entities that were previously designated as QSPEs. The Update also changes the approach companies... -

Page 115

...model we use for debt might not hold until maturity and marketable equity securities are classified as securities available for sale and reported at fair value. Unrealized gains and losses, after applicable taxes, are reported in cumulative OCI. Fair value measurement is based upon quoted prices in... -

Page 116

... venture capital equity securities that are not publicly traded and securities acquired for various purposes, such as to meet regulatory requirements (for example, Federal Reserve Bank and Federal Home Loan Bank (FHLB) stock). These securities are accounted for under the cost or equity method and... -

Page 117

.... See the "Purchased Credit-Impaired Loans" section in this Note for our accounting policy for PCI loans. Unearned income, deferred fees and costs, and discounts and premiums are amortized to interest income over the contractual life of the loan using the interest method. Loan commitment fees are... -

Page 118

...IMPAIRED (PCI) LOANS Loans acquired in a transfer, including business combinations, where there is evidence of credit deterioration since origination and it is probable at the date of acquisition that we will not collect all contractually required principal and interest payments are accounted for as... -

Page 119

...is management's estimate of credit losses inherent in the loan portfolio at the balance sheet date. record a gain or loss in other fee income for the difference between the carrying amount and the fair value of the assets sold. Fair values are based on quoted market prices, quoted market prices for... -

Page 120

... amortize capitalized leased assets on a straight-line basis over the lives of the respective leases. Goodwill and Identifiable Intangible Assets Goodwill is recorded in business combinations under the purchase method of accounting when the purchase price is higher than the fair value of net assets... -

Page 121

... in each hedging relationship is expected to be and has been highly effective in offsetting changes in fair values or cash flows of the hedged item using the regression analysis method or, in limited cases, the dollar offset method. We discontinue hedge accounting prospectively when (1) a derivative... -

Page 122

... entities: Trading assets Securities available for sale Loans Other assets Short-term borrowings Long-term debt Accrued expenses and other liabilities Net transfer from additional paid-in capital to noncontrolling interests Issuance of common and preferred stock for purchase accounting Decrease in... -

Page 123

... the Wells Fargo Merchant Services, LLC joint venture. (5) Consists of 12 acquisitions of insurance brokerage businesses. On December 31, 2008, Wells Fargo acquired Wachovia. The purchase accounting for the Wachovia acquisition was finalized as of December 31, 2009, which included costs associated... -

Page 124

... actions by the Company including per share dividend increases and share repurchases from the Company's benefit plans and the market. The Company has submitted a Capital Plan Review to the FRB. Note 4: Federal Funds Sold, Securities Purchased under Resale Agreements and Other Short-Term Investments... -

Page 125

... by home equity loans with a cost basis and fair value of $927 million and $1.1 billion, respectively, at December 31, 2010, and $2.3 billion and $2.5 billion, respectively, at December 31, 2009. The remaining balances primarily include asset-backed securities collateralized by credit cards and... -

Page 126

... Bank. We also pledge securities to secure trust and public deposits and for other purposes as required or permitted by law. Securities pledged where the secured party does not have the right to sell or repledge totaled $94.2 billion and $98.9 billion at December 31, 2010 and 2009, respectively... -

Page 127

... mortgage loans in each transaction. We use forecasted loan performance to project cash flows to the various tranches in the structure. We also consider cash flow forecasts and, as applicable, independent industry analyst reports and forecasts, sector credit ratings, and other independent market... -

Page 128

... Rating Services (S&P) or Moody's Investors Service (Moody's). Credit ratings express opinions about the credit quality of a security. Securities rated investment grade, that is those rated BBB- or higher by S&P or Baa3 or higher by Moody's, are generally considered by the rating agencies and market... -

Page 129

...yields of debt securities available for sale. The remaining contractual...Mortgage-backed securities: Federal agencies Residential Commercial Total mortgage-backed securities Corporate debt securities Collateralized debt obligations Other Total debt securities at fair value December 31, 2009 Securities... -

