WeightWatchers 2015 Annual Report Download - page 36

Download and view the complete annual report

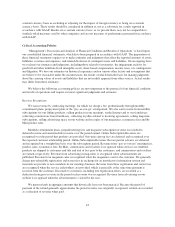

Please find page 36 of the 2015 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On July 14, 2015, we drew down the $48.0 million available on our Revolving Facility in order to enhance

our cash position and to provide additional financial flexibility. The revolver borrowing has been classified as a

short-term liability in consideration of the fact that the terms of the Revolving Facility require an assessment as

to whether there have been any material adverse changes with respect to the Company in connection with our

monthly interest elections. Although the revolver borrowing has been classified as a short-term liability, absent

any change in fact and circumstance, we have the ability to extend and not repay the Revolving Facility until its

due date of April 2, 2018.

For additional details on the WWI Credit Facility, see “Item 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations—Liquidity and Capital Resources—Long-Term Debt” in Part II

of this Annual Report on Form 10-K.

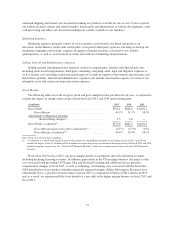

Working Capital

In fiscal 2015, the change in working capital was driven in large part by the increase in short-term debt due

within one year and the decline in cash resulting from the prepayment of debt during the fiscal year. The

refinancing of our credit facilities in April 2013 resulted in much lower debt repayments in fiscal 2013 and fiscal

2014 as compared to our debt repayments in fiscal 2011 and fiscal 2012. Our lower debt repayment obligations in

fiscal 2013 and fiscal 2014 drove increases in cash in those years thereby lowering the working capital deficit.

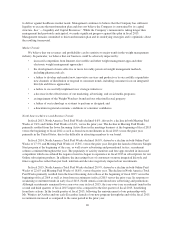

Other Comprehensive Loss

Other comprehensive loss, net of taxes, was $18.3 million in fiscal 2015 as compared to $28.9 million in

fiscal 2014 primarily due to the unfavorable impact of foreign currency translation adjustments and to a lesser

extent the mark to market of our interest rate swap. In fiscal 2015, foreign currency translation adjustments

unfavorably impacted results by $27.8 million ($17.0 million after tax) as compared to $19.2 million

($11.7 million after tax) in fiscal 2014 primarily due to the devaluation of the Euro, Canadian dollar, and the

British Pound. In addition, due to hedge accounting, Changes in Other Comprehensive Loss decreased by

$2.2 million ($1.4 million after tax) in fiscal 2015 as compared to $28.3 million ($17.3 million after tax) in fiscal

2014.

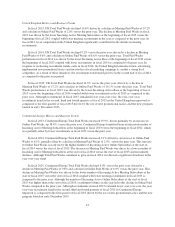

Acquisition of Additional Equity Interest in Brazil and Gain on Brazil Acquisition

Prior to March 12, 2014, the Company had owned 35% of Vigilantes do Peso Marketing Ltda., or VPM, a

Brazilian limited liability partnership. On March 12, 2014, the Company acquired an additional 45% equity

interest in VPM for a net purchase price of $14.2 million. VPM was converted into a joint-stock corporation prior

to closing and subsequently operates as a subsidiary of the Company with rights to conduct typical business lines.

As a result of the acquisition, the Company gained a direct controlling financial interest in VPM and began to

consolidate this entity as of the date of acquisition.

As a result of our Brazil acquisition, we adjusted our previously held equity interest to fair value of

$11.0 million and recorded a charge of $0.5 million associated with the settlement of the royalty-free

arrangement of the Brazilian partnership. The net effect of these items resulted in our recognizing a gain of

$10.5 million ($6.4 million after tax or $0.11 per fully diluted share) in fiscal 2014.

Acquisition of Wello

On April 16, 2014, the Company acquired Knowplicity, Inc., d/b/a Wello, an online fitness and personal

training company for a net purchase price of $9.0 million. Payment was in the form of common stock issued of

$4.2 million and cash of $4.8 million. As a result of the acquisition, Wello became a wholly-owned subsidiary of

the Company and the Company began to consolidate the entity as of the date of acquisition.

33