WeightWatchers 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

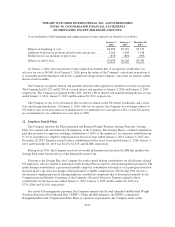

In July 2015, the FASB issued updated guidance to simplify the measurement of inventory. Under this

amendment, an entity using an inventory method other than last-in, first out or the retail inventory method should

measure inventory at the lower of cost and net realizable value. The new guidance clarifies that net realizable

value is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of

completion, disposal, and transportation. This guidance is effective for fiscal years beginning after December 15,

2016, including interim periods within those fiscal years, and should be applied prospectively with earlier

adoption permitted as of the beginning of the interim or annual reporting period. The Company is currently

evaluating the impact that the adoption of this guidance will have on the consolidated financial position of the

Company.

In September 2015, the FASB issued updated guidance to simplify the accounting for adjustments made to

provisional amounts recognized in a business combination, eliminating the requirement to retrospectively

account for those adjustments. This guidance is effective for fiscal years beginning after December 15, 2015,

including interim periods within those fiscal years, and should be applied prospectively with earlier adoption

permitted as of the beginning of the interim or annual reporting period. There is no impact on the consolidated

financial position, results of operations or cash flows of the Company as a result of this guidance.

In November 2015, the FASB issued updated guidance that in a classified statement of financial position, an

entity shall classify deferred tax assets and liabilities as noncurrent amounts. This guidance is effective for fiscal

years beginning after December 15, 2016, including interim periods within those fiscal years and earlier adoption

is permitted. The Company does not expect the adoption to have a material impact on the financial statements.

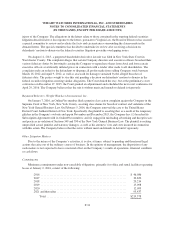

21. Related Party

As more fully described in Note 3, on October 18, 2015, the Company entered into the Strategic

Collaboration Agreement with Ms. Winfrey, under which she will consult with the Company and participate in

developing, planning, executing and enhancing the Weight Watchers program and related initiatives, and provide

it with services in her discretion to promote the Company and its programs, products and services.

In addition to the Strategic Collaboration Agreement, Ms. Winfrey and her related entities provided services

to the Company totaling $647 for the fiscal year ended January 2, 2016, which services included advertising,

production and related fees.

The Company’s accounts payable to parties related to Ms. Winfrey at January 2, 2016 was $574.

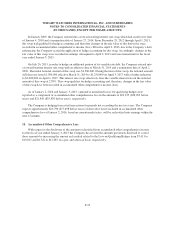

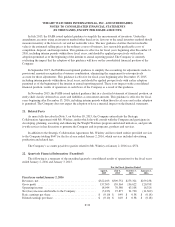

22. Quarterly Financial Information (Unaudited)

The following is a summary of the unaudited quarterly consolidated results of operations for the fiscal years

ended January 2, 2016 and January 3, 2015.

For the Fiscal Quarters Ended

April 4,

2015

July 4,

2015

October 3,

2015

January 2,

2016

Fiscal year ended January 2, 2016

Revenues, net ........................................ $322,103 $309,754 $273,324 $259,238

Gross profit ......................................... 157,303 159,364 136,622 120,798

Operating income .................................... 18,044 70,580 63,108 16,326

Net (loss) income attributable to the Company .............. (5,433) 27,877 21,790 (11,309)

Basic earnings per share ............................... $ (0.10) $ 0.49 $ 0.38 $ (0.18)

Diluted earnings per share .............................. $ (0.10) $ 0.49 $ 0.38 $ (0.18)

F-39