Page 130

... debt securities and marketable and nonmarketable equity securities. Year ended December 31, (in millions) OTTI write-downs included in earnings Debt securities: U.S. states and political subdivisions Mortgage-backed securities: Federal agencies (1) Residential Commercial Corporate debt securities... -

Page 131

...directly to OCI for non-credit-related impairment: U.S. states and political subdivisions Residential mortgage-backed securities Commercial mortgage-backed securities Corporate debt securities Collateralized debt obligations Other debt securities Total recorded directly to OCI for non-credit-related... -

Page 132

... the year ended December 31, 2010, had expected remaining life of loan loss assumptions of 0 to 10%. (4) Calculated by weighting the relevant input/assumption for each individual security by current outstanding amortized cost basis of the security. (5) Represents current level of credit protection... -

Page 133

... loans net of any remaining purchase accounting adjustments. Information about PCI loans is presented separately in the "Purchased Credit-Impaired Loans" section of this Note. Effective June 30, 2010, real estate construction outstanding balances and all other related data include certain commercial... -

Page 134

... to the specific credit underwriting, terms and structure of loans funded immediately or under a commitment to fund at a later date. The contractual amount of our unfunded credit commitments, net of participations and net of all standby and commercial letters of credit issued under the terms... -

Page 135

...conditions. We have had limited changes in our allowance methodology primarily associated with integration alignment of loss estimation processes between Wells Fargo and Wachovia. Those changes did not significantly impact the allowance for credit losses. COMMERCIAL PORTFOLIO SEGMENT ACL METHODOLOGY... -

Page 136

... consolidation accounting guidance on January 1, 2010. (4) The allowance for credit losses includes $298 million and $333 million at December 31, 2010 and 2009, respectively, related to PCI loans acquired from Wachovia. Loans acquired from Wachovia are included in total loans net of related purchase... -

Page 137

... segments. Year ended December 31, 2010 (in millions) Balance, beginning of year Provision for credit losses Interest income on certain impaired loans Loan charge-offs Loan recoveries Net loan charge-offs Allowance related to business combinations/other Balance, end of year $ $ Commercial 8,141... -

Page 138

... Real estate Lease financing Foreign Total mortgage construction In addition, while we monitor past due status, we do not consider it a key driver of our credit risk management practices for commercial loans. The following table provides past due information for commercial loans, excluding PCI... -

Page 139

The following table provides the outstanding balances of our consumer portfolio by delinquency status, excluding PCI loans. December 31, 2010 Real estate Real estate 1-4 family first (in millions) By delinquency status: Current 1-29 DPD 30-59 DPD 60-89 DPD 90-119 DPD 120-179 DPD 180+ DPD Total ... -

Page 140

..., then the value is estimated using the original appraised value adjusted by the change in Home Price Index (HPI) for the property location. If an HPI is not available, the original appraised value is used. The HPI value is normally the only method considered for high value properties as the AVM... -

Page 141

... based on consideration given to contractual interest payments. Non-PCI loans 90 days or more past due and still accruing were $18.5 billion at December 31, 2010, and $22.2 billion at December 31, 2009. Those balances which include mortgage loans held for sale, have $14.7 billion and $15.3 billion... -

Page 142

... Impaired loans with related Impaired loans Unpaid (in millions) Commercial: Commercial and industrial Real estate mortgage Real estate construction Lease financing Foreign Total commercial Consumer: Real estate 1-4 family first mortgage Real estate 1-4 family junior lien mortgage Credit card Other... -

Page 143

... interest income recognized on impaired loans after impairment. Year ended December 31, (in millions) Average recorded investment in impaired loans Interest income: Cash basis of accounting Other (1) Total interest income $ $ 250 448 698 130 102 232 34 9 43 2010 2009 2008 $ 23,268 10,557 1,952... -

Page 144

...) Purchased Credit-Impaired Loans Certain loans acquired in the Wachovia acquisition are accounted for as PCI loans. The following table presents PCI loans net of any remaining purchase accounting adjustments. December 31, (in millions) Commercial: Commercial and industrial Real estate mortgage Real... -

