WeightWatchers 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

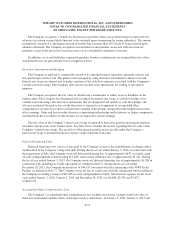

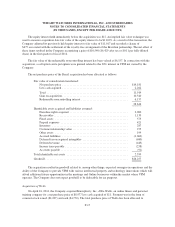

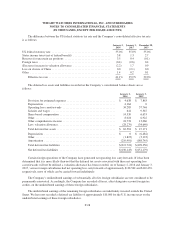

9. Earnings Per Share

Basic earnings per share (“EPS”) are calculated utilizing the weighted average number of common shares

outstanding during the periods presented. Diluted EPS is calculated utilizing the weighted average number of common

shares outstanding during the periods presented adjusted for the effect of dilutive common stock equivalents.

The following table sets forth the computation of basic and diluted EPS for the fiscal years ended:

January 2,

2016

January 3,

2015

December 28,

2013

Numerator:

Net income attributable to Weight Watchers International, Inc. ...... $32,945 $117,787 $202,742

Denominator:

Weighted average shares of common stock outstanding ............ 58,369 56,607 56,144

Effect of dilutive common stock equivalents ..................... 597 98 250

Weighted average diluted common shares outstanding ............. 58,966 56,705 56,394

Earnings Per Share attributable to Weight Watchers International, Inc.

Basic .................................................... $ 0.56 $ 2.08 $ 3.61

Diluted ................................................... $ 0.56 $ 2.08 $ 3.60

The number of anti-dilutive common stock equivalents excluded from the calculation of the weighted

average number of common shares for diluted EPS was 1,699, 3,073, and 1,285 for the years ended January 2,

2016, January 3, 2015 and December 28, 2013, respectively.

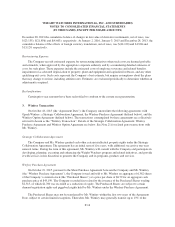

10. Stock Plans

Incentive Compensation Plans and Winfrey Option

On May 6, 2008 and May 12, 2004, respectively, the Company’s shareholders approved the 2008 Stock

Incentive Plan (the “2008 Plan”) and the 2004 Stock Incentive Plan (the “2004 Plan”). On May 6, 2014, the

Company’s shareholders approved the 2014 Stock Incentive Plan (as amended, the “2014 Plan” and together

with the 2004 Plan and the 2008 Plan, the “Stock Plans”), which replaced the 2008 Plan and 2004 Plan for all

equity-based awards granted on or after May 6, 2014. The 2014 Plan is designed to promote the long-term

financial interests and growth of the Company by attracting, motivating and retaining employees with the ability

to contribute to the success of the business and to align compensation for the Company’s employees over a multi-

year period directly with the interests of the shareholders of the Company. The Company’s Board of Directors or

a committee thereof administers the 2014 Plan.

Under the 2014 Plan, grants may take the following forms at the Compensation and Benefit Committee’s

discretion: non-qualified stock options, incentive stock options, stock appreciation rights, restricted stock units

(“RSUs”), restricted stock and other share-based awards. As of its effective date, the maximum number of shares

of common stock available for grant under the 2014 Plan was 3,500, subject to increase and adjustment as set

forth in the 2014 Plan.

Under the 2014 Plan, the Company also grants fully-vested shares of its common stock to certain members

of its Board of Directors. While these shares are fully vested the directors are restricted from selling these shares

while they are still serving on the Company’s Board of Directors. During the fiscal years ended January 2,

2016, January 3, 2015 and December 28, 2013, the Company granted 50, 20, and 14, fully-vested shares,

respectively, and recognized compensation expense of $507, $497, and $524, respectively.

F-23