Page 145

...summarizes the changes in allowance for PCI loan losses. Other (in millions) Balance, December 31, 2008 Provision for losses due to credit deterioration Charge-offs Balance, December 31, 2009 Provision for losses due to credit deterioration Charge-offs Balance, December 31, 2010 $ $ Commercial 850... -

Page 146

...and Allowance for Credit Losses (continued) The following table provides FICO scores for consumer PCI loans. December 31, 2010 Real estate Real estate 1-4 family first (in millions) By FICO: < 600 600-639 640-679 680-719 720-759 760-799 800+ No FICO available Total consumer PCI loans Total consumer... -

Page 147

..., 2010. Operating (in millions) Year ended December 31, 2011 2012 2013 2014 2015 Thereafter Total minimum lease payments Executory costs Amounts representing interest Present value of net minimum lease payments $ 26 $ leases Capital leases Total nonmarketable equity investments Corporate/bank-owned... -

Page 148

... SPE if the outstanding balance of the receivables falls to a level where the cost exceeds the benefits of servicing such receivables. In addition, we may purchase the right to service loans in an SPE that were transferred to the SPE by a third party. In connection with our securitization activities... -

Page 149

... in our balance sheet associated with our transactions with VIEs follow: Transfers that we account for as secured borrowings Total VIEs that we (in millions) December 31, 2010 Cash Trading assets Securities available for sale (1) Loans Mortgage servicing rights Other assets Total assets Short-term... -

Page 150

... (liability) Residential mortgage loan securitizations: Conforming Other/nonconforming Commercial mortgage securitizations Collateralized debt obligations: Debt securities Loans (2) Asset-based finance structures Tax credit structures Collateralized loan obligations Investment funds Other (3) Total... -

Page 151

... rating agencies at December 31, 2010. These senior loans were acquired in the Wachovia business combination and are accounted for at amortized cost as initially determined under purchase accounting and are subject to the Company's allowance and credit charge-off policies. (3) Includes student loan... -

Page 152

...we utilize for determining stressed case regulatory capital needs. COMMERCIAL MORTGAGE LOAN SECURITIZATIONS Commercial mortgage loan securitizations are financed through the issuance of fixed- or floating-rate-asset-backed-securities, which are collateralized by the loans transferred to the VIE. In... -

Page 153

... they require a source of liquidity to fund ongoing vehicle sales operations. The third party auto financing institutions manage the collateral in the VIEs, which is indicative of power in these transactions and we therefore do not consolidate these VIEs. TAX CREDIT STRUCTURES We co-sponsor and make... -

Page 154

...involved in transfers accounted for as sales. Year ended December 31, 2010 Other financial assets 34 442 2009 Other financial assets 42 310 - Mortgage (in millions) Sales proceeds from securitizations (1) Servicing fees Other interests held (2) Purchases of delinquent assets Net servicing advances... -

Page 155

... 31, 2010 Expected weighted-average life (in years) Prepayment speed assumption (annual CPR) Decrease in fair value from: 10% adverse change 25% adverse change Discount rate assumption Decrease in fair value from: 100 basis point increase 200 basis point increase Credit loss assumption Decrease in... -

Page 156

... VIEs: Nonconforming residential mortgage loan securitizations Multi-seller commercial paper conduit Auto loan securitizations Structured asset finance Investment funds Other Total consolidated VIEs Total secured borrowings and consolidated VIEs December 31, 2009 Secured borrowings: Municipal tender... -

Page 157

... of highly rated commercial paper to third party investors. The primary source of repayment of the commercial paper is the cash flows from the conduit's assets or the re-issuance of commercial paper upon maturity. The conduit's assets are structured with deal-specific credit enhancements generally... -

Page 158

...The changes in MSRs measured using the fair value method were: Year ended December 31, (in millions) Fair value, beginning of year Adjustments from adoption of consolidation accounting guidance Purchases Acquired from Wachovia (1) Servicing from securitizations or asset transfers Sales Net additions... -

Page 159

...for MSRs in excess of fair value Net derivative gains from economic hedges (5) Total servicing income, net Net gains on mortgage loan origination/sales activities (2) Total mortgage banking noninterest income Market-related valuation changes to MSRs, net of hedge results (3) + (5) $ $ (2,957) (2,554... -

Page 160

..." in our consolidated financial statements and the provision for repurchase losses reduces net gains on mortgage loan origination/sales activities. Year ended December 31, (in millions) Balance, beginning of year Wachovia acquisition (1) Provision for repurchase losses: Loan sales Change in estimate... -

Page 161

... asset balances at December 31, 2010. Future amortization expense may vary from these projections. The following table provides the current year and estimated future amortization expense for amortized intangible assets. Customer Core Amortized (in millions) Year ended December 31, 2010 (actual... -

Page 162

... business combinations Foreign currency translation adjustments December 31, 2009 Goodwill from business combinations, net December 31, 2010 $ $ Community Banking 16,638 1,329 7 17,974 (52) 17,922 Wholesale Banking 5,621 844 6,465 10 6,475 Brokerage and Retirement 368 5 373 373 Consolidated Company... -

Page 163

... time deposits issued by foreign offices with a denomination of $100,000 or more were $16.7 billion and $20.4 billion at December 31, 2010 and 2009, respectively. Demand deposit overdrafts of $557.0 million and $667.0 million were included as loan balances at December 31, 2010 and 2009, respectively... -

Page 164

... information for short-term borrowings, which generally mature in less than 30 days. 2010 (in millions) As of December 31, Commercial paper and other short-term borrowings Federal funds purchased and securities sold under agreements to repurchase Total Year ended December 31, Average daily balance... -

Page 165

... unamortized debt discounts and premiums, and purchase accounting adjustments for debt assumed in the Wachovia acquisition, where applicable): December 31, 2010 Maturity (in millions) Wells Fargo & Company (Parent only) Senior Fixed-rate notes (2) Floating-rate notes (2) Market-linked notes... -

Page 166

... 6,167 6,682 1,625 8,307 date(s) Stated interest rate(s) 2009 (1) (1) Balances have been revised to conform with current period presentation. (2) On December 10, 2008, Wells Fargo issued $3 billion of 3% fixed senior unsecured notes and $3 billion of floating senior unsecured notes both maturing on... -

Page 167

...various financial and operational covenants. Some of the agreements under which debt has been issued have provisions that may limit the merger or sale of certain subsidiary banks and the issuance of capital stock or convertible securities by certain subsidiary banks. At December 31, 2010, we were in... -

Page 168

... incurred in connection with legal and other proceedings arising from relationships or transactions with us. These relationships or transactions include those arising from service as a director or officer of the Company, underwriting agreements relating to our securities, acquisition agreements and... -

Page 169

... off-balance sheet entities that hold securitized fixed-rate municipal bonds and consumer or commercial assets that are partially funded with the issuance of money market and other short-term notes. The decrease in maximum exposure to loss from December 31, 2009, is due to the amounts related to... -

Page 170

...and certain senior officers, in the U.S. District Court for the Western District of North Carolina. The case was filed on behalf of employees of Wachovia Corporation and its affiliates who held shares of Wachovia Corporation common stock in their Wachovia Savings Plan accounts. On August 6, 2010, an... -

Page 171

... fraud relating to Le-Nature's financial condition. Wachovia Capital Markets, LLC and/or Wachovia Bank, N.A. are named as defendants in a number of lawsuits including the following: (1) a case filed in the New York State Supreme Court for the County of Manhattan by hedge fund purchasers of the bank... -

Page 172

... which the Banks post debit card transactions to consumer deposit accounts. There are currently 12 such cases pending against Wells Fargo Bank (including the Wachovia Bank cases to which Wells Fargo succeeded), all but three of which have been consolidated in multi-district litigation proceedings in... -

Page 173

... v. Wachovia Corp et al., was filed in the Southern District of New York. On May 3, 2010, the judge in the Southern District of New York issued an order granting Plaintiffs leave to amend the class action and other complaints pending in that court, and directing the parties to submit a schedule for... -

Page 174

... to market risk, interest rate risk, credit risk and foreign currency risk, to generate profits from proprietary trading and to assist customers with their risk management objectives. Derivative transactions are measured in terms of the notional amount, but this amount is not recorded on the balance... -

Page 175

... (economic hedges): Interest rate contracts (2) Equity contracts Foreign exchange contracts Credit contracts - protection purchased Other derivatives Subtotal Customer accommodation, trading and other free-standing derivatives (3): Interest rate contracts Commodity contracts Equity contracts... -

Page 176

... ended December 31, 2010 and 2009, of gains (losses) on forward derivatives hedging foreign currency securities available for sale, short-term borrowings and long-term debt, representing the portion of derivatives gains (losses) excluded from the assessment of hedge effectiveness (time value). 174 -

Page 177

... by using interest rate swaps, caps, floors and futures to limit variability of cash flows due to changes in the benchmark interest rate. We also use interest rate swaps and floors to hedge the variability in interest payments received on certain floatingrate commercial loans, due to changes in... -

Page 178

... Derivatives We use credit derivatives to manage exposure to credit risk related to lending and investing activity and to assist customers with their risk management objectives. This may include protection sold to offset purchased protection in structured product transactions, as well as liquidity... -

Page 179

...index Loan deliverable credit default swaps Other Total credit derivatives December 31, 2009 Credit default swaps on: Corporate bonds Structured products Credit protection on: Default swap index Commercial mortgage-backed securities index Asset-backed securities index Loan deliverable credit default... -

Page 180

... credit risk through credit approvals, limits, monitoring procedures, executing master netting arrangements and obtaining collateral, where appropriate. To the extent the master netting arrangements and other criteria meet the applicable requirements, derivatives balances and related cash... -

Page 181

..., commercial MBS, CDOs, home equity asset-backed securities, auto asset-backed securities and credit card-backed securities. The methodology used to adjust the quotes involved weighting the price quotes and results of internal pricing techniques such as the net present value of future expected cash... -

Page 182

... by the appropriate levels of management. Similarly, while securities available for sale traded in secondary markets are typically valued using unadjusted vendor prices or vendor prices adjusted by weighting them with internal discounted cash flow techniques, these prices are reviewed and, if deemed... -

Page 183

...market participants use in estimating future net servicing income cash flows, including estimates of prepayment speeds (including housing price volatility), discount rate, default rates, cost to service (including delinquency and foreclosure costs), escrow account earnings, contractual servicing fee... -

Page 184

... market rate and other savings, is equal to the amount payable on demand at the measurement date. The fair value of other time deposits is calculated based on the discounted value of contractual cash flows. The discount rate is estimated using the rates currently offered for like wholesale deposits... -

Page 185

... value recorded in our financial statements are not included in the following table. Independent brokers Third party pricing services Level 1 Level 2 Level 3 (in millions) December 31, 2010 Trading assets (excluding derivatives) Securities available for sale: Securities of U.S. Treasury and federal... -

Page 186

... Commercial Total mortgage-backed securities Corporate debt securities Collateralized debt obligations Asset-backed securities: Auto loans and leases Home equity loans Other asset-backed securities Total asset-backed securities Other debt securities Total debt securities Marketable equity securities... -

Page 187

... obligations Other Total debt securities Marketable equity securities: Perpetual preferred securities Other marketable equity securities Total marketable equity securities Total securities available for sale Mortgages held for sale Loans held for sale Mortgage servicing rights Other assets (3) Total... -

Page 188

... sale Loans Mortgage servicing rights Net derivative assets and liabilities: Interest rate contracts Commodity contracts Equity contracts Foreign exchange contracts Credit contracts Other derivative contracts Total derivative contracts Other assets Short sale liabilities (corporate debt securities... -

Page 189

...marketable equity securities Total marketable equity securities Total securities available for sale Mortgages held for sale Mortgage servicing rights Net derivative assets and liabilities Other assets (excluding derivatives) Liabilities (excluding derivatives)(7) Year ended December 31, 2008 Trading... -

Page 190

... available for sale, $1.9 billion; and mortgage servicing rights, $118 million. Increases in Level 3 balances, which represent newly consolidated VIE assets, are reflected as transfers in for the following categories: securities available for sale, $829 million; loans, $366 million; and long-term... -

Page 191

... income statement. (in millions) Year ended December 31, 2010 Mortgages held for sale Loans held for sale Loans: Commercial Consumer Total loans (1) Mortgage servicing rights (amortized) Other assets (2) Total Year ended December 31, 2009 Mortgages held for sale Loans held for sale Loans (1) Other... -

Page 192

... 31, 2010 and 2009, respectively, due to lock-up provisions that will remain in effect until November 2012. Private equity funds invest in equity and debt securities issued by private and publicly-held companies in connection with leveraged buyouts, recapitalizations and expansion opportunities... -

Page 193

...value for prime MHFS originations for which an active secondary market and readily available market prices exist to reliably support fair value pricing models used for these loans. Loan origination fees on these loans are recorded when earned, and related direct loan origination costs are recognized... -

Page 194

... subsequent changes in fair value included in earnings for these assets measured at fair value are shown, by income statement line item, below. 2010 Mortgage banking noninterest income Net gains on mortgage (in millions) Year ended December 31, Mortgages held for sale Loans held for sale Loans Long... -

Page 195

... of the Company. December 31, 2010 Carrying Estimated fair value Carrying amount 2009 Estimated fair value (in millions) Financial assets Mortgages held for sale (1) Loans held for sale (2) Loans, net (3) Nonmarketable equity investments (cost method) Financial liabilities Deposits Long-term debt... -

Page 196

...sale of our income trust securities held by these trusts to third party investors. See Note 8 for additional information on our trust preferred security structures and Note 13 for information about our income trust notes. We have no commitment to issue Series G or H preferred stock. In December 2009... -

Page 197

... on behalf of the Wells Fargo & Company 401(k) Plan (the 401(k) Plan). Dividends on the ESOP Preferred Stock are cumulative from the date of initial issuance and are payable quarterly at annual rates based upon the year of issuance. Each share of ESOP Preferred Stock released from the unallocated... -

Page 198

... is granted a new option to purchase at the fair market value of the stock as of the date of the reload, the number of shares of stock equal to the sum of the number of shares used in payment of the exercise price and a number of shares with respect to related statutory minimum withholding... -

Page 199

... TARP CPP investment in Wells Fargo in December 2009. No salary increases were paid in common stock after February 2010. For various acquisitions and mergers, we converted employee and director stock options of acquired or merged companies into stock options to purchase our common stock based on the... -

Page 200

Note 18: Common Stock and Stock Plans (continued) WeightedWeightedaverage exercise Number Incentive compensation plans Options outstanding as of December 31, 2009 Granted Canceled or forfeited Exercised Options outstanding as of December 31, 2010 As of December 31, 2010: Options exercisable and ... -

Page 201

... amount and timing of our share repurchases, including our capital requirements, the number of shares we expect to issue for acquisitions and employee benefit plans, market conditions (including the trading price of our stock), and regulatory and legal considerations. These factors can change at any... -

Page 202

... Stock and Stock Plans (continued) Employee Stock Ownership Plan The Wells Fargo & Company 401(k) Plan (401(k) Plan) is a defined contribution plan with an Employee Stock Ownership Plan (ESOP) feature. Effective December 31, 2009, the Wachovia Savings Plan, which also had an ESOP feature, merged... -

Page 203

... 28, 2009, the Board of Directors approved amendments to freeze the benefits earned under the Wells Fargo qualified and supplemental Cash Balance Plans and the Wachovia Corporation Pension Plan, a cash balance plan that covered eligible employees of the legacy Wachovia Corporation, and to merge the... -

Page 204

...year Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Employer contribution Plan participants' contributions Benefits paid Foreign exchange impact Fair value of plan assets at end of year Funded status at end of year Amounts recognized in the balance... -

Page 205

... of net periodic benefit cost were: December 31, 2010 Pension benefits Non(in millions) Service cost Interest cost Expected return on plan assets Amortization of net actuarial loss Amortization of prior service cost Curtailment loss (gain) Net periodic benefit cost Other changes in plan assets... -

Page 206

... Includes both qualified and nonqualified pension benefits. (2) Due to the freeze of the Wells Fargo qualified and supplemental Cash Balance Plans and the Wachovia Corporation Pension Plan, the discount rate for the 2009 pension benefits was the weighted average of 6.75% from January through April... -

Page 207

...cost and service cost components of the net periodic benefit cost for 2010 by $4 million. The investment strategy for assets held in the Retiree Medical Plan Voluntary Employees' Beneficiary Association (VEBA) trust is established separately from the strategy for the assets in the Cash Balance Plan... -

Page 208

... market stocks Real estate/timber (5) Multi-strategy hedge funds (6) Private equity Other Total plan investments Payable upon return of securities loaned Net receivables (payables) Total plan assets December 31, 2009 Cash and cash equivalents Intermediate (core) fixed income (1) High-yield fixed... -

Page 209

...: Purchases, sales, Balance beginning (in millions) Year ended December 31, 2010 Pension plan assets Intermediate (core) fixed income High-yield fixed income Domestic large-cap stocks International stocks Real estate/timber Multi-strategy hedge funds Private equity Other $ Other benefits plan... -

Page 210

... measurement at the reporting date. In 2009, the 401(k) Plan was amended to permit us to make discretionary profit sharing contributions. Based on 2010 and 2009 earnings, we committed to make a contribution in shares of common stock to eligible employees' 401(k) Plan accounts equaling 2% and 1% of... -

Page 211

... paid PCI loans Basis difference in investments Net operating loss and tax credit carry forwards Other Total deferred tax assets Deferred tax assets valuation allowance Deferred tax liabilities Mortgage servicing rights Leasing Mark to market, net Intangible assets Net unrealized gains on securities... -

Page 212

... For tax positions from business combinations (1) Reductions: For tax positions related to prior years Lapse of statute of limitations Settlements with tax authorities Balance at end of year (1) Unrecognized tax benefits from the Wachovia acquisition. 2010 $ 4,921 579 301 (111) 2009 7,521 438 898... -

Page 213

... per common share calculations. Year ended December 31, (in millions, except per share amounts) Wells Fargo net income Less: Preferred stock dividends and accretion and other (1) Wells Fargo net income applicable to common stock (numerator) Earnings per common share Average common shares outstanding... -

Page 214

... 31, 2009 Net change Balance, December 31, 2010 $ 73 67 45 112 (53) 9,806 3,541 1,525 5,066 (221) 650 89 739 273 (1,249) 70 (1,179) (53) 9,931 3,009 1,729 4,738 $ adjustments 52 (58) (6) available for sale 398 (6,610) (6,212) and hedging activities 435 436 871 Defined benefit pension plans (160... -

Page 215

... equipment leases, real estate and other commercial financing, Small Business Administration financing, venture capital financing, cash management, payroll services, retirement plans, Health Savings Accounts, credit cards, and merchant payment processing. Community Banking also purchases sales... -

Page 216

... to fund its assets, a funding charge based on the cost of excess liabilities from another segment. (3) Represents segment net income (loss) for Community Banking; Wholesale Banking; and Wealth, Brokerage and Retirement segments and Wells Fargo net income for the consolidated company. 214 -

Page 217

... periodic reports under the Securities Exchange Act of 1934 and is no Condensed Consolidating Statement of Income Other consolidating WFFI subsidiaries Consolidated Company longer a separately rated company. The Parent also guaranteed all outstanding term debt securities of Wells Fargo Financial... -

Page 218

Note 24: Condensed Consolidating Financial Statements (continued) Condensed Consolidating Statements of Income Other consolidating WFFI subsidiaries Consolidated Company (in millions) Year ended December 31, 2009 Dividends from subsidiaries: Bank Nonbank Interest income from loans Interest income ... -

Page 219

... Consolidating Balance Sheets Other consolidating WFFI subsidiaries Consolidated Company (in millions) December 31, 2010 Assets Cash and cash equivalents due from: Subsidiary banks Nonaffiliates Securities available for sale Mortgages and loans held for sale Loans Loans to subsidiaries: Bank... -

Page 220

...benefits related to stock option payments Change in noncontrolling interests: Purchase of Prudential's noncontrolling interest Other, net Other, net Net cash used by financing activities Net change in cash and due from banks Cash and due from banks at beginning of year Cash and due from banks at end... -

Page 221

... Net decrease (increase) in investment in subsidiaries Net cash acquired from acquisitions Other, net Net cash provided (used) by investing activities Cash flows from financing activities: Net change in: Deposits Short-term borrowings Long-term debt: Proceeds from issuance Repayment Preferred stock... -

Page 222

... Reserve establishes capital requirements, including well capitalized standards, for the consolidated financial holding company, and the OCC has similar requirements for the Company's national banks, including Wells Fargo Bank, N.A. Under the Federal Deposit Insurance Corporation Improvement Act... -

Page 223

... consolidated balance sheet of Wells Fargo & Company and Subsidiaries (the Company) as of December 31, 2010 and 2009, and the related consolidated statements of income, changes in equity and comprehensive income, and cash flows for each of the years in the three-year period ended December 31, 2010... -

Page 224

... for credit losses Noninterest income Service charges on deposit accounts Trust and investment fees Card fees Other fees Mortgage banking Insurance Net gains from trading activities Net gains (losses) on debt securities available for sale Net gains (losses) from equity investments Operating leases... -

Page 225

... junior lien mortgage Credit card Other revolving credit and installment Total consumer Total loans (5) Other Total earning assets Funding sources Deposits: Interest-bearing checking Market rate and other savings Savings certificates Other time deposits Deposits in foreign offices Total interest... -

Page 226

... Commercial real estate Employee Stock Ownership Plan Statement of Financial Accounting Standards Financial Accounting Standards Board Federal Deposit Insurance Corporation Federal Housing Administration Federal Home Loan Bank Federal Home Loan Mortgage Company Fair Isaac Corporation (credit rating... -

Page 227

Page intentionally left blank -

Page 228

Page intentionally left blank -

Page 229

... and total compound annual growth rate (CAGR) for our common stock (NYSE: WFC) for the five- and ten-year periods ended December 31, 2010, with the cumulative total stockholder returns for the same periods for the Keefe, Bruyette and Woods (KBW) Total Return Bank Index (KBW Bank Index (BKX)) and... -

Page 230

...Currency "Outstanding" rating for Community Reinvestment Act performance (Wells Fargo Bank, N.A.) Trade Finance #2 Best Trade Bank in the U.S. #4 Best Trade Bank in North America Brand Keys #1 Bank Brand in Customer Loyalty Engagement Index Stock purchase and dividend reinvestment You can buy Wells... -

Page 231

... mortgage lender Used car lender (AutoCount 2010) Small business lender in dollars (2009 Community Reinvestment Act government data) SBA 7(a) lender in dollars (2010 Small Business Administration federal ï¬scal year-end data) Underwriter of preferred stock (FY 2010, Bloomberg) REIT preferred stock... -

Page 232

Wells Fargo & Company Montgomery Street San Francisco, California wellsfargo.com Our Vision: Satisfy all our customers' ï¬nancial needs and help them succeed ï¬nancially. Nuestra Vision: Deseamos satisfacer todas las necesidades ï¬nancieras de nuestros clientes y ayudarlos a tener éxito en ...